Air Cargo Update: Straining to sustain growth

While air cargo volumes continue to stage a modest uptick, shippers are now waiting to see how the introduction of larger freight aircraft might serve to sustain this growth. At the same time, shippers need to keep an eye on which domestic airports are prepared to handle more capacity and the new demands driven by e-commerce.

After a weak start to the year, demand for global airfreight has been trending steadily upward, note analysts for The International Air Transport Association (IATA). Shippers should realize, however, that the rapid expansion witnessed in 2017 may be coming to an end, with demand still growing, but at a slower pace through the last half of 2018.

According to Geneva-based IATA, there are three factors pointing to this slow down. First, the re-stocking cycle which required quick delivery to meet urgent shipper needs has come to an end. Then there’s the observation that the new export orders component of the global manufacturing Purchasing Managers’ Index (PMI) is at a 21-month low. And finally, global trade appears to be softening as trade tensions are amplified.

Indeed, IATA’s director general and CEO Alexandre de Juniac has warned his stakeholders that “headwinds” are strengthening with growing friction among governments worldwide. “Experience tells us that trade wars, in the long run, only produce losers,” he added in IATA’s latest statistical report.

In the meantime, recently released statistics compiled by Amsterdam-based WorldACD Market Data BV agrees with the IATA that demand for air cargo this past quarter indicates “a downward growth trend” noticed since the start of this year.

Both European air cargo think tanks note that Asia-Pacific airlines saw freight demand increase by 4.9% compared to the same period last year. This was an increase over the 3.9% recorded year-to-date in the Pacific Rim with capacity increasing 7.4%. Furthermore, the trans-Pacific continues to represent the largest freight flying trade lane, with carriers moving close to 37% of global tonnage.

IATA analysts sound a note of caution, however, declaring that the risks from protectionist measures affecting the Asia-Pacific are “disproportionately high.” Still, the region continues to lead all other global marketplaces in air cargo activity and demand.

The Association of Asia Pacific Airlines (AAPA) also acknowledges that “rising global trade tensions” are a concern now, but reports that air cargo demand grew by 5.4% in the Asia-Pacific with volumes sustained at relatively high levels.

AAPA director general Andrew Herdman a few notes of concern about “protectionist rhetoric” in his latest note to member airlines, and also shares this caveat: “The operating environment for airlines is increasingly challenging due to the impact of higher fuel costs,” he writes.

“Accordingly, the region’s carriers continue to seek avenues to increase operational efficiencies in a bid to boost profitability.” None of these declarations impress Charles Clowdis, Jr., managing director of the consultancy Trans-Logistics Group, who notes that all statistical reports signal modest and steady improvement in cargo payloads.

“I don’t see much reason to become alarmed over 2.4% growth year-to-date,” says Clowdis. “The increase is still growth nonetheless. Air cargo continues to mainly consist of commodities requiring speed-to-market, and absent a month without a major event—such as a new tech consumer product release—it typically slows a bit.”

Furthermore, Clowdis pays little heed to the worries over trade war rumors. “As long as consumers stay positive and spending stability continues, air cargo will remain on a positive trajectory,” he adds.

Pressure on airports

Clowdis also points to the fact that Boeing and other aircraft manufacturers are ramping up production to meet anticipated demand in the coming years for the major integrators. For example, FedEx Express—the world’s largest air cargo carrier—recently announced a new order for 12 767 freighters and another dozen 777 freighters as it modernizes its fleet with more efficient and lower emission aircraft.

Boeing notes that with the 777 freighter, FedEx has been able to connect Asia with its hub in Memphis, Tenn., non-stop in an effort to reduce transit times by up to three hours, thereby enabling FedEx to accept packages later in the day and still deliver them on time.

Earlier this year, UPS purchased four Boeing 767 freighters as it rushed to keep pace with growing demand and take advantage of the U.S. corporate tax cut for “stepped-up” investment. Meanwhile, DHL has ordered one 767-300ER Boeing converted freighter.

