Enterprise Resource Planning Vendors Making Significant Inroads into Supply Chain Management

With the big ERP vendors invading their turf, best-of-breed SCM providers are coming up with deeper, niche-oriented solutions to help shippers manage their supply chains, our analysts discuss just how far ERP can go in this sector that’s now considered the foundation of success for digital commerce.

Merging of ERP & SCM Applications

The time when best-of-breed supply chain management (SCM) software providers could confidently say that their in-depth solutions rose above those developed by large enterprise resource planning (ERP) developers is behind us.

Over the last couple of years, ERPs have made significant inroads in SCM - often by acquiring best-of-breed providers of specialized software.

At the same time, more logistics management professionals have warmed up to the one-stop-shop approach to supply chain applications, knowing that those platforms will not only integrate well with one another but that they’ll probably also be a little cheaper.

In this article we’ll explore the continued merging of ERP and SCM applications; discuss the rapid progress vendors continue to make; explore the areas where best-of-breeds continue to reign, and then give our experts’ prognosis on just how far ERPs can go in this software sector that’s now considered the foundation of success in digital commerce.

Expanding Their Footprints

As the ERPs’ footprint in the SCM space got both wider and deeper - and as these providers move more of their applications to the Cloud - shippers have been paying attention.

“On the ERP front, we’ve seen a big shift from the old school, monolithic systems to more ‘modular’ offerings,” explains Rajeev Sinha, global logistics leader in Capgemini’s digital supply chain practice.

To round out those offerings, SAP acquired Ariba (for procurement); Oracle bought NetSuite (for Cloud), and RedPrairie JDA merger (for warehouse management systems).

“The list of acquisitions goes on and on,” says Sinha, “because that’s what the big, legacy vendors are going for.” This mass consumption has actually played out well for best-of-breed SCM providers that have dug down even deeper into their respective niches, he points out.

By fulfilling shippers’ wishes on the “modular” software front - albeit not under the same ERP umbrella - these smaller players continue to carve out a place for themselves in the market.

Mega-Suite vs. Heterogeneous

Referring to ERPs as “mega-suite” vendors, Dwight Klappich, research vice president at Gartner, says he’s seeing a growing number of shippers working these large providers’ solutions into their supply chain software strategies.

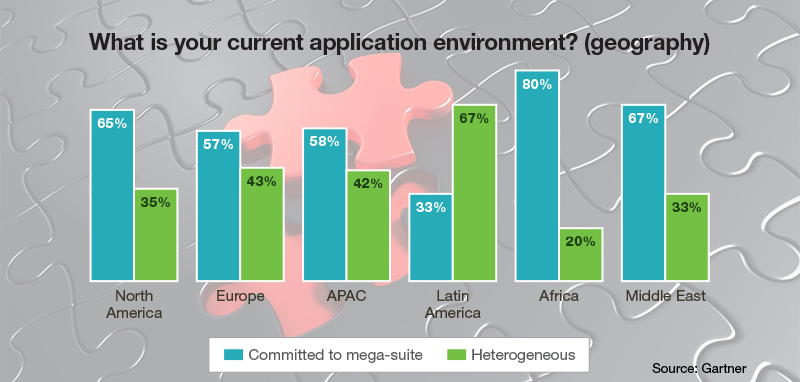

In a recent Gartner survey, for example, participants were asked to place their current application environments into one of two categories. Either they were “largely committed” to a single or primary mega-suite platform vendor (SAP, Oracle, Infor, Microsoft) or respondents were largely a heterogeneous application environment with no dominant vendor. Klappich says 62% of companies fell into the first category, with 38% using the “heterogeneous” approach.

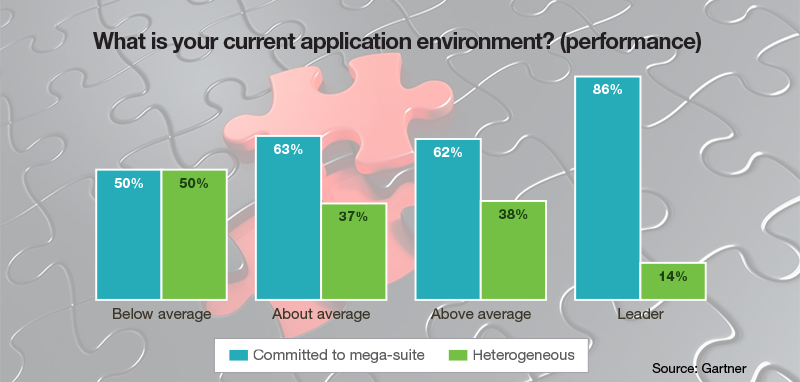

Gartner also found that 86% of industry “leaders” are committed to ERP usage and that just 14% of leaders employ a heterogeneous strategy. By contrast, the number of “below average” shippers using mega-suite versus the heterogeneous approach was an even 50/50.

