E-Commerce Reshaping the Logistics Landscape

The maturation of multi-channel distribution has put added pressure on all major modes of freight transportation, with “Just-in-time” and “just-in-case” strategies now having to meet the “just do it” demands created by today’s highly impatient consumer.

The flowering of e-commerce, while welcomed by most manufacturers and retailers, has introduced far more risk and complexity for logistics managers.

Determining the optimal distribution network has never been more of a challenge, as shippers strive to strike a delicate balance between service and cost.

Parcel express providers have been ahead of the game for some time now, and are adding a new dimension to the scenario as volume cargo playing fields are reconfigured.

Amazon, for example, may have startled many when it announced its intention to become a non-vessel operating common carrier (NVOCC), but some industry analysts saw it coming all along.

“This gives Amazon a foothold in the $350 billion a year ocean freight business,” says Satish Jindel, president of SJ Consulting Group, a transportation and logistics analyst firm.

“This makes perfect sense for Amazon. It will not operate ships because they would rather subcontract that work”

It’s a move that the ocean cargo industry experts applaud, even in these days of rock-bottom rates. But that does not mean that Fedex or UPS might be fully averse to purchasing their own fleet of aftermarket container vessels, especially if fuel-related expenses remain manageable.

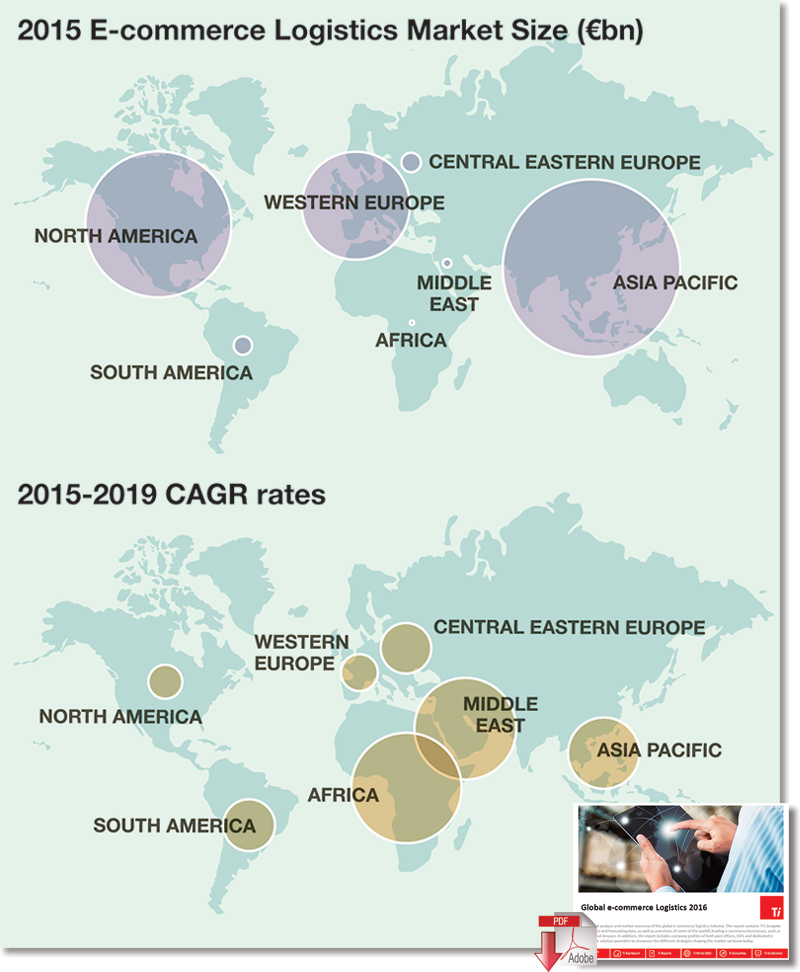

“Any provider that establishes a strong reputation in e-commerce logistics and finds a formula which yields a consistently decent margin is set for years of success,” says David Buckby, economist with the London-based consultancy Transport Intelligence [Ti].

In its report “Global E-Commerce Logistics 2016,” Ti analysts observe that even the stodgy and moribund ocean container shipping industry is facing massive disruptions.

“In order to find an edge in an increasingly crowded market place, the role of technology will continue to hold significant sway in this sector,” adds Buckby.

“Those ocean carriers who are able to work with retailers to create the most efficient and cost effective services will be the ones who prosper, others will find themselves shelved.”

