Autonomous Trucking Overlooks Skilled Labor Need

Analysts expect automated trucks to proliferate in the next five to ten years, leading to significant job losses in the process, but the problem is the numbers do not clearly back up the predictions.

Automation has become one of the major ongoing stories regarding the future of the American economy.

What began with the rise of robots - and loss of jobs - across manufacturing industries is now a full blown threat to traditional jobs across all industries, salary bands, and education requirements.

The effects are wide-reaching, no job may be safe.

On the surface, trucking seems to fit perfectly into this national narrative.

Autonomous vehicles are one of the hottest developments in technology across the country, and an automated truck already delivered 50,000 cans of beer within Colorado last fall.

Meanwhile, truckers hold the most common occupation in 29 different states.

This map quickly spread around the internet.

Unsurprisingly, analysts expect automated trucks to proliferate in the next five to ten years, leading to significant job losses in the process.

The only problem? The numbers do not clearly back up the predictions.

In addition to the numerous regulatory and logistical hurdles that automated trucks still need to clear, generalizing the skilled work undertaken by millions of truck drivers and their peers overlooks how this industry functions.

In many ways, the current national conversation on the trucking industry tends to overemphasize the technology and oversimplify the complex set of labor concerns, where many jobs are not likely to disappear anytime soon.

Similar to most infrastructure jobs, truck drivers depend on a wide range of skills to carry out their jobs every day. Just as there are different types of doctors, there are different types of truck drivers – from heavy and tractor-trailer truck drivers who focus on long-haul journeys to delivery truck drivers who carry lighter loads and navigate local streets.

Read APICS Blog: Truck Drivers (Still) Wanted

Not surprisingly, many of these drivers are not simply sitting behind the wheel all day on auto drive. They also inspect their freight loads, fix equipment, make deliveries, and perform other non-routinized tasks.

Standardized data verify this non-routinized conception of truck-driving. The Department of Labor’s O*NET database shows how truck drivers have a lower “degree of automation” compared to most occupations nationally.

On a scale of 0 (not at all automated) to 100 (completely automated), O*NET surveys workers across all types of occupations, where those with simpler, repeated tasks are often better suited for automated technologies, such as telephone operators and travel agents.

The average degree of automation, however, remains quite low (29.6) for all occupations, and heavy and tractor-trailer truck drivers (22) and delivery drivers (24) rate even lower than that. Significantly, they also rate lower than some of the country’s other largest occupations, including office clerks (32), cashiers (37), and receptionists (47).

Degree of automation for the 100 largest occupations, by employment, 2015

Lower automation scores by themselves, of course, do not necessarily mean that trucks may not ultimately drive themselves. And when these trucks hit the market - and they will - they very well may have an empty front seat.

Yet, it also seems likely that many new complementary jobs may emerge over time too, requiring new skillsets to oversee these new trucks and complete other non-automated tasks to support them.

While it can be difficult to predict the exact positions needed, it is possible that new types of material movers and inspectors may appear within major shipping industries, or there may even be a new form of on-call trucking repair jobs.

At the same time, local retailers, from restaurants to clothing stores, may need extra staff hours to unload trucks.

Whatever happens, it is crucial to not confuse truck drivers themselves with their entire industry, which depends on many different types of workers who carry out tasks that are not always easily automated.

The trucking industry as a whole relies on a variety of workers who are also less susceptible to automation according to O*NET.

Truck drivers only make up 60 percent of the nearly 1.5 million workers in this industry. Other support workers fill roles across more than 150 different occupations, from truck mechanics to cargo agents to accountants, who have a relatively low degree of automation (25.5) on average.

In this way, even as automated trucks may alter the actual shipment of goods, these technologies are unlikely to supplant all of the various technical, financial, and logistical work activities in support of that movement.

Indeed, regardless of how these automated technologies play out, truck drivers and their fellow support workers are going to still carry out several specialized tasks, which will require continued on-the-job training and familiarity with precise sets of tools.