When asked how their ERPs factor in during the SCM software selection process, 53% said that they “seek the best solution,” while 47% strongly favor mega-suite options - but only if its capabilities fully meet or exceed the company’s requirements.

Klappich says that the results are telling in that they show that the closer a logistics professional gets to the execution or operational level, the higher the interest in using the same ERP vendor for supply chain execution applications like warehouse management systems (WMS), transportation management (TMS), global trade management (GTM), and even areas like order and financial management.

The latter two have long been part of ERP, according to Klappich, while WMS and TMS weren’t necessarily integrated into full-blown ERP systems.

So, what’s driving more shippers to work with their existing ERPs instead of acquiring and implementing standalone SCM applications?

Easier integration and the ability to gain analytical insights across broader, enterprise-wide processes are all playing a part in the decision-making process.

The fact that not all shippers need full SCM applications with all of the bells and whistles that a best-of-breed option provides is another driver.

“At this point, the top ERPs have a ‘reasonable’ TMS, but they’re not best-of-breed by any stretch,” Klappich points out, using a car-buying example to show that not all shippers want or need full-blown, niche-oriented TMS.

“SAP and Oracle are comparable to the Hyundai Sonata or the Toyota Camry, both of which are solid cars,” says Klappich, “but neither has the same high-performance engines, suspensions, or performance that a BMW 7-Series delivers. However, the ERPs do a good job for a high percentage of companies - that’s why they’re growing.”

Also propelling the ERP’s growth on the SCM front is a large audience of international shippers that need to either purchase new or upgrade their existing systems. Many of those shippers lack transportation and warehousing management sophistication, Klappich notes, and some are still using manual approaches to an increasingly-complex component of the global supply chain.

“SAP, Oracle, and Infor are positioned better than most of the best-of-breeds to exploit this level of international growth,” says Klappich, who recently spoke with the logistics manager at a large, Asia-based tire manufacturer that was still using manual warehouse management processes.

“It was literally coming from paper, with no systems whatsoever. For a company like this, the ERP vendor is good enough. In fact, it probably offers more features and functions than many of those international firms even want or need.”

Going Into The Cloud

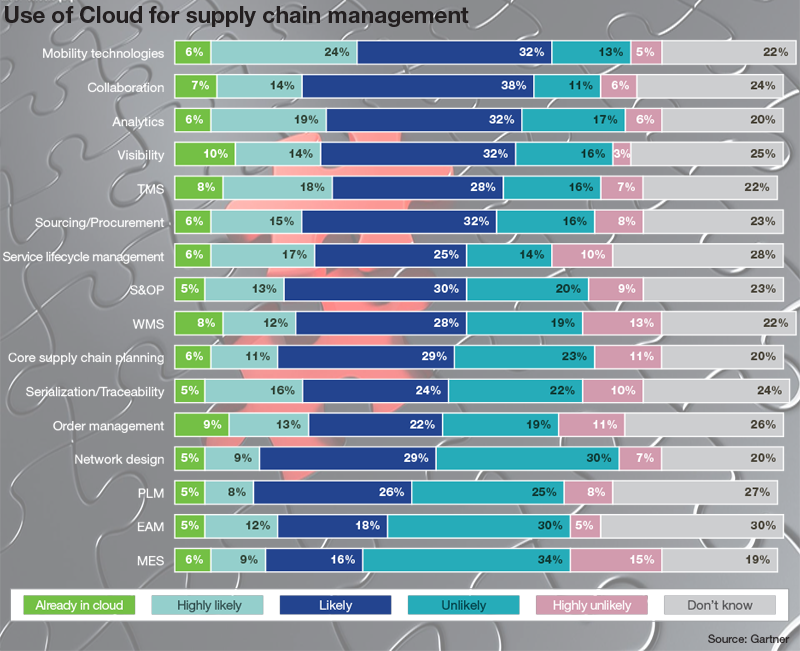

In assessing the propensity to use an ERP versus a best-of-breed SCM application, Gartner’s recent survey also looked at shippers’ plans for buying, replacing or upgrading applications to the Cloud in the near future.

TMS and WMS both made the list, with 54% of shippers either already using TMS in the Cloud or “highly likely” or “likely” to make that move soon.

On the WMS side, 48% of companies said that they’re either likely, highly likely or already using that particular application in the Cloud.

Klappich says that the ERPs are responding to shippers’ demand for Cloud-based systems, and says they’ve taken this request very seriously. “I often jokingly say that they all just jumped right into the deep end of the pool,” says Klappich. “It’s ‘Cloud first’ right now as all vendors are pushing this software delivery method hard.”

In terms of applications, TMS continues to reign as the top Cloud-based SCM application, with WMS slowly taking a similar direction. “WMS isn’t really ‘there’ yet,” says Klappich, “but we’re anticipating that it will become a [major] Cloud player sometime soon.”

