Aging Truck Driver Work Force - A Major Issue in Filling Demand & Empty Seats

With a combination of retirements and people exiting the industry, carriers need to recruit in roughly 100,000 drivers per year over the next decade to simply keep pace with projected United States freight needs.

The American Transportation Research Institute (ATRI) released a fascinating white paper analyzing the age demographics of truck drivers.

I highly recommend the entire paper, but want to comment on some of the key findings.

All of the charts in this post are from the ATRI white paper.

The bottom line is that the U.S. truck driver population is aging and there are not enough young drivers in the labor force to fill the empty seats that will be opened by the upcoming retirement of drivers.

As I think about how to attack the driver shortage problem, I believe the answer is more than higher pay.

In fact, I do not think there is one simple answer but believe there are numerous actions than can have an impact.

I also believe that we have to focus on both increasing the supply of truck drivers and decreasing the growth in demand for drivers as the economy expands.

Increasing Supply

The primary shortage is for over-the-road TL drivers who spend weeks at a time away from home, sleeping in their trucks, showering and eating in truck stops, and enduring unnecessary hassles in getting unloaded in a timely fashion.

Increasingly, we also hear about shortages in LTL and drayage capacity. Higher pay is the simplistic answer, but manufacturers and retailers can ill afford higher transportation rates so higher pay has to be associated with greater productivity.

Getting 18-year olds into the industry is critical, but is limited by the CDL 21-year old age requirements. Immigration can be part of the solution to the driver shortage, just as it is for high tech workers.

Legislation from Nebraska Senator Looks to Lower Age Limits for Truck Drivers

It is hard to argue that one of the biggest, if not the single biggest, issue in the freight transportation sector is the truck driver shortage.

As reported many times on this site and in the pages of Logistics Management, there are many reasons for this ongoing predicament. Even with an increased onus on augmenting driver training, retention, and compensation packages, many carriers are still struggling with how to fill the empty seats.

The ongoing driver shortage still serves as a major factor for tight over the road capacity, which has been burdensome for shippers in that they need to pay higher rates in order to get their freight moved in a timely and efficient manner.

What’s more, many industry stakeholders say that the lack of available - and willing - drivers will only get worse in the coming years, with the average age of drivers still firmly entrenched around 50.

For those still not sold on how serious the current situation is, consider this: the American Trucking Associations (ATA) has said it estimates the current driver shortage is in the 35,000-to-40,000 range, and with a combination of retirements and people exiting the industry, carriers need to recruit in roughly 100,000 drivers per year over the next decade to simply keep pace with projected United States freight needs.

With such a dire situation, based on these numbers of industry dynamics, the ATA last week praised Senator Deb Fischer (R-Neb.) for her bill that takes some positive steps towards alleviating the current environment.

The most significant and obvious step the bill, entitled The Commercial Driver Act, takes to get more drivers into the trucking sector is by lowering the age commercial drivers can operate across state lines.

ATA President and CEO commended Fischer on this bill and its objectives in a statement issued late last week.

“In each of the continental United States, a person can get a commercial driver’s license and drive a truck at the age of 18, but federal law prevents them from driving across state lines until they reach the age of 21,” said Graves. “It is illogical that a 20-year-old can drive the 500 miles from San Francisco to San Diego, but not the eight miles from Memphis, Tennessee to West Memphis, Arkansas – or simply cross the street in Texarkana. Even more illogical is that a 20-year-old may not drive a truck in any state if the cargo in it originated outside the state or will eventually leave the state by some other means.”

Fischer’s bill will launch a pilot study dedicated to lowering the federal driver age, coupled with other efforts to create driver openings for high school graduates, whose overall unemployment rates are up to triple the national average, according to ATA.

At a time when the lack of available and willing drivers becomes more and more apparent by the day, more is needed to get seats filled. While it is far to early to know or tell is this bill will get across the finish line and meet its stated goals, it at least shows and demonstrates that some people in the Nation’s Capital are paying attention and realize it is a problem that is not going away.

Logistics Management, Jeff Berman

Equipment advances like automatic transmissions (already here) and self-parking vehicles (in the future) would expand the labor pool. Bringing retirees, particularly spousal teams, into the industry even if for only part of the year could be a win-win. Expanding truck-driving schools can help. Reducing the hassles of driving by providing greater access to parking and showers, and minimizing driver wait time and load-unload time will help keep drivers in the industry.

