The New Expanded Panama Canal: Bigger Ships, Bigger Paydays for Beans, Coal, and Gas

Bigger ships could mean bigger paydays for commodity producers when the expanded Panama Canal opens today as they can utilize larger vessels more frequently to tap into fast growing Asia-Pacific consumer markets.

The Panama Canal Authority estimates that the enlarged waterway will cut sailing times between Atlantic Ocean ports and Asia by up to 16 days for ships that previously could not fit through.

Soybean farmers, natural gas producers, container shippers, and coal miners hope to be among the winners when the expanded Panama Canal is inaugurated today at a cost of $5.2 billion and after a two-year delay.

Crude oil and iron ore exporters will see less benefit as they still depend on vessels too big for the waterway.

The U.S. Soy Transportation Coalition, which represents soybean farmers, said moving to ships carrying up to 100,000 dead weight tonnes (dwt) of beans on the canal from the current 76,000 tonne limit would add up to $8 million in value per vessel.

“A customer of U.S. soybeans in Asia could save 35 cents per bushel simply due to greater transportation efficiency,” said Mike Steenhoek, the Coalition executive director.

The United States is the second-largest exporter of soybeans to China, accounting for 30 percent of China’s 81.5 million tonnes of imports last year, according to China customs figures. Brazil accounted for 54 percent.

Shipping volumes through the Canal stalled in the mid-2000s, after rising earlier in the decade on increased Chinese trade, as vessels became too large to traverse the waterway.

Post-expansion, the Canal Authority hopes that tonnage volumes will rise by an average of 3 percent per year, from almost 341 million tonnes in 2015.

Gas & Coal

Liquefied natural gas (LNG) and liquefied petroleum gas (LPG) sellers from the U.S. Gulf and Caribbean, as well as Colombian coal suppliers should benefit from the expansion.

The U.S. is ramping up LNG and LPG exports after the shale extraction boom and will compete with Middle East LPG sellers and Australian LNG exporters.

“It will create competition for all the producers in the Arabian Gulf by getting products from the U.S. almost as quickly as from the Arabian Gulf,” said a senior executive at a tanker shipping company who declined to be named.

Colombian shippers hope the bigger canal will open up trade to Asia as rising natural gas and renewable energy usage has cut coal consumption in its traditional North American and European markets.

Colombian miners have already started shipping coal to Japan and South Korea but the voyages around South America and Africa can take up to two months.

Container shippers, carrying everything from fresh food to electronics, can sail ships of up to 13,000 teu (20-foot equivalent units) through the bigger Canal from the current limit of 5,000 teu.

Slow Change

Crude oil traders will be less affected because the supertankers they use remain too big for the canal at 300,000 dwt.

Water depth and lock restrictions still mean the enlarged canal will not be able to handle the biggest 180,000 to 200,000 tonne dry cargo ships, which mostly carry Brazilian iron ore.

Shippers also say the expansion will not make an immediate impact as ports need upgrading.

“Trading patterns will not change so quickly because of loading and discharge port limitations,” said Ong Choo Kiat, president and director at U-Ming Marine Transport Corporation, Taiwan’s largest dry-bulk and tanker ship owner.

One group with generally negative views of the expansion are shippers, already battling an eight-year downturn, as shorter routes mean less charter income.

“Not only will charter hire revenues decrease in view of shorter duration, but with shorter trips the total sea days will be less and thus weigh extra on the already heavily oversupplied market,” said Jean Yves Brion, commercial manager at Belgian dry shipper Boconti Shipping.

Source: Reuters

Article Photo: Flexport Blog

The New Panama Canal: A Risky Bet

How a $3.1 Billion Expansion Collided With Reality

Excerpt from The New York Times

Walt Bogdanich, Jacqueline Williams and Ana Graciela Méndez

PANAMA CITY - On July 8, 2009, the champagne finally flowed.

After an intense two-year competition, a consortium led by a Spanish company in severe financial distress learned that its rock-bottom bid of $3.1 billion had won the worldwide competition to build a new set of locks for the historic Panama Canal.

The unlikely victors toasted their win at La Vitrola, a sleek restaurant in an upscale neighborhood east of downtown Panama City. Within days, executives of the four-nation consortium, Grupo Unidos por el Canal, flew to Europe to begin planning the project.

This time, there would be no champagne. Disputes quickly erupted over how to divide responsibilities. Some executives appeared not to fully grasp how little money they had to complete a complex project with a tight deadline and a multicultural team whose members did not always see things the same way.

Internal arguments soon gave way to bigger problems. There would be work stoppages, porous concrete, a risk of earthquakes and at least $3.4 billion in disputed costs: more than the budget for the entire project.

Seven years later, and nearly two years late, the locks have finally been declared ready to accept the new generation of giant ships that carry much of the world’s cargo but cannot fit in the original canal. To mark the occasion, Panama has invited 70 heads of state to watch on Sunday as a Chinese container ship becomes the first commercial vessel to attempt the passage from the Atlantic Ocean to the Pacific through the larger locks.

For more than 100 years, the canal has been a vital artery nourishing the world economy, a testament to American engineering and one of the signature public works of the 20th century. The new locks, built by Panama without help from other governments, were sold to the nation and the world as a way to ensure that the canal remained as much of a lifeline in the hyperglobalized 21st century as it was in the last.

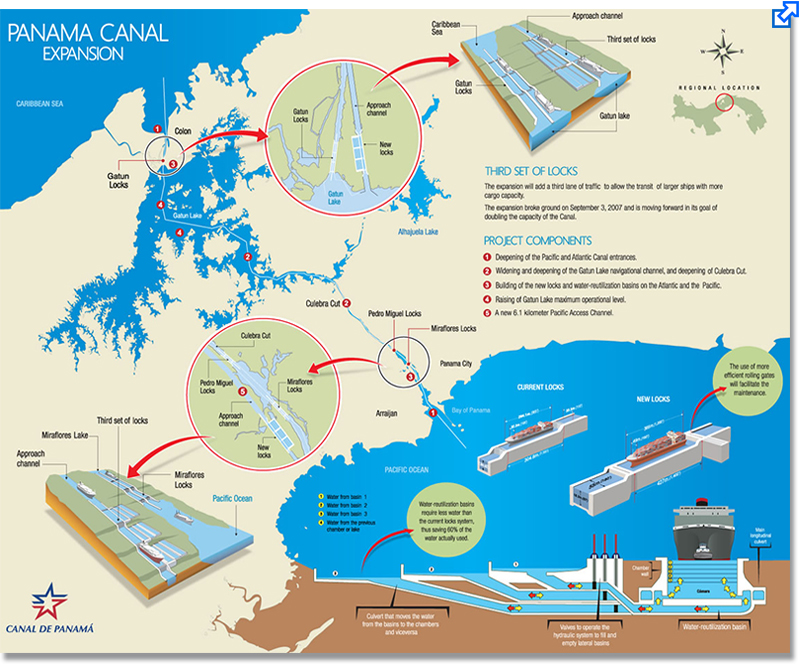

Related Article: Panama Canal Expansion - Redrawing the Logistics Map