A few years ago, for example, Gartner projected that about 40% of WMS implementations would be Cloud-based by now - a level it has yet to achieve. “TMS is several years ahead of WMS in terms of Cloud-based applications,” says Klappich, “but WMS is starting to catch up quite rapidly.”

Steve Banker, vice president of supply chain management at ARC Advisory Services in Boston, says that Tier 1 shippers (i.e., those with over $1 billion in revenues) remain “reluctant” to embrace the Cloud, while other suppliers say that all their customers are moving to the Cloud. “At the same time, we’re also hearing that Cloud solutions have been key to suppliers growing their revenues rapidly in traditionally challenging emerging markets,” he adds.

Calling Cloud solutions “truly standard, off-the-shelf software solutions with no customization,” Banker says that they tend to be attractive because they can be installed quickly - and in most cases, 50% faster - a fact that’s helping to raise shippers’ confidence in the new software acquisition process.

“You can’t argue about the price of software for six months when it’s implemented in three months,” says Banker, “a situation that’s clearly improving the supplier/customer sales environment.”

Room for both at the Top?

Not everyone wants to drive a Hyundai, and not everyone wants to allocate big bucks for a top-of-the-line luxury car. The same philosophy extends in the SCM space, where for some shippers “good enough is good enough.” Because of this, there’s still a healthy demand for both mega-suite and best-of-breed vendors.

“There’s definitely a market for the best-of-breed software provider who can demonstrate that there’s true value in the breadth and depth of its applications,” Klappich says. Within the best-of-breed market, there are varying levels of application sophistication, and complexity, he notes, with Manhattan Associates, JDA, and HighJump populating the upper end of the market. “These companies have the bells and whistles that large companies need.”

Klappich says that he’s also seeing a resurgence of vendors at the lower-end of the market, where a multi-channel market needs pop-up storage lockers in which to store its inventory for distribution to end users. He points to DSI, a digital supply chain platform, and RFgen, used for mobile data collection, as two vendors that are catering to these types of shipper needs by developing systems that can be layered onto an existing ERP.

“We’re seeing a resurgence of vendors in these areas, where shippers need simple, customized solutions - attached to an ERP - versus having to go down the full-blown TMS path,” says Klappich. “That’s almost the other extreme, where simplicity and ease-of-use are most important.”

To shippers that are trying to make the decision between their ERP-provided SCM applications and those developed by niche software providers, Klappich says it generally pays to explore the first option - at least as a starting point. “All other things being equal, having a single vendor maintaining an integrating solution has certain advantages,” says Klappich.

“So, if you’re already working with an ERP vendor, short listing that vendor may make the most sense at this point in time.”

Related Article: The Truth About Growing Your Business in an Age of Personalized Products & Mass Customization

Related White Papers

Last-Mile Supply Chain Mastery: Is Your ERP Really Up for the Job?

This white paper details how 3pls, contract packagers, and corrugators are transforming last-mile logistics with specialist software-as-a-service applications. Download Now!

The ERP Selection Process Survival Guide

This guide provides an overview of the steps for conducting an effective and successful enterprise resource planning solution evaluation, the process can be challenging because of the level of detail that must be addressed, ensuring that key steps are not overlooked. Download Now!

Will Your Legacy ERP System Define Your Legacy?

Making the switch can help secure your business and your reputation - if you don’t pull the plug in time, your business could be on its way down a dangerous spiral of lost opportunities and profits. Download Now!

The Current and Future State of Digital Supply Chain Transformation

Executives see a large gap between the current state of digital transformation across their extended global value chains and what they expect to see in just five years from now. Download Now!

An Innovative Approach to Enterprise Software Implementations

Making the switch can help secure your business and your reputation - if you don’t pull the plug in time, your business could be on its way down a dangerous spiral of lost opportunities and profits. Download Now!

Oracle JD Edwards Cloud Computing

Choosing a deployment strategy that fits - Companies can own and manage their computing solution, yet still be involved in cloud computing by the fact that they have a private cloud for their internal application users. Download Now!

Deploying SAP EWM or WM in Your Automated Warehouse

As the market-leading enterprise resource planning system, SAP has become the go-to choice for companies seeking to streamline their operational processes to gain a competitive edge. Download Now!

More SC24/7: ERP White Papers

Article Topics

Blue Yonder News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Frictionless Podcast: Understanding Your Supply Chain Goals with Ann Marie Jonkman Blue Yonder announces acquisition of flexis AG Supply Chain Management (SCM) applications keep the supply chain humming How Collaborative Efforts Can Enhance Reverse Logistics Netlogistik partners with SVT Robotics to resell SOFTBOT platform More Blue YonderLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply ChainAbout the Author