Boeing-converted freighters carry high-density cargo on long-range routes, as well as e-commerce cargo on domestic and regional routes. With these carriers beefing up fleets, Clowdis adds that this is

a sure indication that air cargo providers remain bullish on the future.

However, there’s a downside to this kind of news, say analysts at Fitch Ratings, who observe that a sudden surge in aircraft capacity puts added pressure on U.S. airports. “Memphis can handle

the current workload from FedEx, and Louisville is doing well with UPS, but many of the larger gateways are less well positioned to absorb more traffic in the future,” says Seth Lehman, Fitch’s senior director and lead analyst for U.S. airports.

“Large-hub airports like Los Angeles, San Francisco, Atlanta and Dallas still remain the leading performers,” Lehman says. “And currently, midtier and smaller regional airports are also showing

favorable performance.”

According to Lehman, JFK in New York is well positioned in the Atlantic trade lanes, while Miami is key for Latin America. Even the often-overlooked gateway of Anchorage, Alaska, remains vital as a

transfer destination, given its proximity to Asia. Lehman also wonders about Amazon’s intention in the future.

Addressing the pilot shortage

While there has been considerable concern in the trucking sector about finding new drivers, there’s a pilot shortage that’s haunting the air cargo sector these days as well. In an effort to recruit the best aviators in the industry over the coming years, FedEx Express created “Purple Runway—A FedEx Pathways Program” this past April to address the need to support the airline and its feeder operators with a pipeline of highly trained and qualified aviators.

J. Bruce Chan, an air cargo institutional investment analyst with Stifel Capital Markets, acknowledges that while training is essential, recruitment on a larger scale may still face significant challenges.

“The potential to relax regulatory requirements is generally higher under the current administration relative to previous ones, but we believe that overcoming the safety lobby and pilots unions is no small feat,” he says. Making the goal somewhat more difficult, says Chan, is the heighted media attention given to aviation safety-related incidents.

“While there may be some compromise (for example, allowing a certain amount of academic training to substitute for real world flying), ultimately, we believe the answer will come down to higher pilot pay,” says Chan.

“As their asset-based operations expand, they will want to hub out of a strategic location,” he adds. “This will create more planning for local and regional municipalities for funding.”

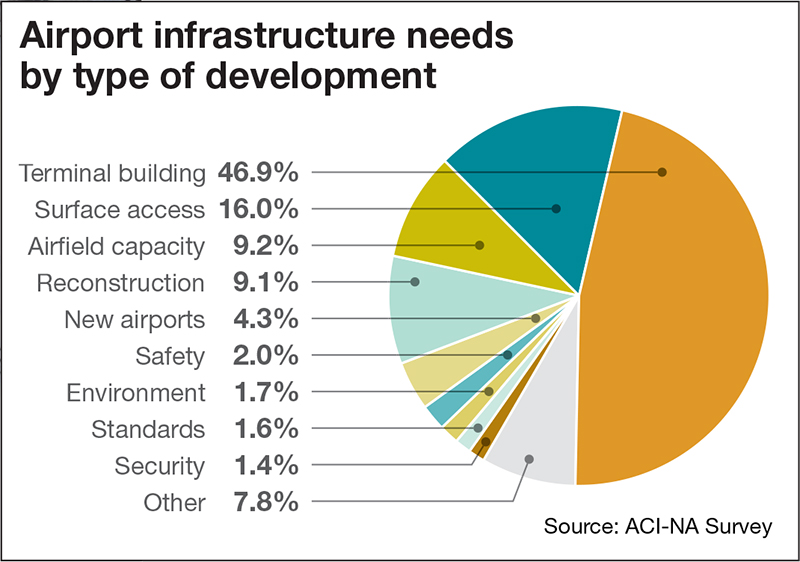

Spokesmen for Airports Council International-North America (ACINA), the trade association representing commercial service airports in the United States and Canada, concur, maintaining that in order to support aircraft innovation and added capacity and capabilities necessary to keep up with e-commerce, airports require nearly $100 billion to maintain and build new infrastructure.

