A Textbook Transformation: How Biogen Idec Overhauled its Supply Chain

The management team at Biogen Idec knew they had to transform the supply chain to cope with increasing volume and complexity at this biotech company.

Although strategic sourcing capabilities are well established in industries ranging from automotive to pharmaceuticals, they are still in the formative stages in the biotechnology sector.

It isn’t easy to drive the necessary changes. With their external spend increasing so fast, there is great pressure on biotech companies to rethink how their sourcing structures are set up to add most value.

The first wave of strategic sourcing strategies is often targeted at cost-cutting through volume consolidation and leveraging of the organization’s total spend, followed by supplier base reduction and longer-term contracting.

But as organizations mature, executives require their sourcing groups to develop and deliver additional capabilities. In a growing number of companies today, supply management is being asked to demonstrate deep insights into customer requirements, and to quickly translate those insights into product offerings that often rely more on outsourced capabilities.

Biogen Idec Inc. is showing how this can happen in the biotech sector. In the last year, the company has undergone a huge shift in the way it operates its supply chain, particularly in the management of sourcing.

What began as a “grass-roots” transformation effort at Biogen Idec produced strong early results in the form of cost savings. The initiative was soon recognized by the executive team, but as the effort expanded, it produced results beyond cost savings, sustaining momentum and moving the organization to higher levels of process performance. This was achieved by focusing on stakeholder engagement and use of an analytical sourcing framework.

Because Biogen Idec is applying a multi-faceted approach to sourcing and procurement activities—in effect, following the best-practice textbook—its approach is noteworthy for any company that believes that additional value can be derived from sourcing and procurement operations. In this article, we present the elements that were assessed and processes that were enhanced to deliver the supply chain transformation.

Anticipating a More Complex Supply Chain

Headquartered in Weston, Mass. and with international headquarters in Zug, Switzerland, Biogen Idec is the world’s oldest independent biotech and a Fortune 500 company with more than $4 billion in annual revenues.

The company discovers, develops, manufactures, and markets biological products for treating conditions such as multiple sclerosis and non-Hodgkin’s lymphoma. It was formed from the November 2003 merger of Biogen, Inc.and IDEC Pharmaceuticals Corp.

In addition to its portfolio of drug candidates, the company has capabilities, including capacity for protein manufacturing, that are world-class in quality and scale. Biogen Idec is one of a handful of biotechs that have licensed and dedicated biological bulk-manufacturing facilities. It has a large-scale manufacturing plant in Research Triangle Park, N.C.—one of the world’s largest cell culture facilities—and a new 90,000-liter facility for producing biologics in Hillerod, Denmark.

The company’s global operations (supply chain) unit reports into its Pharmaceutical Operations and Technology (PO&T) business area. The global operations mission is to ensure the uninterrupted supply of the highest-quality products to patient sites worldwide.

To meet its goals, PO&T sources an array of products and services, including active pharmaceutical ingredients, outsourced contract services, professional services, manufacturing and facilities equipment, manufacturing contract services, and raw materials and lab consumables. Like many other companies in this sector, external spend is significant—several hundred million U.S. dollars annually.

Prior to 2009, support for PO&T sourcing and pro-curement was provided by a corporate sourcing group under a centralized business model. In September 2009, anticipating a sharp rise in the complexity of the company’s supply chain, the management team launched an assessment of supply chain maturity across PO&T. Several factors had converged to spark the maturity assessment.

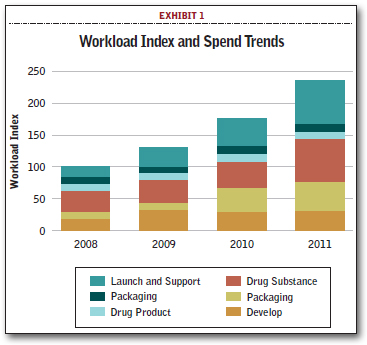

To begin with, there were many more clinical trials in the pipeline, dealing with a range of new technologies that had not been sourced before. Concurrently, contract manufacturing spend was increasing; As a result, the executives anticipated that workload would increase in multiple PO&T areas, as seen in the workload index in the anticipated spend profiles in Exhibit 1.

