Amazon Gets Serious About China with Supply Chain Investment

Amazon has stepped up its presence in China with a strategic partnership with the Shanghai Free Trade Zone (FTZ).

The news that Amazon is expanding its ecommerce operations in China comes as no surprise following moves by its Chinese equivalent – Alibaba – to conquer the U.S. market (view video above).

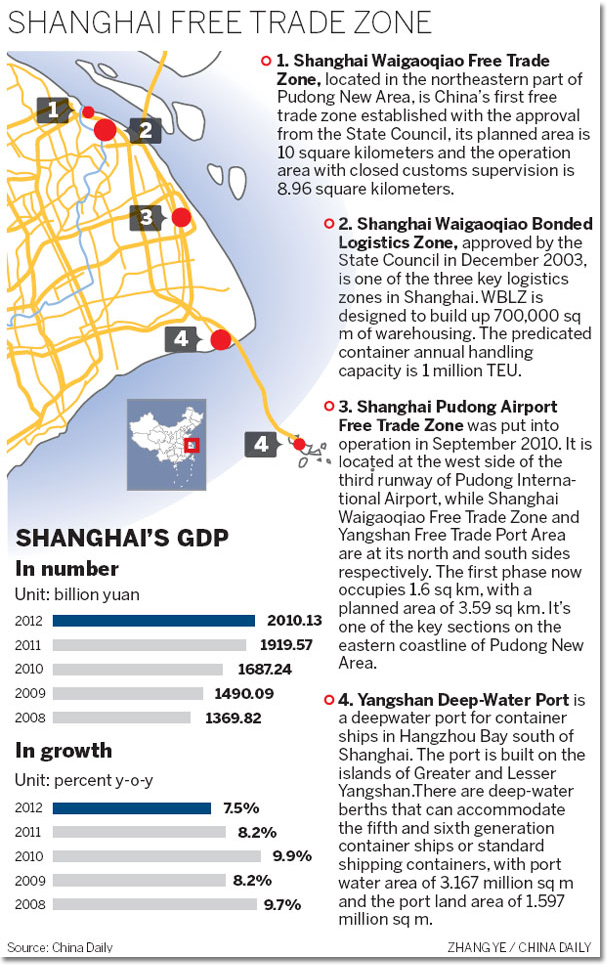

After 10 years of maintaining a low-key presence in the region, Amazon is getting serious about capturing a share of the burgeoning Chinese online retail market by entering into a strategic partnership with the Shanghai Free Trade Zone (FTZ).

The new partnership will not only enable Amazon to sell its expansive range of products directly to Chinese customers and add additional lines offered by local distributors but, importantly, to fulfill orders from customers.

While the rapid expansion of the Chinese middle classes and associated growth in spending power and desirability of luxury brands has been well-documented, Western retailers have struggled to capitalize fully on this, mainly due to equally well-documented restrictions on foreign trade and investment, with significant trade deficits still apparent.

Initiatives such as the Shanghai FTZ are being put in place to change this position, however removing the ‘red tape’ around trade will not alleviate the other major barrier for retailers wishing to expand into China – the challenge of successfully executing logistics in a country so vast that it has multiple taxation systems, languages and micro-climates yet an inconsistent (non-existent in places) transport infrastructure.

Under the new agreement, Amazon will build a major presence in the Shanghai FTZ which will incorporate a logistics center and the extensive warehousing that will be required if it is to replicate the mega regional distribution center model it has implemented to such great success in the U.S. and Europe, with orders fulfilled centrally for the most part and direct dispatch by suppliers discouraged for its retail marketplace.

Being located within the FTZ will certainly make it much easier to amass stock from global suppliers and dispatch it onward to customers, however even Amazon, the master architect of online retail, will be at the mercy of logistics partners to enable delivery to its customers, and that’s where the difficulty lies.

Although China is broadly the same size as the U.S., it currently lacks the developed road, rail and air freight networks that drove carriers there to establish their businesses, meaning there isn’t always even a single option for delivering a parcel to a customer. Clearly this is a fairly major limitation for an online retailer.

Related: Logistics & Warehousing - China’s Weakest Link

Despite major investment by the Chinese government in fast-forwarding infrastructure development, with new roads and airports opening at an impressive pace, Amazon will most likely have to strategically select the urban locations that fall within established logistics networks and carrier coverage, which will limit the pace and direction which it can expand initially to major cities and the surrounding areas.

However Amazon’s relentless focus on offering the widest possible range of products and speed of delivery means its arrival as a real competitor in online retail is hotly anticipated and the groundwork is there to instantly benefit from every future infrastructure improvement made by the Chinese government.

Conversely, local hero Alibaba has achieved success by operating a completely different, decentralized distribution model that either plays to the strengths or counteracts the limitations of the Chinese market, depending on your perspective, with fulfillment executed by distributors.

However the company has recently forged its own distribution network comprising of a series of local and national logistics providers to ensure more complete coverage, a more standardized service and shorter standard delivery times, and will no doubt continue to expand the range of products on offer from international suppliers as it itself expands overseas.

It will be very interesting to track the progress of both Amazon and Alibaba in evolving their very different online retail models to achieve success in China and the U.S. respectively.

Related: The Logistics “Flow of Things” in China is Costly and Cumbersome

Article Topics

BluJay Solutions News & Resources

5 Signs You May Need a More Modern Supply Chain Solution How Supply Chains are Becoming Resilient Amid Disruptions Supply Chain 2020 Innovation Update BluJay research focuses on the need to build resilient supply chains 5 Signs It’s Time to Modernize Your Supply Chain Technology Supply Chains of the Future Boost the Power of Your Trading-Partner Network More BluJay SolutionsLatest in Business

FedEx Announces Plans to Shut Down Four Facilities Women in Supply Chain: Ann Marie Jonkman of Blue Yonder U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia More Business