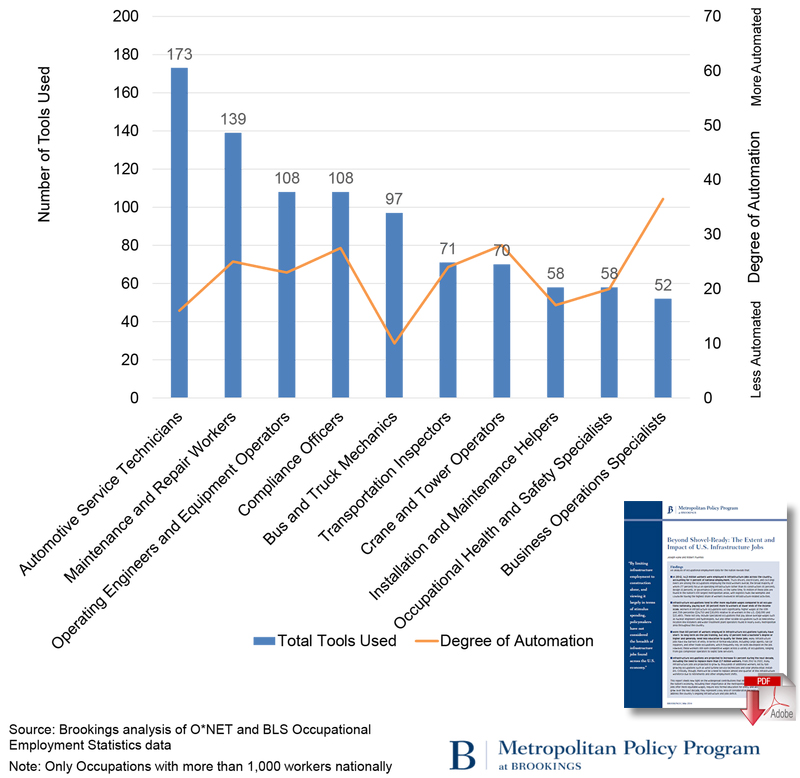

O*NET tracks the particular types of tools used by individual occupations to better understand the technical skills and familiarity required to fill a given job, ranging from utility knives and two-way radios to personal computers and GPS receivers.

On average, workers across all occupations nationally use about six tools to perform their jobs; however, workers in the trucking industry use about 27 tools on average, requiring a greater depth of knowledge and training that make it more difficult to automate their activities.

Some workers use considerably more tools, including automotive service technicians (173), compliance officers (108), and truck mechanics (97).

Occupations that use the most tools in the trucking industry, including degree of automation, 2015

Finally, there are some overarching regulations that could stall the automation impacts from driverless technologies. States currently maintain oversight for whether driverless trucks can operate within their borders - and those regulations are inconsistent from state to state.

Those inconsistencies will likely limit interstate shippers from using these vehicles to easily move goods across different states (add pdf)until certain regulatory thresholds are consistent. You can apply the same thinking to local regulations.

Without approvals for driverless trucks to operate along specific rights of way - say a busy pedestrian corridor - municipalities and counties could make it difficult for trucking firms to use the technology.

With the rise of new automated vehicle technologies, policymakers and planners must prepare for a self-driving future. And for good reason.

These technologies hold promise in improving transportation across the country, including reductions in energy use, pollution, and significant safety benefits. But they also raise questions over land use impacts and economic access, among a host of other concerns.

Frequently lost in this conversation, though, is talk on where workers stand. Truck drivers and Silicon Valley are at odds of how, when, and where any potential labor market effects will take place, with many running under the assumption that some changes are bound to happen nationally in the next decade, especially given the enormous geographic reach of the industry.

Rather than glossing over the potential labor impacts, policymakers, employers, educators, and others should closely monitor these developments over time and link them to relevant workforce development efforts.

Automated trucks are likely to change how the industry moves its goods and relies on particular workers, but they will still require workers in general and should not shift the focus away from sustaining economic opportunity.

Source: Brookings

About the Authors

Joseph Kane

Senior Research Analyst and Associate Fellow - Metropolitan Policy Program

Adie Tomer

Fellow - Metropolitan Policy Program

Related Article: The Never-Ending Truck Driver Shortage Story

Related White Papers

Beyond Shovel-Ready: The Extent and Impact of U.S. Infrastructure Jobs

This report sheds new light on the widespread contributions that infrastructure jobs make to the nation’s economy, including their importance at the metropolitan level. Download Now!

Mapping Freight: The Highly Concentrated Nature of Goods Trade in the United States

This report sheds new light on the widespread contributions that infrastructure jobs make to the nation’s economy, including their importance at the metropolitan level. Download Now!

Self-Driving Vehicles in Logistics

This report sheds light on various best-practice applications of self-driving vehicles in various industries today, and also reveals a detailed look into the use cases of self-driving vehicles across the entire logistics value chain. Download Now!

Your Guide to Upcoming Trucking Regulations

New regulations are anticipated to decrease the driver pool and truck capacity, which could ultimately disrupt over-the-road shipping, this paper is a guide to understanding and navigating the driver shortage and trucking regulations. Download Now!

Truck Driver Shortage Analysis

According to analysis by the American Trucking Associations, the shortage of truck drivers has grown to nearly 48,000 and could expand further due to industry growth and a retiring workforce. Download Now!

Article Topics

The Brookings Institution News & Resources

Impact of Automation & Artificial Intelligence on the Workforce Automation & Artificial Intelligence: How Machines Are Affecting People and Places What’s Behind America’s Disappearing Workforce? Where Have All the Workers Gone? Rise of Robots Will Change Future Jobs Reports America’s Advanced Industries: What They Are, Where They Are, and Why They Matter Beyond Shovel-Ready: The Extent and Impact of U.S. Infrastructure Jobs More The Brookings InstitutionLatest in Transportation

Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge Examining the freight railroad and intermodal markets with Tony Hatch More Transportation