E-Commerce the Biggest Driver of Change and Growth in Supply Chain & Logistics

U.S. retail sales this year is a $3.8 trillion business, and e-commerce is bringing a whole new series of opportunities to companies like FedEx, mainly in the area of returns, logistics, and disposition.

With the days falling off the calendar leading up to the holiday season, the ongoing influence and emergence of e-commerce on supply chain management shows no signs of stopping.

That was a major takeaway of a keynote speech given by Henry Maier, president and CEO of FedEx Ground at the University of Rhode Island’s Supply Chain Management Forum earlier this week.

“The North American transportation industry is both mature and stable, however, for those of us who derive our livelihoods from this business, we have never seen a market more chaotic and challenging than the one we are in now,” he said.

Maier pointed to e-commerce as a major driver for changes that are occurring in supply chain and transportation. He likened it to a National Geographic movie that traced the advent of airplanes and how they radically changed the world over the last half-century. And he explained that in the not too distant future it would not be surprising to see a similar documentary on another revolutionary shift in society focused on living in the age of e-commerce.

“E-commerce is the biggest driver of change and growth in the transportation industry, this year it will top roughly $300 billion, which only represents a little less than 10 percent of total retail sales. It is fast outpacing the growth of traditional brick and mortar”

From 2012-2014, Maier said e-commerce sales increased by about 102 percent, whereas during that same period the number of “Web,” or e-commerce-type stores shot up by 1,354 percent, with much of those changes being driven by consumer behavior and expectations.

What’s more, he noted that the cost of shipping represents the number one driver of whether or not an online shopper makes a purchase or not. But at the same time, if a consumer is presented with free shipping, that does not mean he or she is willing to wait a long time for their order to come.

And he went on to explain e-commerce is going through what could be called a revolutionary change in which customers will ultimately have more control than retail shippers. This will likely continue, he said, as FedEx has always thought the true value of transportation ultimately benefits the receiver of goods and not the shipper. This is in tandem with customer expectations in that they want to order from anywhere, send to anywhere, at any time of the day or night.

“This makes omnichannel a key priority for retailers, particularly brick and mortar retailers, and drives a lot of changes in proponent strategy which impact all of us in transportation with serious implications for retailers’ customer service and order management systems as well,” noted Maier. “Every brick and mortar retailer today has an Amazon strategy that runs the gamut from ‘how do we compete with these people?’ to ‘how do we survive?’”

The subsequent impact of that is the increase in online orders being shipped to retail stores for pick up with retailers’ objective being that consumers will purchase additional items once they are in the store.

eCommerce Has Gone Global

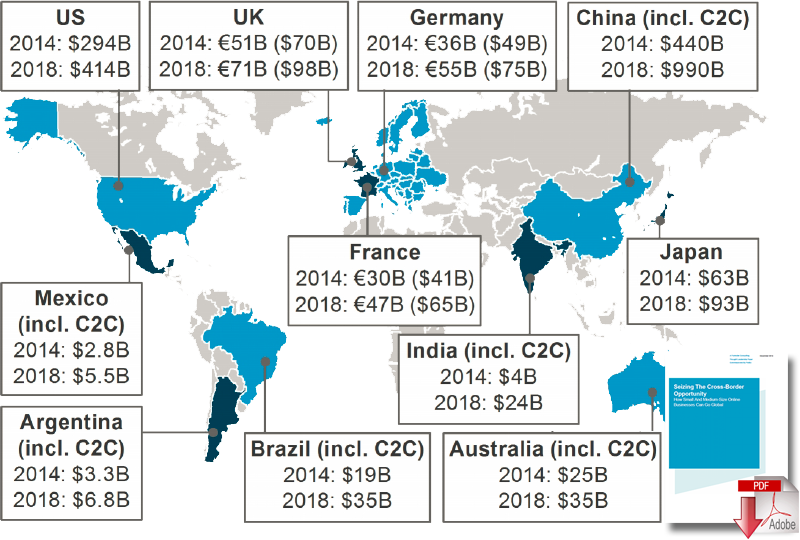

Global eCommerce is growing across a variety of regions and countries, with online buying behavior currently representing over $1 trillion in sales per year and forecasted to nearly double within four years.

Through forces such as rapid growth in emerging markets and the proliferation of digital channels through which to search for and engage with businesses, consumers all around the globe are becoming online shoppers. Beyond the products and brands consumers know locally, the Internet is introducing them to new merchants and unique products not readily available in their own markets. The Internet, therefore, has unleashed a new global shopping reality: Not satisfied with what is around the corner or online locally, shoppers from all corners of the earth are going crossborder seeking hard-to-find items and great deals.

Source: Seizing The Cross-Border Opportunity - How Small And Medium-Size Online Businesses Can Go Global

Another emerging trend he pointed out is shipping goods from store locations, which he termed “genius” because effectively using a store as a distribution center works well because stores are closer to customers and reduces transit times, which, in turn, make this type of approach more competitive with something like Amazon Prime, as it is quicker than Prime’s two-day delivery window.

“But it also comes with serious challenges as most stores’ WMS (warehouse management systems) and order entry systems don’t have any vision for where an order actually is in a store,” he said. “We see retailers increasingly challenged these days, because they know where the ordered item is in the store but employees need to find them. It can be a serious problem if an order item cannot be found, because it then cannot be shipped.”

“There is also an increased focus on customization ‘to get me exactly what I need when and where I need it.’ It is part of an attitude that is driving significant change in retail across the board and is magnified during every holiday shopping and shipping season, which we are now on the cusp of. You see retailers trying to differentiate themselves every year and you also see, especially in recent years, consumer behavior become less and less predictable and all the while consumers wait and wait, holding out to the last possible minute to get the best possible deal.”

As an example, he used the 2014 holiday shopping season, which saw myriad retailers deal with issues related to the West Coast port labor dispute. For FedEx, he said that last year’s Peak Season served as proof that the key to success in the three-week period between Thanksgiving and Christmas is flexibility in the e-commerce economy.

“As much growth as e-commerce has brought to the industry, there is still a lot of runway ahead,” said Maier. “U.S. retail sales this year is a $3.8 trillion business, and…e-commerce is bringing a whole new series of opportunities to companies like FedEx, mainly in the area of returns, logistics, and disposition. E-tailers are not really set up to handle returns, nor are brick and mortar retailers. They are happy to take the return back, because they are hopeful it will be exchanged for something else and maybe they will buy something else while they are there, but many do not have a real process for handling those returns.”

Taking that another step, Maier said there is ostensibly a cottage industry brewing, which he dubbed “The Rs: return, refurbish, re-pack, replace, or recycle.” As much as a consumer would like to return a gift in January, Maier said the reality is that a retailer does not want it back.”

Looking ahead, Maier posed the question of what does the e-commerce supply chain look like in the future? He then explained that while free shipping is not really free, it is also not sustainable in its current form, noting that in the future there could be a situation in which it is only an option when a residential delivery is made to a commercial location such as a neighborhood drug store or a kiosk or a FedEx location, where a customer can pick up a shipment on the way home.

Related: Is Anyone Really Completely Omnichannel Ready?

Article Topics

FedEx News & Resources

FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Ranking the Top 50 Trucking Companies of 2024 Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More FedExLatest in Supply Chain

Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Supply ChainAbout the Author