To keep that from happening, asset-based ocean carriers are maintaining close links to cloud-based supply chain specialists like INTTRA, GT Nexus and CargoSmart who were all early adapters to e-commerce.

These three major players currently provide shippers with an e-commerce platform including sailing schedules, booking, shipping instructions, bill of lading, track and trace, and reports.

But according to Inna Kuznetsova, president and chief operating officer of INTTRA Marketplace, having such a relationship with an ocean carrier can also keep all stakeholders happy.

“Business-to-business [B2B] e-commerce technology can have a significant and measurable impact on a company’s stock price when it solves fundamental challenges in how the company handles its ocean container shipping activities,” she says, adding that there are far-reaching implications for global carriers and shippers with large-scale distribution needs unique to both heavy and light manufacturing.

Michelle Cummings, vice president of ocean services and partners for GT Nexus, agrees. “Many companies have deployed cloud technology platforms to serve as an easy-to-use, transparent tool to facilitate bookings and shipping documentation,” she says. “But the real power is beyond these point benefits, in the essence of transparency and collaboration fostered at the core of the relationship.”

Indeed, relationship building was the main impetus behind the e-commerce partnership forged by Drewry Consulting and CargoSmart two years ago. Prior to the agreement, Drewry had been using data from CargoSmart to augment its coverage of ocean carrier service reliability on key container shipping trades.

And while Drewry was the first company to introduce independent schedule reliability key performance indicators (KPIs) and container freight rate benchmarks nearly a decade ago, its alliance with CargoSmart gives it a foothold in the burgeoning e-commerce marketplace where information is king.

Philip Damas, who heads up Drewry Supply Chain Advisors, the logistics arm of the Drewry Group, wishes to end any speculation that integrators and e-commerce providers will have the volumes to fill containerships on their own.

“As Amazon has shown, the best strategy for international ocean freight is to increase their buying power and buy space from common-user ocean carriers,” says Damas. “Operating or owning containerships would be uneconomic for them. It’s not the same as operating a cargo freighter from one airport to another airport.”

Air Jam

However, one should not assume that all is rosy at international airports. According to Shawn McWhorter, president of the freighter operator Nippon Cargo Airlines (NCA), freight forwarders are not always quick to retrieve goods when they arrive through e-commerce orders. The chain of custody, for example, is sometimes compromised.

“Integrators use common carriers so they can still call upon their own freight forwarding divisions, as well as their ground transportation to eliminate some of the links in the conventional air freight supply chain,” says McWhorter.

Currently, UPS and FedEx handle the bulk of Amazon’s deliveries, but Amazon has attempted to take more control over its supply chain after a mixture of bad weather and a last-minute surge in e-commerce orders delayed deliveries during the crucial holiday season two years ago.

Read: Amazon and ATSG Ink Air Transport Network Deal

Glyn Hughes, president of global cargo for the International Air Transport Association (IATA), observes that a whole host of industry stakeholders are trying to address the e-commerce conundrum.

“Airfreight spends 90% of time on the ground,” he says. “It’s stationary for too long. We need to do things differently.”

Hughes adds that air cargo providers need to take “a forensic look” at the segmented supply chain before the situation improves. The association is now conducting a global shipper survey to measure the level of discontent and hope in the sector.

In the meantime, IATA is seeking ways to collaborate more closely with the Universal Postal Union, the United Nations agency that coordinates postal policy among nearly 200 member nations. “This may ensure that the mainstream airfreight supply chain retains its share of the online market and eliminate the air waybill, which is often redundant,” says Hughes.

Rail’s E-Commerce Charge

Combination airfreight carriers are facing another challenge from railroads, says IATA, which notes in a recent report that Hewlett-Packard opted to send computers bound for the European market on a 17-day rail journey from its manufacturing site in China rather than booking a flight.

International shippers have also cited Indian Railways, the world’s fourth largest network, as an example of how auto parts manufacturers are cashing in on the nation’s booming $4 billion e-commerce industry. “The Indian Railways is also exploring ways in which it can help in door-to-door transportation of goods,” says Abu Jadu, an analyst based in Delhi. “It may soon use ‘road railers’ that are capable of movement on road as well as rail to provide last mile connectivity.”

Here in North America, freight railroads are harnessing the power of data to improve the health of the nation’s rail network. Working with North Carolina-based Railinc, railroads are collaborating in an unprecedented way to identify equipment-related problems before they occur, improve the efficiency of repairs and enhance safety across the nation’s e-commerce rail network.

