Building a Better Materials Handling Distribution Center Information Technology (IT) Backbone

Capital expenditure plans for materials handling solutions are ebbing overall, but restrained spending on hardware is balanced by steady investment in the information solutions that tie equipment together.

Investment in materials handling solutions in warehousing, manufacturing and distribution facilities has tapered for the first time in recent years, and sentiments suggest changing priorities in the near term.

In fact, the results of Peerless Research Group’s (PRG) “2016 State of Warehouse/DC Equipment Survey” indicate a significant softening of investments for the first time since the recession.

More than 20% say they’re holding off on investments, up from an average of 14% in the previous four years. After 35% said they plan to move ahead with investments in 2015, just 28% still have irons in the fire.

However, 20% - also the highest since the downturn - say the economy is having little or no effect on spending decisions.

Revisit: 2015 Warehouse & DC Operations Survey

Respondent demographics reflect smaller companies this year, with average revenues and facility size about 10% smaller than in 2015. About 56% of readers anticipate spending less than $250,000 in the coming year, and average spending continued its decline, shedding 5% to about $327,000.

Still, among the 41% with a pre-approved capital expenditure budget for materials handling solutions, the average budget is the highest since 2012 at $439,000. Fully 30% have more than $1 million to spend, and the 5% increase in this cohort from last year contrasts with a 5% decline in those with $25,000 or less.

Judd Aschenbrand, director of research for PRG, notes that although the same percentage of respondents intends to move forward with investments, the anticipated increase is smaller than in recent years. “This is a snapshot of sentiment in January, and there could be a number of factors behind the curve,” he says. “Is it because it’s an election year? Is it because the market got off to a rough start this year? Whatever the drivers, there are indications that companies are looking to optimize their available resources and be smarter about how they spend money.”

Prudent Planning

The survey captures both actual spend on materials handling equipment in the previous year and anticipated spend in the coming one to three years.

Readers’ projections tend to be accurate, if a bit conservative, and this year’s forecast suggests a dip in anticipated spending. More than twice the percentage of respondents in previous editions of the survey expects decreased spending in the coming year by an average of 33%.

Those who plan to hold off on investments in the coming year will pull back on all major capital purchases (51%), capital equipment (27%), software (20%) and lift trucks (17%). Those who intend to move ahead with investments will pursue lift trucks (53%, down from an average of 65% in recent years), and conveyors and sortation (31%, down from an average of 41%). Information system investment, meanwhile, is consistent with recent years at 49%.

For much of the history of this survey, the “wait and see” approach has been the most popular by a large margin.

Last year, the percentage of hesitant readers sharply dipped from 43% to 35%, the second 8% drop in a row. It continued falling this year to 31%, down from a high of 50% in 2013. However, those who have finally chosen a side of the fence seem to have settled on the conservative side. In fact, 21% are holding off on investing, up from an average of 14% in the previous five years.

