Does Artificial Intelligence Enabled Demand Forecasting Improve Supply Chain Efficiency?

Improving demand forecasting with artificial intelligence is one of the most promising applications for supply chains, but how do the non-traditional methods compare in performance with established forecasting practices?

Improving Demand Forecasting with Artificial Intelligence

Using artificial intelligence (AI) and machine learning to improve demand forecasting is one of the most promising applications of AI for supply chains.

The technology “learns” from past experience and can analyze the multitude of complex relationships and factors that influence product demand.

However, AI-enabled demand forecasting is still at a relatively early stage of development.

A key question for supply chain professionals is: How do the non-traditional methods compare in performance with established forecasting practices?

And, to what extent does it affect supply chain efficiency?

A thesis research project at the Malaysia Institute of Supply Chain Innovation (MISI) made such a comparison.

The project affirms the value of AI in demand forecasting for certain product types and highlights areas where more research is needed.

Accuracy in Demand

The subject of the research is a steel-making enterprise that operates globally.

Steel products are “functional” in that they typically have long life cycles, fewer variants (compared, to say, “innovative” products), and modest margins.

Demand for these products is generally stable and predictable.

However, a product that benefits from stable demand invites competition. To create and sustain competitive advantage for functional products, companies must keep inventory, storage, and transportation costs to a minimum.

Reducing inventory costs also improves working capital performance; an important benefit where capital is constrained.

The steel manufacturer for this research project has been operating for some 50 years. Historically, the company focused on supplying construction markets with customized products.

Orders are received in advance, and the competitive strategy for this segment lies in providing attractive lead times to customers. In response to economic growth, the company has expanded into the retail market segment. Retail has become its fastest-growing segment, with a year-over-year growth rate of 5% by volume.

In this market, the company offers a wide range of products such as coated and painted steel coils for roofing applications in a make-to-stock (MTS) manufacturing environment. In this operating mode, the planning horizon is short-term - one month to three months - and demand forecasting has to be accurate at both the product family and individual SKU levels.

Knowing how much to manufacture as precisely as possible is a key requirement that will gain in importance as the manufacturer continues on its current growth path - hence its interest in improving the demand forecasts that drive production.

Traditional Solution Drawbacks

The company currently uses two traditional time-series forecasting methods, Holt-Winter’s and Damped trend, to generate monthly product demand forecasts. One of the limitations of these methods is that they account for a relatively narrow range of demand-influencing factors such as seasonality. In the real world, demand moves up and down in response to numerous market and macroeconomic forces.

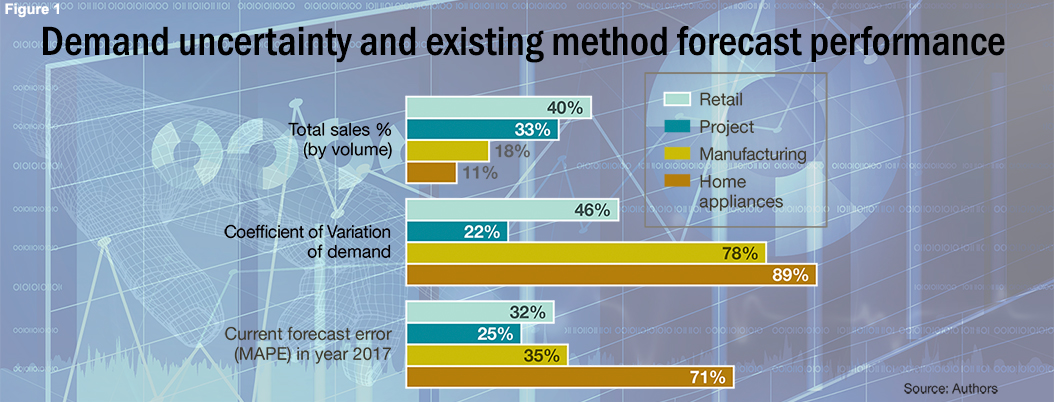

Such limitations cause traditional solutions to produce poor forecasts, which is reflected in the company’s prediction performance. Figure 1 compares performances for the year 2017 for different market segments. As can be seen, the mean absolute percentage error, or MAPE, varies from 25% to 71%. Clearly, there is room for improvement.

The analysis above also highlights the reasons that the company is especially keen to improve its demand forecasting performance in its retail market segment.

Retail is the largest segment with 40% of total volume sales. Its demand pattern shows significant volatility with a coefficient of variation (COV) of 46%. Although the home appliances and manufacturing segments have significantly higher COVs compared to retail (78% and 89% respectively), their combined market share is markedly less than retail.

The project market segment is the largest in terms of sales volume, but its demand is driven by large construction projects that are visible years in advance and hence exhibit relatively predictable demand. This is evident in the lower COV for this segment (22%) and lower forecast error (25%).

In addition to the company’s fastest-growing market segment, retail displays significant volatility and demand forecasting error.

Knowledge Gaps

Machine learning-based forecasting could help the company address these challenges and improve both supply chain efficiency and engagements with customers.

These non-traditional solutions combine AI learning algorithms with Big Data to analyze an unlimited number of causal factors simultaneously. And by learning from data on past and current performances, AI-enabled approaches continuously refine and improve the demand forecasting process.