The step change expected in Biogen Idec’s spending on contract manufacturing—and on distribution and logistics—was largely due to the company’s assertive move into the “small molecule” space, the manufacturing of which was completely outsourced. (“Small molecule” describes traditional pills, tablets, etc., whereas “large molecule” refers to complex biologics.) In addition, the imminent commercialization of the next generation of large molecule products was going to drive activity and complexity in the contract manufacturing organizations. (drug product manufacturing at Biogen Idec is almost exclusively outsourced.)

The assessment formally confirmed that there was tremendous opportunity within the supply chain to add value by instilling sourcing processes, personnel, and tools that would maximize Biogen Idec’s return on external spend and allow for the expected increase in work- load to be handled without a big jump in the need to hire new employees.

The central conclusion from the maturity assessment was that sourcing systems could benefit greatly from more analytical focus and organizational optimization in the way that supply chain systems (particularly in con- tract negotiations and supplier management) were being managed. Six process specifics were considered key to the transformation:

Oversight and Organization. At the time of the gap analysis, there were multiple forums that had over- sight of the major sourcing and supply chain initiatives. Sourcing and procurement services within PO&T were provided via an alliance between the corporate sourcing and the line functions. Under this model, the line functions were responsible for forecasting spend and the priority was to achieve targeted spend rather than achieve targeted cost savings or avoidances. Suppliers typically worked closely with respective line functions (such as manufacturing or quality) to drive specifications and pricing, with minimal engagement of the sourcing teams in analyzing key markets or cost management. This often drove a proliferation of unique items and suppliers for common categories of purchases.

Procure to Pay (P2P). Although spend management processes existed, and with the external manufacturing workload increasing, it was clear that adequate criteria should be introduced to ensure that spend was being optimally bid across all categories. The metrics used to track spending or savings lacked consistency and comprehensiveness, which meant that the organization risked not having adequate oversight of the over- all value of contracts with suppliers. Purchase order approvals typically took longer than desired because there were frequent questions about whether the appropriate diligence had been carried out or if the value of the PO could be reduced by bidding.

Category Management. Under the existing model, some sourcing category strategies had been identified, but formal category management processes for PO&T had not been established. The sourcing and procurement activities were placed in the line functions across the PO&T organization, which also were involved in the day-to-day management of making the product and maintaining supplier relationships. Thus, while supply chain risk was recognized, contingency planning activities for risk management efforts were not yet formalized. Also, the staff who carried out sourcing activities was more focused on expediting or managing quality issues than on strategic sourcing.

Supplier Relationship Management. With multiple governance forums, it was difficult to ensure that supplier selection in areas such as selection criteria, standard market price benchmarking, and performance measures were consistent and fully in accordance with company manufacturing and risk strategies. In addition, PO&T’s supplier base had quadrupled from 500 to 2,000 suppliers from 2007 to 2009, causing an explosion in the workload needed to manage them. Although supplier performance management (SPM) scorecards were in use, they were not standardized.

Performance Measurement. Biogen Idec did use key performance indicators (KPIs) for tracking supply chain performance around processes such as spend under management, supplier performance, contracting status, cost savings, visibility of service level metrics, or multiple sourcing agreements with suppliers across sites. However, the KPIs were neither standardized nor trended. In addition, certain KPIs, although monitored, were being tracked in separate databases and therefore not considered in aggregate. Thus, performance management systems existed, but were not set up to truly improve transparency and ease of access to contract pricing structures.

Talent Management. It became apparent that the capabilities of the sourcing groups could be greatly enhanced by inclusion of staff with experience relevant to the sourcing categories for which they were responsible. This would enable greater engagement in technical discussions and a more data-driven approach to sourcing.

Recognizing this, Esther Alegria, Vice President of Manufacturing in N.C., and Alasdair Shepherd, the company’s Vice President of Global Operations, quickly decided to sponsor an effort that would help the supply chain external spend, risk, and compliance to attain an “optimized managed state.” This was characterized as a state in which: external spend was assessed via external market-intelligence-based research; pricing was “fair;” supplier selection was based on analytical market research; contracts were developed via a clear business process; procurement transactions complied with financial imperatives; and supplier risk was systematically managed through a formal sourcing process.

