Ecommerce Has Shippers at a Strategic Crossroads

The findings from the “25th Annual Trends and Issues in Transportation and Logistics” suggest that three complex, interrelated supply chain elements - transportation, technology, and organizational structure - are major contributors to the indecision of committing to a direction.

Waiting too long at the crossroads will only result in a competitive disadvantage that will be difficult to overcome in a global economy.

Symbolically, a crossroads signifies dealing with choice and the consequence of making a decision about future direction.

What often gets overlooked in the angst of making the “right” decision regarding direction is the perspective of being at a point of potential.

The potential of gaining competitive advantage from being a “first mover” or “early adopter” should be considered.

This entails doing your homework, looking at the signals in the market, and setting a path that supports the firm’s strategy and objectives.

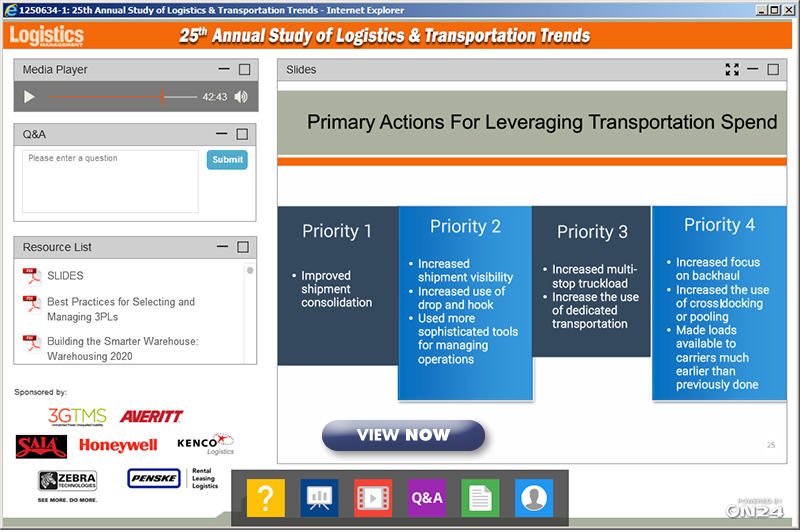

The Masters of Logistics are at the forefront of leveraging their considerable transportation volumes to gain significant improvements in efficiency and effectiveness.

Recognizing the strategic importance of logistics and transportation activities on firm performance, the Masters elevated these areas to prominence in their organizations as indicated by titles such as vice president or senior director of logistics.

Logistics Management: 25th Annual Masters of Logistics

The insights that were gleaned from the Masters over the years of conducting our study revealed best practices in logistics and transportation that consistently resulted in increased efficiency and effectiveness.

Fortunately, time and innovation has a way of leveling the playing field, even in business.

Over the past few years, supply chain software hosted via cloud technology, a phenomenal growth in e-commerce, and evolving organizational structures to manage transportation as a value-added activity have made it possible for any size company to create an advantage over their competitors - that is, if they act.

Is Your Logistics Operation Ready To Commit To A Path Toward Omni-Channel Fulfillment Success? Find Out Now!

View Now the Full Results of the 25th Annual Study of Logistics and Transportation Trends (Masters of Logistics)

The 2016 study showed that the Masters of Logistics reported “better” to “much better” profitability than their competitors over the past year.

Three factors that contributed to creating their competitive advantage years ago are still the same three factors that exist today.

We believe that these factors provide critical insights for companies that are waiting at the crossroads and looking for a path forward.

- Technology must enable an integrated supply chain strategy. The Masters have learned how to deal with demand uncertainty better than other size firms. Developing this capability is difficult, as it requires timeliness of data that’s only possible through end-to-end supply chain visibility. The foundation is supply chain technology that supports both of these conditions. Future competitive advantage will belong to those companies that move from static reports with stale information to real-time, granular data with prescriptive analytics that enables them to determine the best course of action. Without this technological capability, companies will continue to manage discrete networks for their distribution channels rather than the ideal integrated network that supports a unified supply chain strategy. The 2016 study results indicate that the Masters are making more progress in developing the technological infrastructure to create this ability as “demand uncertainty” dropped out of the top five factors driving managerial changes for this group while it remained as the second biggest challenge for other sized companies.

- Transportation should be a shared strategic activity and responsibility. The challenges facing carriers and shippers today require the collective efforts of internal and external functional areas to achieve the desired results. The procurement of transportation services necessitates the expertise of both domains. According to the 2016 results, the Masters of Logistics are investing in building internal partnerships to co-manage this key strategic activity and are including their strategic carriers in this process to ensure that short-term savings do not derail long-term strategic goals.

- Supply chain must be part of the C-suite. While there has been a noticeable increase in the percentage of companies that have a chief supply chain officer (CSCO) as part of their key leadership team, a majority of companies don’t have a person with this title. Our analysis showed that the Masters, however, have statistically significant more CSCOs than either medium- or small-sized companies. Crafting an integrated supply chain strategy that leads to better firm performance necessitates that this area have a seat at the C-suite table and access to the board of directors.

The macro- and micro-level issues facing companies today are neither simple nor straightforward. It has been seven years after one of the worst global recessions since World War II, and uncertainty still surrounds global and domestic economies.

The direction to take is not as uncertain as many believe; so, our suggestion is to stop waiting at the crossroads. The Masters are already navigating the path ahead. Now is the time to commit to a direction to join them.

Article Topics

Penske Logistics News & Resources

PITT OHIO Wins 2023 Penske Logistics Freight Management Carrier Award CSCMP EGDE Panel Weighs Volatility’s Impact on Operations Penske Logistics is taking steps to expand its freight brokerage operations U.S. logistics business costs rise by 22.4% to $1.85 trillion in 2021, new report says U.S. business logistics costs fall 4% in pandemic year of ‘chaos,’ new study finds Penske Logistics announces it plans to acquire Black Horse Carriers Inc. 31st Annual State of Logistics: Resilience put to the test More Penske LogisticsLatest in Transportation

The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws More Transportation