“America’s e-commerce rail network will only become smarter in the years to come as Railinc helps railroads implement advanced technology, such as installing sensors beside track and directly onto locomotives and rail carsto identify improvements in freight loading,” says Edward R. Hamberger, president and CEO of The Association of American Railroads (AAR).

“Big Data will continue to help railroads make intelligent decisions about the rail network and maintain a system of cargo delivery second to none.”

Still, the “Cass Freight Index” reports that railroads experienced lower growth in container and trailer volumes the final quarter of last year, and that segment fell 1.4% in December. Meanwhile, trucking companies reported excess capacity, and may be looking over their collective backs as rail mounts an e-commerce charge.

Trucking Along

The trucking picture was further muddled early last year with a blockbuster deal that was designed to enhance the e-commerce capabilities of two industry giants, notes Dan Goodwill, president of the consultancy Dan Goodwill & Associates based in Montreal.

“C.H. Robinson acquired Freightquote.com, Inc. in January 2015 – one of the largest internet-based freight brokers in the United States,” says Goodwill. “Its proprietary e-commerce technology allows shippers to access competitive rates and automated load acceptance and payment functionality. E-commerce is going to be a bigger part of our future supply chain services.”

Goodwill also agrees with analysts who predict that e-commerce shipments will expand four times faster than the U.S. economy, thereby adding additional pressure to trucking firms charged with providing “last mile” delivery.

“Plenty of runway exists over the coming 5 years to 10 years for intermodal to continue capturing truck traffic, often with the blessing of the truckload carrier,” says Goodwill.

“Shippers are increasingly looking for carriers and logistics service providers to offer multi-modal capabilities, and the expanding e-commerce trend will only contribute to the velocity.”

Finally, Amazon is blurring the lines between online and traditional in-store retail by introducing “Treasure Truck,” a store on wheels that poses yet another challenge to the conventional trucking model.

Amazon trucks carry a limited quantity of one product each day that shoppers can order via the company’s mobile app and then collect by meeting the vehicle at a designated pickup location. And if you missed that delivery, don’t fret. Just wait for an alert using the Amazon app.

Retail Research: Many Retailers Still Don’t Get It

Further clouding the e-commerce picture is the fact that customer and retailer perceptions and expectations are not aligned, say industry analysts.

Furthermore, many retail stores lack the essential technology to measure and apply shopper data across all channels.

RetailNext, a provider of retail industry analytics technology notes in a recent study that physical retail is alive and persisting, and increasingly influenced by digital.

Researchers add that today’s new “shopping journeys” recognize the value of physical retail and its particular set of competitive advantages, such as the ability to experience products and services and interact with sales associates.

However, shoppers also require seamless cross-channel experiences, and only 49% of consumer respondents feel they receive consistent experiences across all channels.

Among the report’s other findings:

- Retailers don’t understand what matters most to shoppers. Retailers are experiencing “a disconnect” between strategy and tactics and what shoppers want most, such as consistent pricing across channels and the ability to make returns regardless of the channel where the initial purchase was made. And 79% of shoppers reported pricing consistency as a critical or important requirement, while just 52% of retailers agreed.

- The role of the sales professional is evolving. Today’s digitally-empowered, smart-phone-wielding shoppers expect on-demand sales professionals who are facilitators of “exceptional shopping experiences.” However, just 29% of consumer respondents feel that sales people are “really knowledgeable and helpful.” Retailers are not measuring customer behavior, especially in-store.

Retailers understand and agree that in-store technology drives both operational excellence and the overall digital customer experience.

However, retailers overwhelmingly struggle to measure customer behavior, and surprisingly few reported the use of key performance indicator metrics in-store, with just 33% of retailers reporting that they always measure conversion rates.

Forrester Consulting conducted in-depth surveys with 500 consumers and 150 retail decision-makers in the United States and United Kingdom to develop the findings.

Related: What Does Amazon’s E-Commerce Domination Mean for Logistics Service Providers?

Article Topics

Forrester Research News & Resources

The Forrester Wave™: Supplier Value Management Platforms, Q1 2022 E-commerce Returns Are the New Normal Tomorrow’s Midmarket B2B eCommerce will Take Place in the Cloud Five Steps to Excellence in B2B eCommerce E-Commerce Reshaping the Logistics Landscape Real-Time Data Drives The Future Of Retail Digital Predator or Digital Prey? More Forrester ResearchLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author