Global Logistics: Emerging markets gain traction

Long regarded as upstarts, today’s emerging markets are demanding respect as they vie for genuine contention in today’s global marketplace. These climbers are concentrating on their logistical advantages to capture market share and attract new investment.

Over the past five years, emerging markets have maintained their “growth dynamic,” observes John Manners-Bell, CEO of the London-based think tank Transport Intelligence (Ti). At the same time, however, none of the upstarts have remained immune from profound economic and political upheavals. Furthermore, the Eurozone crisis and political gridlock in the U.S. make it more difficult for aspirational nations to realize their destinies. “Yet it’s extraordinary that emerging markets have continued to grow so robustly,” says Manners-Bell.

Indeed, Ti is forecasting emerging market expansion at 6 percent in the next five years, far out-stripping progress in the developed world. It’s for this reason, say Ti analysts, that emerging markets remain so relevant to the global economy—and more specifically to the global logistics industry.

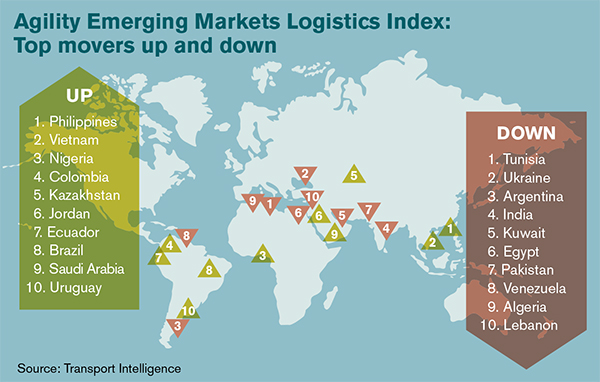

Working in partnership with global third-party logistics provider(3PL) Agility, Ti recently released The Agility Emerging Markets Logistics Index. This body of work contains country rankings, major trade lanes by volume and mode of transport, and, finally, a survey of trade and logistics professionals.

“In 2013, slowing growth in China, India, Brazil, and other emerging economies prompted a reappraisal of their prospects and potential,” says Essa Al-Saleh, CEO and president of Agility. “Many countries in the index are at a crossroads, facing difficult policy choices. Others are threatened by unrest or intractable social problems.”

Among the major conclusions drawn from this survey are that logistics and trade professionals remain overwhelmingly upbeat about prospects for emerging markets in 2014, but are a bit more guarded than they were a year ago.

Of the more than 800 shippers interviewed this year, nearly 74 percent said that prospects for emerging markets were either “very good” or “good,” as compared with 75 percent who said so in 2013. However, the percentage of shippers who saw emerging market prospects as “very good” fell from 22 percent to about 17 percent.

Not surprisingly, the Asia Pacific enjoys the brightest outlook. Nearly 58 percent of respondents believe that emerging markets in this region will grow fastest in 2014. Latin American markets were the choice for roughly 25 percent of respondents.

“Shippers continue to see the greatest potential for growth in non-Asian emerging markets in extractive industries, including mining, minerals, gas, and oil,” says Ti analyst Cathy Roberson. “In Asia Pacific, where China in particular is trying to develop a more balanced economy powered by both exports and consumption, retail, and consumer goods were identified as having the greatest potential.”

An overwhelming percentage of respondents, more than 63 percent, “agree” or “agree strongly” that manufacturing production will move away from China to other emerging markets countries. Vietnam, India, Mexico, and Indonesia were seen as the top alternative destinations. “Growth, trade volume, and investment are far more important than security and lack of corruption when it comes to factors driving the emergence of an economy,” adds Roberson.

Survey respondents believe supply chain risks vary by region. In the Asia Pacific, the top risks identified were natural disasters and economic shocks. In Latin America, corruption and poor infrastructure were the leading worries. Government instability and terrorism were top concerns for the Middle East and North Africa. In Sub-Saharan Africa, poor infrastructure and government instability were seen as the greatest risks.

Risk versus resilience

AsiaInspection, a global provider of quality control services for businesses importing from Asia, Africa, Southern Europe, and Latin America, maintains that shippers should pay more attention to risk irrespective of region.

The Hong Kong-based consultancy has just released its 2014 Q2 Barometer, a quarterly synopsis on outsourced manufacturing and quality control measures indicating that supply chain transparency is far from adequate nearly everywhere in the emerging markets matrix.