The Back End Moves Front and Center

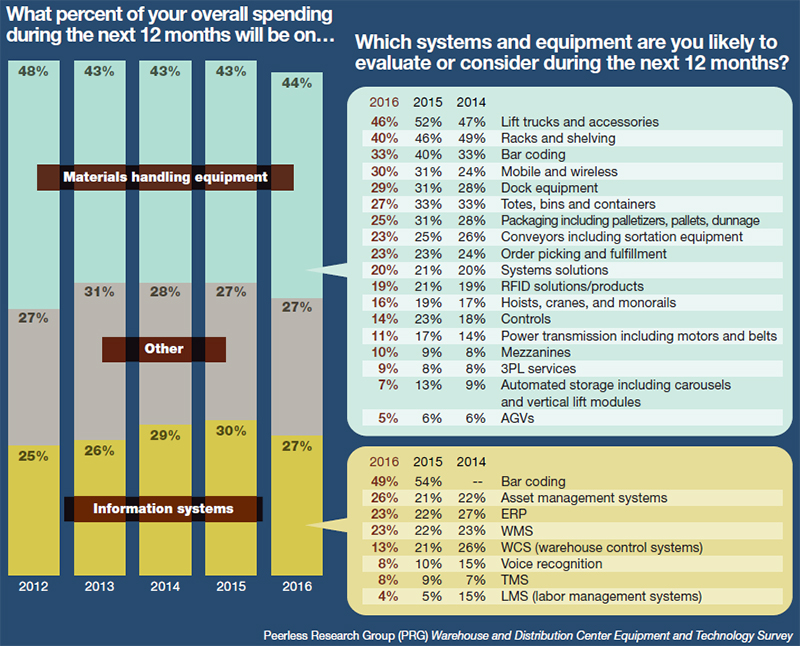

An alternating pattern of investment in IT and hardware has become a trend in recent years. Planned spending on information technology suggests many businesses have gotten their asset and hardware houses in order and will continue to focus on execution in 2016. In the next 12 months, 44% of total planned spending will go toward materials handling equipment and 27% toward information systems.

Anticipated investments in physical equipment like totes, racks, lift trucks, packaging, cranes, motors and belts have tapered somewhat, while information technology is expected to remain in focus as respondents pursue mobile and wireless capabilities (30%), fulfillment solutions (23%), systems solutions (20%) and RFID solutions (19%).

When asked whether any recent purchases were firsts or constituted a substantial change in historical business processes, 46% pointed to new information technology systems. Only three in 10 said their investments had not impacted the status quo, and 27% reported transitions based on physical assets like lift trucks, conveyors or automated storage systems.

Among information system solution groups, warehouse control systems (WCS) have seen the steepest decline in anticipated spending over the next 12 months. With only 13% of respondents expecting to invest in WCS in the coming year, the figure is half of the 26% who were interested in the 2014 survey. Voice and labor management (LMS) also softened, while asset management systems jumped to just over one in four.

Because LMS modules are now found in all tiers of warehouse management systems (WMS), and since a number of other new solutions can boost labor visibility, a shifting market could account for the falling interest in LMS from 15% to 4% over the last two years. Elsewhere, the survey clearly illustrates a strong focus on labor management, safety and productivity.

In terms of hardware, readers are looking to buy lift trucks and accessories (47%), racks and shelving (40%), totes, bins and containers (33%) and dock equipment (29%). Both bar coding (33%) and mobile and wireless solutions (30%) continue to grow in importance from previous years.

Challenges on the Horizon

When asked about near-term trends, respondents reported a heightened concern for capital availability, with more than two thirds expecting to face a challenge in the next two years. More than a third expect to handle smaller, more frequent orders, and 26% anticipate a growing need for multi-channel fulfillment capabilities.

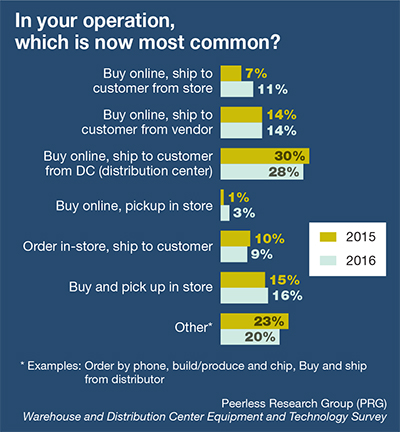

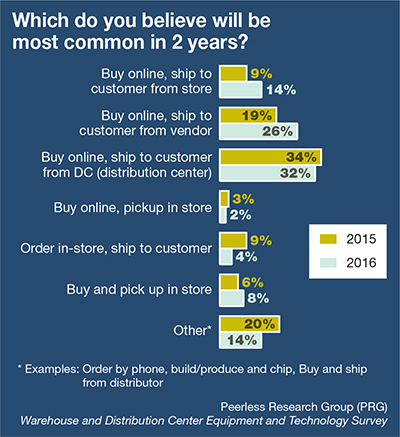

The number of respondents that support “buy online, ship to customer from store” has risen from single digits in recent years to 11%, while “buy online, ship to customer from DC” has fallen slightly. This could indicate that the increased focus on IT solutions is aimed in part at managing and leveraging store inventory to improve service levels.