On the other hand, these applications are relatively new, and more information on how they perform in practice is needed. For example, although the technology has been employed in various areas of the supply chain including transportation management, sourcing and demand forecasting, the results to date in the latter case are inconsistent. Some experts have concluded that traditional demand forecasting methods such as exponential smoothing can yield results that are comparable, or even superior to, those achieved using machine learning.

Doubts like these have prompted research on hybrid solutions that combine traditional and non-traditional methods. To shed more light on how the steel manufacturer might deploy the technology, the research focused on two common machine learning techniques: ARIMAX and Neural Networks (NN). ARIMAX is a general model that bundles both time-series and causal factors into a single model. NN is commonly used in statistical modeling and pattern recognition. It is loosely based on the architecture of the human brain and comprises thousands or even millions of densely interconnected processing nodes.

Comparing the performance of these methods with the two traditional solutions currently in use would help the manufacturer to decide how it might adopt machine learning in its demand forecasting process. Three core supply chain efficiency metrics are used to make the comparison: inventory turn, forecast accuracy and cash conversion cycle (CCC). The first two are operationally oriented, while CCC reflects working capital performance.

The analysis is based on monthly panel data for the period 2012 to 2017 that includes sales volumes, inventory levels (quarterly), accounts receivable as well as payable, cost of goods sold, and revenue. Data on 30 macroeconomic indicators (such as consumer prices and industrial production outputs) was also collected for the same time period on a monthly basis.

Food for Thought

The comparison shows that a machine learning approach to demand forecasting that captures a complex mix of historical data and market variables can indeed perform better than traditional time series and linear models for the functional products studied. The accuracy of demand forecasts improved by around 6.4% on average when machine learning technology was applied.

Moreover, the three core supply chain performance metrics used show that notable improvements are possible. CCC was reduced by 21 days - an outstanding gain in working capital efficiency. Inventory turnover improved by 0.17 turns compared to the baseline figure. This was expected given that IT is a large component of CCC, which recorded a significant gain. Still, improved IT reduces costs in other areas such as product storage and transportation without compromising service levels.

The project also yielded some general observations about the use of machine learning in demand forecasting. For example, applying the technology can mitigate the bullwhip effect to some degree, and especially in industries such as steel manufacturing where demand is not seasonal. However, a more sensible approach to this issue is to improve collaboration and communication across the supply chain.

The research offers some useful insights for practitioners who may be considering the use of AI-enabled demand forecasting or have already embarked on the journey.

For example, the idea was to develop an algorithm that utilizes NN-based demand forecasting in general, and the ARIMAX model when the forecast strayed beyond a certain predetermined threshold. It turned out that the ARIMAX technique was better at predicting peaks in demand, while the NN method generated more “smoothed” and more accurate predictions. It seems that a hybrid solution can yield better forecasts in terms of reduced MAPEs at an aggregate level.

Further research is needed in some key areas. For example, the findings are not applicable in markets such as fast fashion and consumer electronics where product life cycles are short and demand patterns erratic. However, these types of markets rely much more on expert opinion to drive demand predictions, and the research could be extended to help understand how such decisions can be “learned” by AI-based solutions and incorporated into forecasts.

About the Authors

Javad Feizabadi is an associate professor at the Malaysia Institute for Supply Chain Innovation, MIT Global SCALE Network. He can be reached at [email protected]. Apurv Shrivastava is project manager, global logistics improvement group for Cummins Asia Pacific. He can be reached at [email protected].

Related Article: 8 Fundamentals for Achieving Artificial Intelligence Success in the Supply Chain

Related White Papers

8 Keys to Achieving Success with Artificial Intelligence in Supply Chain

This white paper looks at the fundamentals that supply chains need in place in order to achieve real results from Artificial Intelligence implementations. Download Now!

Can Blockchain Revolutionize the Supply Chain?

In this white paper Ranjit Notani, One Network CTO examines Blockchain’s powerful potential as well as a major problem and whether and how Blockchains can revolutionize the Supply Chain. Download Now!

The Internet of Things and Your Supply Chain

This white paper offers a quick and clear guide to the Internet of Things (IoT), it explains why this technology is so exciting for supply chain and offers a few examples of how it and related technology can be used to dramatically cut costs. Download Now!

More Artificial Intelligence Resources

Article Topics

One Network Enterprises News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Companies Need to Develop New Innovative Approaches to Supply Chain Design How to Improve Cost of Goods Sold Horizontally Across the Supply Chain How the Global Pandemic Accelerated Supply Chain Visibility, Digitalization, and Automation AI and Data, the Future of Supply Chain Management AI and Supply Chain Problem Solving More One Network EnterprisesLatest in Supply Chain

Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Ranking the Best Countries for Private Business in EMEA Frictionless Videocast: The Importance of Water at the U.S./Mexico Border with Commissioner Maria-Elena Giner, International Boundary and Water Commission Why are Diesel Prices Climbing Back Over $4 a Gallon? Plastic Pollution is a Problem Many Companies are Still Ignoring Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws 80% of Companies Still Unsure How to Best Leverage AI, Study Finds More Supply Chain