Economic Report – Monday, August 4, 2014

The U.S. economy has rebounded after a slow start to the year, with a number of data sources last week showing manufacturing activity growing strongly of late.

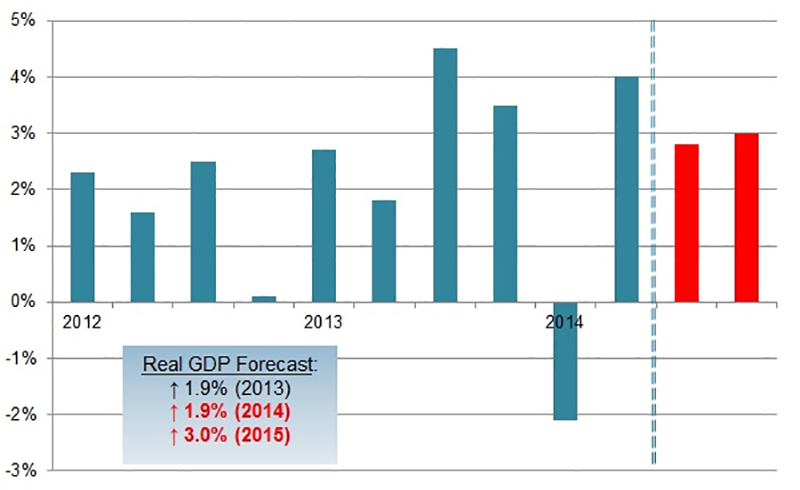

First, real GDP increased by a healthy 4.0 percent in the second quarter, more than offsetting the 2.1 percent drop in output during the first quarter.

Consumer and business spending spurred the higher figure. Inventory investments alone contributed one-third of the growth in real GDP for the quarter, with higher investment levels for housing, nonresidential structures, equipment and intellectual property.

In addition, goods spending increased at its fastest pace since the fourth quarter of 2010. Net exports, however, continued to be a weakness, with growth in goods imports outstripping increases in goods exports.

Moreover, one cannot help but be frustrated with weak economic growth so far this year, even if the outlook has improved. Real GDP rose by a frustratingly slow 0.9 percent in the first half of 2014.

Fortunately, manufacturers are cautiously upbeat about future growth.

Real Gross Domestic Product (Chained 2005 Dollars)

The Institute for Supply Management’s (ISM) manufacturing Purchasing Managers’ Index (PMI) increased from 55.3 in June to 57.1 in July. More importantly, the production index has measured 60 or more for each of the past three months, indicating strong output growth. Demand and hiring were also up sharply, but export sales growth eased, and raw material costs remained elevated. Similarly, the Dallas Federal Reserve Bank’s survey also noted accelerating manufacturing activity, with overall activity up for the 14th consecutive month. The underlying data in that report were mostly higher across-the-board, and at least 45 percent of respondents expect sales, production and shipments to increase over the coming months, with just single-digit percentages anticipating declines. These findings mirror those of other recent regional surveys.

ISM: Healthy Expansion of Manufacturing Activity in July

The Institute for Supply Management’s (ISM) manufacturing purchasing managers’ index (PMI) was up strongly in July, building on the healthy gains seen in June. The headline PMI figure rose from 55.3 in June to 57.1 in July, its highest level since November. After declining sharply in January, sentiment has gradually moved higher each month, with the sector rebounding from winter-related disruptions and slow growth in the first quarter of this year. These findings are largely consistent with other indicators showing manufacturers cautiously optimistic about the next six months.

Production, in particular, appears to have recovered back to the stronger expansionary levels seen in the second half of last year. The index for production increased from 60.0 to 61.2, and it was the third straight month with the measure at 60 or greater. Note that output and sales growth both exceeded 60 for five consecutive months in 2013 (August to December) before that streak ended with weather factors in January. The pace of other components were also higher in July, including new orders (up from 58.9 to 63.4), supplier deliveries (up from 51.9 to 54.1) and employment (up from 52.8 to 58.2). The latter figure hopefully indicates positive news on hiring moving forward.