When asked which issues will become even more important in the next two years, respondents unsurprisingly predicted increased emphasis on labor availability (63%), which was a concern to only 47% in the 2013 survey. Last year’s fourth most cited concern, throughput, fell from 63% to 54%, and now ranks 7th.

Training leapfrogged throughput to occupy the minds of 68% of readers, while ergonomics fell to 41%, its first decrease in several years. This could indicate the growing complexity of materials handling, which requires more skill than physical strain.

Among top concerns in manufacturing operations, respondents reported the highest-ever level of emphasis on labor productivity at 65%, up nearly 10% from last year. Lean manufacturing (59%) continues its steady, years-long rise in importance, as does build-to-order capabilities (53%) and continuous improvement (75%). Meanwhile, just-in-time production, after peaking in 2014, has subsided to become “very important” for just 39% of those surveyed.

For years, as many as 40% of respondents have anticipated the just-in-sequence inventory strategy would increase in importance, but those predictions have consistently fallen flat.

Since at least 2013, the same 27% have expressed the practice’s importance to their current operations, but forward-looking projections now top out at 31%.

Among top concerns in warehousing and distribution operations, labor productivity is also toward the top of the list (64% now, 69% in two years), but efforts to lean inventories are also primed for growth (54% now, 61% in two years). As predicted in previous editions of the survey, outsourcing is taking off.

One in five - twice the percentage of last year’s respondents - report outsourcing is currently important to their warehousing and distribution operations. This could explain the lessening concern about reverse logistics (18%), postponement (12%), value-added services (43%) and compliance with trading partner requirements (23%).

Emphasis on workload planning has also spiked to 63%, beating its previous peak of 57%. Similarly, trading partner collaboration has surpassed respondents’ past projections, with one third indicating its importance to their operations.

Respondent Demographics

In December, Peerless Research Group (PRG) e-mailed survey questionnaires to readers of Logistics Management and Modern Materials Handling, yielding 206 qualified respondents from facilities performing primarily manufacturing (34%), corporate headquarters (27%), warehousing and distribution (22%), and warehousing supporting manufacturing. The median revenue of responding companies is $82 million (average $304 million).

Qualified respondents - those managers and personnel involved in the purchase decision process of materials handling solutions - hold influence over an average of 134,000 square feet of warehouse or DC space.

E-Commerce

The survey investigated the impact of respondents’ e-commerce activity. There was relatively little change since last year among those who currently perform or anticipate a need for distribution functions in a manufacturing environment (44%), or vice versa (40%). However, the location of packaging and fulfillment processes has shifted.

Last year, 47% reported these processes occur in the manufacturing environment in support of e-commerce, 39% in the warehouse, and 22% in the DC. This year, those figures are 38%, 43% and 27%, respectively.

Security

For years, slightly more than half of respondents expressed concerns regarding how much information access they provide to vendors who support their systems. This year, only 38% are concerned, primarily with the potential release of customer information (38%) and financial information, which fell from 50% last year to 38%.

Among the 46% who have a plan for identifying and reducing exposures to risks in materials handling and logistics operations, those efforts are primarily focused on in-house production and operations (61%), logistics risks (61%, up 11%) and supplier risks (58%).

Related: 2015 Warehouse & DC Operations Survey Results

Article Topics

Numina Group News & Resources

Numina Group demonstrates RDS warehouse order orchestration suite Light-directed systems meet integrated solutions Has Your Warehouse Operation Outgrown your ERP? The beauty of integrated pack and ship Voice picking solutions gains impact with integration Numina Group adds to warehouse automation solutions, reducing labor up to 50% Use Cases for AMR and Robotic G2P in Warehouse Picking and Order Fulfillment More Numina GroupLatest in Warehouse|DC

Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Plastic Pollution is a Problem Many Companies are Still Ignoring More Warehouse|DCAbout the Author