ACI-NA president and CEO Kevin Burke recently told his constituents that the $20 billion in average annual infrastructure funding needs for U.S. airports “is more than double” funding currently available through annual airport generated net income.

“The longer we delay, the more America’s airports will fall behind, and our infrastructure needs will become even more expensive to fix,” he told his constituents in the recent report, “Airport Infrastructure Needs.”

According to Burke, the overall increase in airport infrastructure needs is a reflection of both a rebounding global economy and increasing traffic demand. This, he adds, is coupled with airline consolidation and their strategic shift to focus on hub operations, thereby requiring capital investment Fitch’s Lehman concurs, noting that “airports must grow or die.”

Leveraging digitization

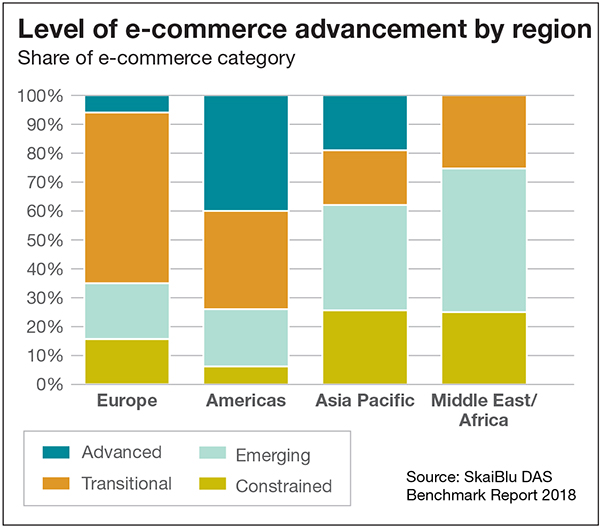

In the view of many air cargo analysts and stakeholders, the airlines themselves can still do much to alleviate airport congestion and scheduling complexity by leveraging digital technology. SkaiBlu, and e-commerce consultancy based in Los Angeles, has recently produced a benchmark report featuring an assessment on the “digital competitiveness” of 90 airlines, finding many of them wanting.

Michael Hanke, SkaiBlu’s founder and managing director, notes in the report’s introduction that “only an handful appear to be well suited to navigate pax technia and manage the next frontiers in cyberspace.”

This observation resonates with Brandon Fried, executive director of the Air-Forwarders Association. Having read the report, he says most of the points are “spot on.” “The e-commerce megatrend

shows us that automation and digital adoption appears to be corporate imperative for all commercial airlines and their cargo departments,” says Fried.

“And while the digital shipper experience may not be an absolute indicator of service performance, a robust web presence capable of providing a feature-rich experience seems to demonstrate a firm product commitment.”

At the same time, Fried was disappointed by the report’s conclusion that digital privacy was the weakest area for all carriers benchmarked. “That use of proprietary digital data is not only a concern for airlines and their shippers, but global commerce as well,” he says.

“In fact, several countries, including Canada and those comprising the EU, have recently adopted strict laws pertaining to the use of personal data belonging to clients. A low score in this area

demonstrates that, indeed, there is work to be done.”

The Millennial generation, says Fried, will most likely represent most shippers within the foreseeable future. He adds that these clients do not know life without the Internet and are impatient for websites that are poorly constructed or under-performed.

“Slow page loads, broken digital site links, multiple languages mixed on a single site and insufficient handling of digital privacy will most likely discourage this group from using those firms insufficiently addressing these areas,” says Fried.

Filling the talent gap is also essential for air cargo providers, not only in the adaptation of digitization, but also in basic cargo operations. “While automation is becoming more essential for commercial airlines’ cargo divisions, they must realize that shippers will always want human interaction to resolve the most urgent requirements,” adds Fried.

“Our association members feel this will be still be the case for quite some time in the future.”