Ecommerce & Logistics Firms Dominate Largest Warehouse Deals in 2018

Ecommerce and logistics companies claimed a larger share of the 100 largest industrial-and-logistics leases signed in 2018 than they did a year earlier, underscoring the growing influence of those companies on U.S. warehouse construction, according to a new report from CBRE.

Largest Warehouse Deals in 2018

The analysis by CBRE, the world’s largest commercial real estate services and investment company, of last year’s industrial-leasing activity in the U.S. found that ecommerce and logistics companies accounted for 61% of the 100 largest warehouse deals (leases and sales) by square footage in 2018, totaling 61.5 million sq. ft.

Overall, there was 100.3 million sq. ft. transacted ranging in size from 742,000 to 2.3 million sq. ft.

Ecommerce & Omnichannel

The ecommerce industry’s share of these top deals (41) includes more retailers that are implementing omnichannel strategies.

Logistics companies’ share was 20 deals, 40% of which involved ecommerce distribution.

Fifty of the 100 deals were for warehouses sized 970,000 sq. ft. or more, reflecting demand for large, tall, modern buildings.

These transactions were spread across 32 markets, with the Inland Empire, PA I-78/81 Corridor and Dallas/Ft. Worth having the largest volume of transactions by square footage.

The two are related in that many logistics companies, specifically, third-party logistics providers, handle ecommerce distribution for their clients.

Explore More Industrial & Logistics Research, Perspectives and Market Reports

David Egan, CBRE’s Global Head of Industrial & Logistics Research, stated;

“These figures show there still is a lot of momentum behind e-commerce uses in U.S. warehouse leasing, despite concerns that the sector’s expansion may be reaching its later stages, and we expect this type of leasing momentum to continue in 2019.”

100 Largest U.S. Warehouse Deals by Industry, 2018

Source: CBRE Research, Q4 2018.

Largest Industrial Leases

Regardless of industry, the largest industrial leases got even larger last year.

The largest 100 from last year – spanning uses such as ecommerce, logistics, manufacturing, food and beverage, technology and retailing – totaled 19 percent more space than the largest of 2017.

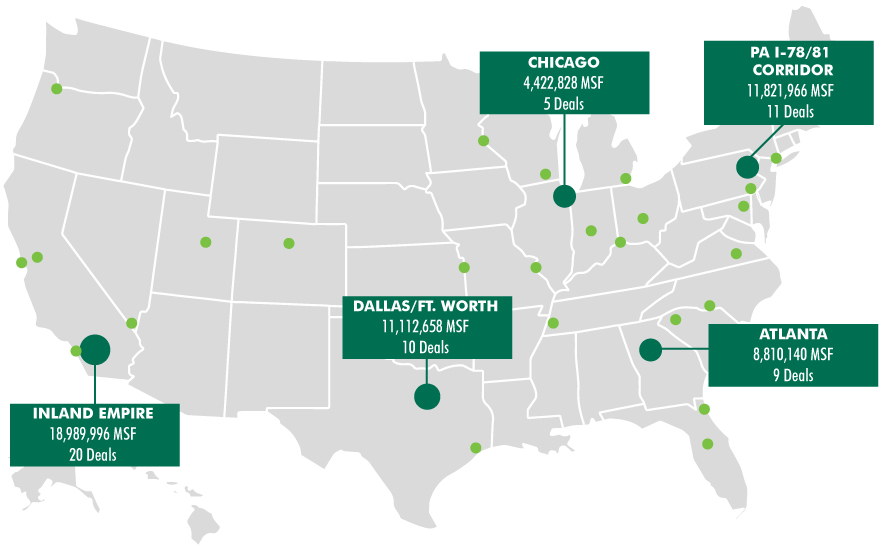

Last year’s largest industrial leases were spread across 32 markets, with many clustering in leading logistics hubs including California’s Inland Empire (20 leases), Pennsylvania’s I-78/I-81 corridor (11), Dallas-Fort Worth (10), Atlanta (nine) and Chicago (five).

Others claiming several large leases were Columbus (four), Detroit (four) and St. Louis (three).

“These are among the leading markets that offer the high-quality logistics facilities that many of these e-commerce users are seeking,” said Chris Zubel, CBRE Americas Industrial & Logistics Investor Leader.

“This activity builds upon itself when a region provides the transportation access, qualified labor pool and state-of-the-art real estate that many e-commerce users need.”

Top U.S. Warehouse Deals by Market, 2018

Source: CBRE Research, Q4 2018 | Green dots represent other markets that had transactions in the top 100 for 2018.

Matt Walaszek, CBRE Senior Research Analyst in Industrial & Logistics told Supply Chain Management Review in an interview that researchers weren’t too surprised with the findings, as they aligned with what they'd been seeing with regard to strong e-commerce growth and high demand for logistics space.

“We were interested to discover that 40% of the 3PL occupiers were serving e-commerce customers, reinforcing our view that online retail continues to evolve and impact demand for logistics space,” he said.

“In total, the cumulative square footage of the top 100 deals grew by 19% Y-o-Y, especially with regard to ecommerce users which rose 42% (in square footage) during the same timeframe.”

Of the top 100 deals, 33 deals took place on the West Coast States (CO, CA, AZ, UT, NV, OR, WA), added Walaszek.

“Of those 33 deals on the West Coast only 6 were renewals, while the remaining were new deals and user sales,” he said.

“West Coast markets will continue to generate huge demand. However, lack of supply is hampering leasing activity as there is simply not a lot of available space for occupiers looking to expand their footprint.”

Related Article: Envisioning & Planning the Future Warehouse of 2030

Related White Papers

Solving the Challenges of Small-order Fulfillment

The newest white paper from Swisslog provides an in-depth review of five automated goods-to-person solutions to help you make the right choice. Download Now!

How Repurposed Retail Space can Enable a Hybrid Approach to E-commerce Fulfillment

The future belongs to organizations that have the flexibility to adapt to how consumers prioritize choice, speed, and convenience on a purchase-by-purchase basis through a true omnichannel experience. Download Now!

More Warehouse Resources

Article Topics

CBRE News & Resources

CBRE report points to a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights the ever-growing role of holiday season reverse logistics operations Top 20 Warehouses 2023: Demand soars and mergers slow Top 20 Warehouses 2023: Demand soars, mergers slow CBRE report highlights mixed Q3 industrial real estate directions Q3 Commercial Construction Starts Fall 37% vs. Q2 More CBRELatest in Warehouse|DC

North Carolina Welcomes Amazon’s Newest Mega-Warehouse SAP Unveils New AI-Driven Supply Chain Innovations U.S. Manufacturing is Growing but Employment Not Keeping Pace Maximize Warehouse Space with Mezzanine Automation: Expert Tips Most Companies Unprepared For Supply Chain Emergency Microsoft Unveils New AI Innovations For Warehouses Spotlight Startup: Cart.com is Reimagining Logistics More Warehouse|DCAbout the Author