“Major differentiating factors between emerging nations can be the reliability of the infrastructure, safety, and political stability, which can result in unpredictable delays and factory shut downs,” says Sebastien Breteau, founder and CEO of AsiaInspection.

“In India, certain provinces provide subsidies to select industries, so knowing where these are located can get you a better deal,” says Breteau. “When sourcing in Vietnam, be aware that there can be a big difference in quality between samples and actual production.”

AsiaInspection advises logistics managers to tie the final payment to an inspection certificate, ensuring that the actual manufactured goods match the agreed upon samples. For example, many Vietnamese factories do not sell direct, but through a trading company with whom they may not have long-term commitments.

“Make sure you know if you’re dealing with the factory or a trading company,” adds Breteau. “In parts of Mexico, particularly those likely to host the cheapest factories, it can be especially dangerous. Furthermore, the level of English can be quite poor, even among the managerial staff.”

For FM Global, one of the world’s largest commercial property insurers, mitigating risk means evaluating emerging nation resilience. The Johnston, R.I.-based consultancy has just released its 2014 FM Global Resilience Index, showing Norway, Switzerland, and Canada to be the top three nations most resilient to supply chain disruption.

“Natural disasters, political unrest, and a lack of global uniformity in safety codes and standards can all have an impact on business continuity, competitiveness, and reputation,” says Jonathan Hall, executive vice president of FM Global. “As supply chains become more global, complex, and interdependent, it’s essential for decision makers to have concrete facts and intelligence about where their facilities and their suppliers’ facilities are located.”

FM Global commissioned analytics and advisory firm Oxford Metrica to develop these rankings with the aim of bolstering intelligent dialogue around building resilience and avoiding supply chain disruption. The data comes from a combination of independent third-party sources and FM Global’s RiskMark benchmarking algorithm that measures the risk quality of more than 100,000 insured commercial properties worldwide.

China’s regions rank 61, 66, and 75, with Shanghai finishing particularly low as a result of poor risk quality due to acute natural hazards. The biggest gains since 2013 are in Bosnia and Herzegovina, climbing 19 places due to improvements in the country’s political risk and in the quality of local suppliers. Conversely, Bangladesh declined significantly because of poor natural hazard risk management and fire risk management.

Rewarding leadership

However, where there’s emerging market risk there’s emerging market reward, say analysts at global consulting giant PwC. They note in a recent report that the global economic recovery continues to be fragile, but with immediate pressures easing.

“CEOs are feeling more optimistic and gradually switching from survival mode to growth mode,” says Dennis Nally, chairman of PwC International.

As the latest PwC Annual Global CEO Survey shows, the changes they’re making within their organizations now have less to do with sheltering from economic headwinds and more to do with preparing for the future.

According to the latest survey, the number of CEOs who believe that the global economy will improve over the next 12 months has doubled to 44 percent, compared to the previous year. Only 7 percent—compared with 28 percent last year—think that things will get worse in the year ahead. CEOs are also feeling better about their own companies’ prospects, with 39 percent now very confident of revenue growth in 2014.

However, CEOs are also challenged to decipher some very mixed signals about the global economy. Last year, the advanced economies were struggling, while the emerging economies surged. This year, the advanced economies are mending, while growth in some of the emerging economies is decelerating.

“The BRICS aren’t a single brick,” says Nally. “China remains robust, thanks to vast foreign exchange reserves and extensive reform measures introduced by the central government. But Brazil is suffering from a huge debt hangover and India has been slow to open up its markets.”

Meanwhile, Russia is unduly reliant on commodity exports and South Africa’s growth has been impeded by heavy regulation. The business leaders in PwC’s survey have sensed the change in the weather. Last year, 53 percent of CEOs in Latin America were very confident that they could increase their company’s revenues over the next 12 months. This year, only 43 percent feel so sanguine.

Meanwhile CEOs in the Middle East have become more upbeat, with 69 percent saying that they believe they can boost revenues—up from 53 percent in 2013. CEOs in Western Europe are also feeling more heartened, although they remain less confident than CEOs in other regions. There’s been a similar shift in regional views about the outlook for the next three years.

And though CEOs are more worried about sluggish growth in the advanced economies than a slowdown in the emerging economies, the gap is surprisingly small. The hidden costs of doing business in some emerging economies are likewise becoming more apparent.

Institutional inefficiencies are one key source of concern. But CEOs in Africa, Latin America, and the Middle East are also more apprehensive about infrastructure problems, supply chain disruptions, and bribery and corruption than those in the rest of the world.