The sample comments echo the positive news seen in the data, but they also hint of possible weaknesses ahead. A transportation executive said, “Business is still very good and we are very optimistic for the rest of the year.” Yet, others are more restrained in their sales outlook, and world events are noted as possible risks to growth. For instance, a chemical manufacturer added, “Geopolitics still present a considerable risk as well as the European market.” Beyond these points, wage pressures are noted, with a petroleum and coal products respondent citing the need for salary increases “due to market competition and shortages in certain specialty skills.”

Along these lines, the ISM data also show both continued pricing pressures and an easing in export sales growth. The index for raw material costs edged higher (up from 58.0 to 59.5), with this indicator averaging 59.1 through the first seven months of 2014. That indicates an acceleration in input costs over the average of 53.8 seen for all of 2013, and it mirrors other inflation data. Regarding trade, the growth rates for exports (down from 54.5 to 53.0) and imports (down from 57.0 to 52.0) were both lower, and we have seen weaker international sales growth year-to-date in other data, as well.

Meanwhile, the latest jobs report was mostly positive, with manufacturers adding 28,000 workers on net in July. More than half of that stemmed from the automotive sector, signifying that, if anything, employment growth could be more broad-based within the sector, extending in particular to the nondurable goods sector more. Yet, manufacturing employment has picked up, averaging 22,000 over the past three months and nearly 15,000 per month since August. Moreover, we continue to hear about skills shortages in many locations, which could create wage pressures moving forward. In fact, during the second quarter, manufacturing wages and salaries increased at their fastest pace in more than a decade, driving up overall employment costs. Nonetheless, total compensation for manufacturers has risen by 2.1 percent year-over-year, suggesting that wage pressures remain in check for the most part—at least for now.

Along those lines, personal income and spending both increased by 0.4 percent in June. Since January, when winter weather dampened purchases, personal spending has risen 2.2 percent, with year-over-year growth of 4.0 percent. This suggests that Americans continue to spend at a decent pace, even if their purchase decisions remain selective and cautious. Furthermore, there were two consumer confidence surveys released last week, with each moving in opposite directions. The University of Michigan and Thomson Reuters found that sentiment edged lower in July, with little change in confidence since December and persistent anxieties about the future direction of the economy. In contrast, the Conference Board observed that sentiment was at its highest point since the beginning of the recession (December 2007), led by an improved perception about the labor market. However, rising confidence did not necessarily translate into increased buying intentions.

For its part, the Federal Reserve Board noted recent improvements in the economy, but it also believes there continues to be “significant underutilization of labor resources.” The Federal Open Market Committee (FOMC) voted to continue tapering its long-term and mortgage-backed security purchases, down from $35 billion to $25 billion per month. These purchases are expected to end by October. While the FOMC will keep short-term rates near zero for now, these rates are predicted to begin rising sometime early in 2015. Nonetheless, the Federal Reserve will continue to monitor incoming economic data, including inflationary pressures. Recent data have shown prices accelerating, but at least for now, they appear to be under control. For instance, core inflation, which excludes food and energy costs, has increased 1.6 percent over the past 12 months, according to personal consumption expenditure deflator data released last week.

Source: Shopfloor

Article Topics

Institute for Supply Management News & Resources

U.S. Manufacturing Gains Momentum After Another Strong Month Services sector sees continued growth in March, notes ISM Manufacturing sees growth in March, snaps 16-month stretch of contraction Services sector activity sees continued growth in February, ISM reports Services sector activity sees continued growth in February, reports ISM February manufacturing output declines, reports ISM February manufacturing output declines amid strong seasonal factors More Institute for Supply ManagementLatest in Business

North Carolina Welcomes Amazon’s Newest Mega-Warehouse How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations FedEx Announces Plans to Shut Down Four Facilities Women in Supply Chain: Ann Marie Jonkman of Blue Yonder U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery More Business