Finally, I believe large carriers have the opportunity to engineer more routes and utilize technology that will provide more frequent get-home time to drivers without sacrificing utilization and pay. This would be a huge competitive advantage for the carriers that figure out how to execute such a strategy.

Decreasing Demand Growth

Shippers need to redesign supply chain networks to enable greater use of intermodal and either private or dedicated fleets to reduce their reliance on long-haul for-hire TL fleets.

Packaging innovation allows more product on fewer trailers. It looks like twin-33’ trailers may make the next highway bill, and while an 88,000 GVW limit is a long shot, it would be a much needed productivity boost. Cross-shipper collaboration eliminates waste by combining heavy and light products on a single trailer or by increasing payload from multiple shippers to smaller-volume receivers. Increasing equipment utilization not only helps increase supply but also reduces demand by getting more freight delivered by a fewer number of trucks.

We need to reduce load/unload times, minimize driver waiting time, and reduce highway congestion. Smoothing out wasteful day-of-week, end-of-month and end-of-quarter freight surges would enable less total trucks to move the same amount of freight.

We need a multi-pronged strategy to deal with a capacity shortage that will only get worse as an aging driver workforce nears retirement. ATRI points a bright light at the challenge we face.

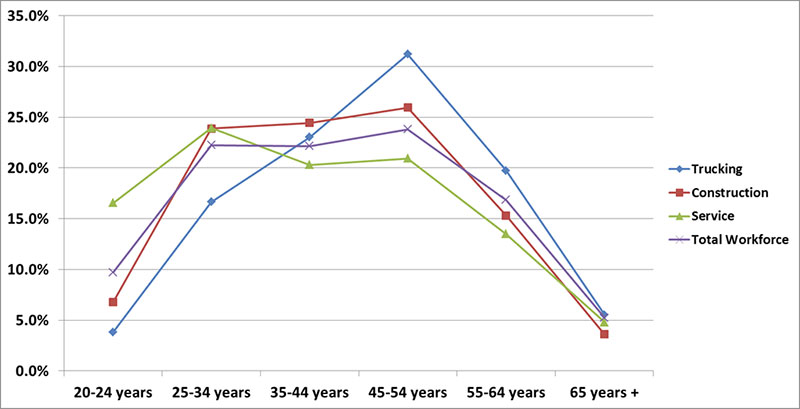

Trucking has a far higher percentage of its workforce in the 45-54 year age group and 55-64 year age group than the total workforce or the construction and service segments of the economy.

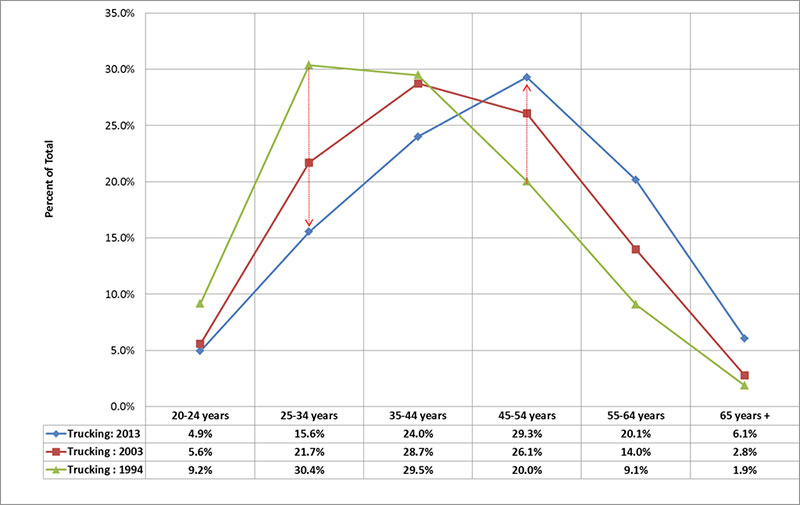

The trucking industry age demographics have shifted substantially over the last 20 years, from a younger to an older workforce. In 1994 over 30% of the workforce was 25-34 years old, but that has been cut in half as only 15% of the workforce falls in that age group today. Meanwhile 49% of the workforce is now between 45 and 64 years old compared to only 29% in 1994. Today we are faced with a dearth of younger workers in trucking to replace a large population that is rapidly approaching retirement age.

