Air cargo continues to carry the day

The Association of Asia Pacific Airlines (AAPA) notes that the solid expansion in international air cargo markets continues unabated.

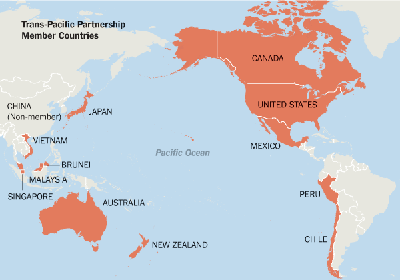

While trans-Pacific ocean traffic was especially robust this past peak season, industry analysts were also impressed by the air cargo surge in the region. If this trend is to continue, however, the need for improved airport infrastructure is obvious.

The Association of Asia Pacific Airlines (AAPA) notes that the solid expansion in international air cargo markets continues unabated. According to their recent analysts, growth is supported by high business confidence levels across the services and manufacturing sectors in major advanced and emerging economies in the region.

In fact, firm demand for manufactured products, particularly pharmaceutical goods and technological equipment, underpinned the season’s strong 12.2% increase in air cargo services. This increase in volumes significantly out-paced the 5.6% expansion in offered freight capacity, leading to a 3.8 percentage point rise in the average international freight load factor to 64.1% for the season.

“Asian airlines were encouraged by the continued expansion in international air cargo markets,” observes Andrew Herdman, the AAPA director general. “Furthermore, global air cargo markets saw a robust 10.6% increase in freight traffic carried by Asian airlines.”

However, Herdman sounded a cautionary note, urging shippers to not become complacent. “The sustained growth in air traffic demand has clearly been positive for the sector,” he says. “Nevertheless, against the backdrop of a challenging operating environment marked by highly competitive rates and rising costs, Asian carriers are continuing to work hard to improve profitability, with considerable variations in individual airline performance, both globally and within the region.”

Looking ahead, Herdman observes that broad-based expansion in global economic output should help to sustain further growth in air cargo traffic demand in the upcoming months. “The longer term outlook remains broadly positive,” he adds.

The International Air Transport Association (IATA) came to many of the same conclusions in its recent report on peak season activity in the Asia Pacific. “Air cargo had another stellar performance,” says Alexandre de Juniac, IATA’s director general and CEO. “Rapid growth in demand means that cargo capacity is now growing in response. The pace of this trend, however, has slowed even as freighter fleets are being utilized more intensely. Overall, that should be good news for much beleaguered cargo yields.”

There are also signs that the peak of the cyclical growth period is near. The global inventory-to-sales ratio in the U.S., for example, has stopped falling. This usually means that re-stocking to meet demand—which gives airfreight a boost—is ending.

Nonetheless, the outlook for air cargo remains strong in the Pacific Rim, with several months of double-digit growth in 2017. The current IATA forecast of 7.5% growth in air cargo demand for 2017 appears to have significant upside potential even if we’re past the seasonal high.

All this news, while good, points to the urgent need for improved airport infrastructure on the U.S. West Coast, say industry experts. A recent study conducted by Airports Council International-North America (ACI-NA) concludes that massive investment should be made soon to rehabilitate existing facilities and support aircraft innovation.

As the principal international gateway on the West Coast, Los Angeles International Airport (LAX) welcomed the findings. “It was important for LAX to participate in this study because it points out the long-term needs of our airport and others across the nation,” says Deborah Flint, CEO of Los Angeles World Airports. “Airports of all sizes combined have an investment need of $20 billion annually for improvements to modernize aging airfields and terminals.”

LAX is currently conducting a $14 billion modernization program that includes major terminal renovations, a new midfield satellite concourse and the proposed Landside Access Modernization Program, which would help relieve congestion in the central terminal area.

At all U.S. airports serving trans-Pacific trade, terminal projects represent 54.1% of overall airport infrastructure needs. Landside projects represent 24.7% of total needs while airside projects represent 21.1% of total needs.

“In recent months, President Trump and policy makers on both sides of the aisle have become outspoken advocates for America’s airports and the state of airport infrastructure,” says ACI-NA president and CEO Kevin Burke. Pacific Rim shippers will no doubt agree, and will soon be evaluating the impact this new study may have on funding future improvements at all air cargo gateways. •