Launching Change on a Large Scale

Alegria and Shepherd sponsored a transformation team in November 2009; the team was directed by Joydeep Ganguly—Biogen Idec’s Director of Operations Analytics—and Robert Ciamarra, associate director of PO&T sourcing, with academic guidance from North Carolina State University’s Dr. Rob Handfield. The team devised a detailed transformation plan and initiated changes in three areas: (1) organization design; (2) governance; and (3) institution of process improvements within spend management, supplier selection and management, risk management, and market intelligence/analytics.

Each of the above categories is examined in detail on the next page>

1. Organization Design Changes

The company made two major changes in its sourcing organization design. The first was the formation of a dedicated and decentralized sourcing team for the Pharmaceutical Operations and Technology area (called PO&T Sourcing and Procurement), reporting directly into PO&T. Previously, sourcing support for PO&T had been provided via a central sourcing group and the line functions themselves. The new team was composed of technical category managers, located at the site level to ensure tight integration with manufacturing engineering, development, and quality groups.

While sharing best practices and working with the same concepts as their corporate counterparts, the team focused on sourcing and procurement efforts within direct materials, contract manufacturing, technical development, and distribution and logistics. The team was staffed primarily by individuals from various technical backgrounds, including manufacturing sciences and operations management. In addition, a portion of the new staff consisted of external sourcing experts from other industries. Collectively, they were very familiar with the activities being sourced, thus providing a sense of both credibility and technical advantage during negotiations and pricing analysis, because the sourcing analysts were experts in the areas they were representing.

Secondly, category teams, led by category team managers within the newly formed PO&T Sourcing and Procurement group, were formed in the areas of raw materials, contract manufacturing, technology development, and distribution/logistics. The workspaces of the category team leads were located close to those of the functional users of these services (for example, the raw material team was placed close to the manufacturing operations) to foster maximum interaction and dialogue. A consistent sourcing approach was developed to ensure that strategies were data-driven and aligned with stake- holder expectations.

The objective of the organization redesign was to create a technical sourcing group that had analytical insights into “what” they were sourcing, had credibility with their suppliers and their internal stakeholders, and that interacted closely with procurement to use analytics to drive future negotiations.

2. Governance Changes

A Pharmaceutical Operations and Technology sourcing council was formed to create and guide supply chain policies and processes, and improve decision-making. The council comprised vice presidents and senior executives from operations, manufacturing, technical development, finance, tax, and quality functions. It reviewed major supply chain projects every quarter to ensure that they were strategically aligned and resourced appropriately. This type of council had never been held before, as supply chain activities had hitherto been spread out across the PO&T organization.

Category managers were mandated to bring new sourcing efforts to the council for approval, sponsorship, and commitment. For example, the council approves new supplier recommendations, non-budgeted spend with non- approved suppliers, and major strategy changes with regard to supply chain configuration. In addition, the facilitator of the council meeting—the operations analytics director—is tasked with presenting the monthly KPIs on the health of PO&T suppliers as well as the spend trends in order to ensure adherence to overall corporate goals. Because robust supplier approvals and/or changes were now being institutionalized, there was far less chance that suppliers would be selected based on the priorities or wishes of individual departments as opposed to organization-wide imperatives. This framework also enabled a uniform, data-driven basis for selecting which projects to pursue, and to commit them to completion.

3. Process Improvements

The following process areas received attention:

Sourcing Based on Market Intelligence. The team introduced a structured, cross-functional team approach, with teams organized by categories of spend (raw materials, contract manufacturing, outsourced development, engineering, and so forth) and with a dedicated category manager and a representative from every key functional area. The functional representatives were typically director-level, with the authority to commission resources toward sanctioned sourcing projects. The roles of this team were to establish priorities; authorize and sponsor sourcing projects; commission resources; and act as a steering committee for project teams as they advanced through each project milestone.