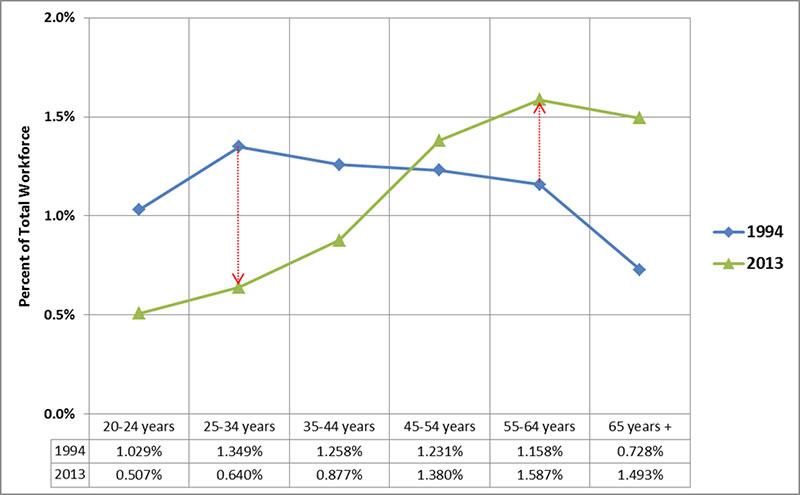

It is not the case that this shift simply represents an aging US population. The percentage of all 35-44 year old workers that are employed in trucking has fallen from 1.35% in 1994 to 0.64% in 2013 while the percentage of 55-64 year old workers employed in transportation has risen from 1.16% in 1994 to 1.59% in 2013. The industry is not attracting young workers at a pace needed to fill long-term employment needs. Part of the reason for this is that a person must be 21 years old to get a commercial drivers license (CDL) so people who do not go to college often move on to other professions and never enter the trucking industry.

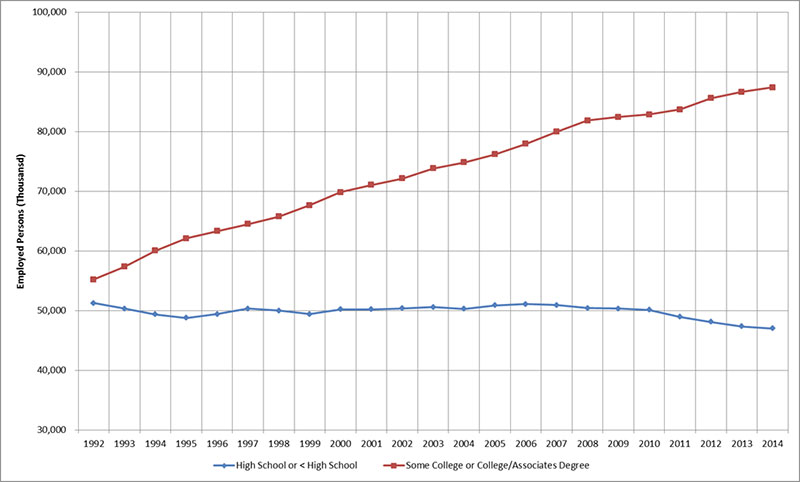

Finally, all of the growth in the employed labor force over the last 20 years is made up of college grads. In 1992 just over 50 million Americans with no college experience were employed. In 2014, that number dropped to just under 50 million. Meanwhile the number of employed Americans with at least some college experience increased from about 55 million to almost 90 million in 2014. College grads are not typically attracted to the truck driving profession. I do believe though, that truck driving can be a more lucrative profession than many other jobs that do not require a college degree, but the challenge is how the industry can win a greater share of this labor pool.

About the Author

Tom Sanderson, CEO, Transplace

With more than 30 years in logistics technology, third-party logistics (3PL), and transportation, Mr. Sanderson leads Transplace and Celtic International with a strong North American presence and services that cover third party logistics, intermodal and freight brokerage to customers.

![]()

Article Image: thehcrscoop - Information for today’s trucker

Related: A Wake-Up Call For Industry As Truck Driver Shortage Reaches Crisis Point In The UK

Article Topics

American Transportation Research Institute News & Resources

ATRI heralds the launch of its annual Top Industry Issues Survey Trucking interests support DOT’s call for more safe trucking parking The Upside of COVID-19 Pandemic-Induced Truck Driver Shortages First comprehensive review of wild, wild West ‘nuclear verdict’ is” bad news for truckers New round of data from ATRI highlights how COVID-19 is affecting trucking movements ATRI Driver Detention Impacts On Safety & Productivity ATRI Critical Issues in the Trucking Industry – 2019 More American Transportation Research InstituteLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation