Amazon Has Still to Conquer the Chinese Market

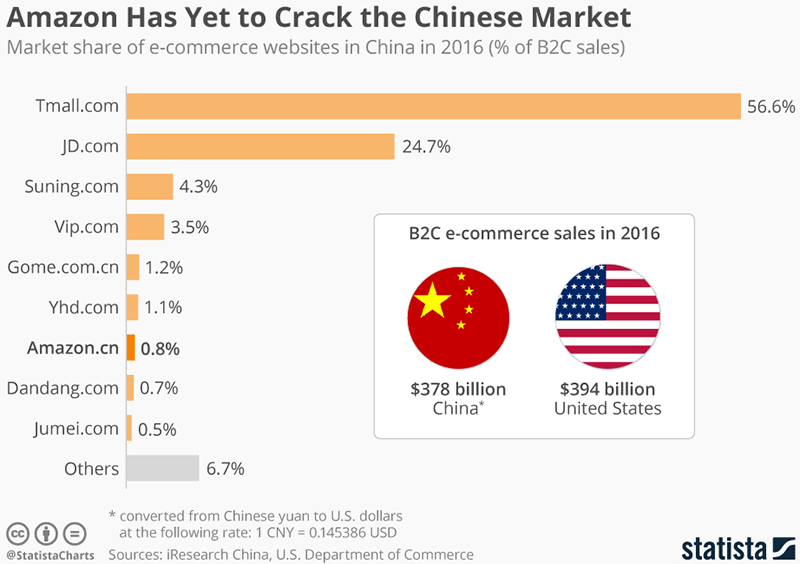

Amazon has become near-synonymous with online shopping in the US, but it’s barely a blip in the Chinese market, and according to a recent report, Amazon’s China site holds less than 1% of the country’s $378 billion e-commerce business in terms of market share.

As dominant as Amazon’s position as the leading online retailer is in most western countries, the Seattle-based company has yet to crack the Chinese market.

According to iResearch China, a Chinese market research company, Amazon’s market share in China amounted to less than 1 percent in 2016.

China’s B2C e-commerce market, which is about the same size as the U.S. market by the way, is clearly dominated by Tmall, Alibaba’s business-to-consumer marketplace, which accounted for 56.6 percent of sales in 2016.

Amazon made its ambitions for China clear when the company acquired Joyo, China’s largest online book seller at the time, for $75 million in 2004.

Joyo.com was moved to Amazon.cn and renamed Joyo Amazon in 2007 before dropping the old name altogether and being rebranded as Amazon China in 2011.

Download the Paper: The eCommerce Challenge

Statistics and Facts about the Alibaba Group

Alibaba Group Holding Limited is the leading online commerce provider in China, offering a broad spectrum of B2B, B2C and C2C e-commerce services as well as mobile payments.

The company is also involved in cloud infrastructure services as well as China’s biggest online video site Youku Todou.

Launched in 1999 as a stand-alone B2B e-commerce portal Alibaba.com, the group is now the leading e-commerce provider in Asia as its C2C online marketplace Taobao and B2C online retail platform Tmall are also the market leaders in their respective business segments.

In the fiscal year ending March 31, 2015, the Alibaba Group’s annual revenue amounted to 76.2 billion yuan (approximately 12.3 billion U.S. dollars) with a net income of 24.32 billion yuan (3.73 billion U.S. dollars). The majority of group revenues are generated through its various e-commerce ventures with local e-commerce accounting for 83 percent of Alibaba’s income in 2014.

As of the third quarter of 2015, the group generated an online shopping gross merchandise volume of 713 billion yuan through its online shopping properties Taobao Marketplace, Tmall and Juhuasuan; with the cumulative number of active online buyers across these properties amounting to 386 million.

The current digital buying penetration rate among internet users in China is 55.2 percent. The increasing usage of mobile internet has opened up the possibilities of mobile shopping for both consumers and e-tailers. Alibaba has seen a rapid growth of mobile usage on its online shopping properties with a 62 percent mobile share of gross merchandise volume, up from 36 percent in the previous year.

The overall share of mobile shopping revenues was 61 percent as of the third quarter of 2015 with a 2.39 percent mobile conversion rate.

Alibaba also owns China’s most popular online payment platform Alipay. According to 2013 industry figures, Alipay accounted for 48.7 percent of the local online payment market.

This text provides general information, and due to varying update cycles, statistics can display more up-to-date data than referenced in the text.

Three Imperatives for Global eCommerce

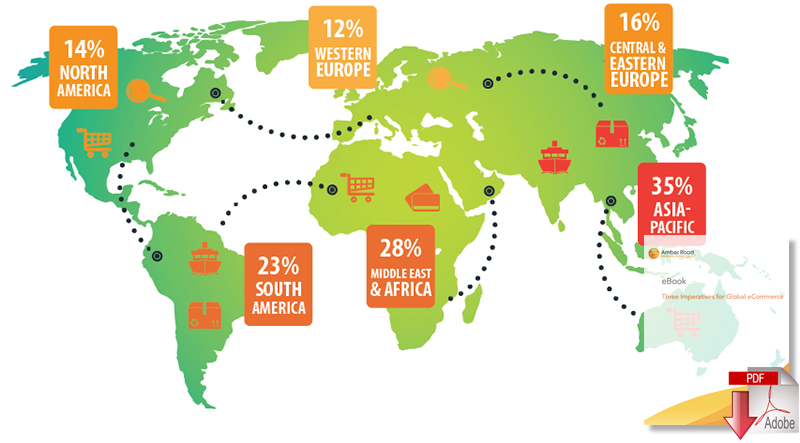

While there is clearly a large market opportunity associated with global eCommerce, companies must address several challenges to the strategy.

Retailers, consumer products companies, 3PLs, eCommerce marketplaces, and others need to create a comprehensive plan, and should consider partnering with a solution provider experienced in global trade regulations and practices.

eCommerce Global Growth Rates

Article Topics

Amber Road News & Resources

Logistics Platforms: Ways Companies Can Win In the Digital Era Ethical Sourcing – The Business Imperative (and Advantage) How Rules of Origin Really Do Make a Difference for Sourcing Practices E2open’s acquisition of Amber Road is a done deal E2open Completes Acquisition of Amber Road Bridging the Data Gap Between Sourcing and Logistics Medical Technologies Company Remedies Complex Compliance Operations More Amber RoadLatest in Supply Chain

Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds More Supply Chain