Sourcing projects were identified in one of three ways: corporate and divisional strategies (for example, mergers and acquisitions, partnership arrangements, etc.); program and/or team member objectives (such as technology initiatives, life-cycle management); and category portfolio analysis, whereby portfolios were analyzed for their business impact and complexity. Impact was measured as a combination of risk, service levels, and cost; complexity was gauged as a mix of technical, regulatory, and market protection—that is, in terms of patents or know-how.

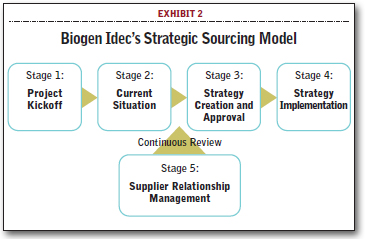

Regardless of where projects originated, it was important to establish and agree on the relative impact of the project on the business. Once projects were sanctioned, the category teams followed a phased sourcing process as shown in the model in Exhibit 2.

Contract Negotiation Business Process. Biogen Idec’s managers saw that it would be critical to implement more efficient contract negotiation processes given the growth in the numbers of suppliers and subsequent contracts the company would have to implement. A new business process was created that began with the creation of an optimized guidance document that spelled out definitions of the types of contracts (master service agreements, quality agreements, and so forth), and the points at which each document would be needed. It also spelled out who would “own” the contracts and who was responsible for policing them.

In addition, a standard minimum terms sheet was created that spelled out the non-negotiable terms (for example, a legal section defines protection of intellectual property, termination clauses, and so on). This document ensured consistency in the terms received by the company. Also, the transformation team sketched out a process flow that mapped out exactly who develops a contract, who reviews it, when sourcing teams get involved and how, and who approves particular sections in an agreement. All PO&T contracts were funneled to its Sourcing and Procurement group to ensure that they were reviewed against the standard minimum term sheet and in compliance with the corporate transaction policy.

Lastly, as part of the process reengineering effort, the transformation team set up a contract storage and retrieval process where contracts were intelligently stored (standard nomenclature, intuitive and standard titles, etc.) in a central database, and could be retrieved easily. This eliminated any potential inertia that would exist in verifying contract terms when purchases were being made, and allowed the procurement group to quickly match purchase orders (POs) with contractual covenants.

Analytics. A standard set of metrics and analytics was defined to measure key elements within the supply chain. A dashboard was created for each category to track these metrics: 12-month rolling spend in category; top 10 highest spend suppliers within category; spend that was in a “managed state;” financial compliance; supplier risk indices, as measured by z scores; percentage of items dual-sourced within category; contract negotiation status within category; supplier quality scores (multivarate); number of sourcing projects worked on, and return on investment (ROI) for each; and percent of spend with preferred suppliers.

By adopting a “less is more” attitude towards metrics and analytics, the sourcing category managers were able to hone in on a few areas that needed attention, and drive improvements against the pertinent metrics.

In addition, sophisticated “should-cost” models were created for key high-spend materials and services, using past data as well as industry benchmarks. These models were used to determine entry positions into contracts and provided very useful negotiation tools when pricing analyses were being reviewed with various suppliers.

Procurement Process. One of the most important changes was the development of a routine PO recommendation memo for all purchases over a certain dollar amount. The memo, prepared by the PO&T Sourcing and Procurement group, was a standard template that captured the essential justification, fair value, and rationale for the purchase. The idea was to provide PO&T management with visibility of the due diligence conducted prior to issuing the PO, as well as to demonstrate that all of the financial imperatives were met (such as ensuring that the pricing adhered to the contract and the supplier was an approved supplier). To emphasize the importance of P2P processes, the category managers and the broader team began to track PO processing times, and to define acceptable lead times.

Risk Management Tools and Eye-Opening Results continued on the next page>

Risk Management Tools. The PO&T Sourcing and Procurement group also re-engineered its overall risk management process, applying a three-pronged approach to manage and monitor supplier risk. To begin with, standard supplier scorecards were created that measured critical suppliers on the dimensions of performance, quality, and on-time delivery. The scorecards were used in discussions with key suppliers at quarterly business review meetings. They included elements of supplier performance that were deemed to be important from a drug supply perspective, such that reduction in performance would be construed as added risk. The intent was to use supplier scorecards, in conjunction with fair value pricing, to dual-source key materials and services and thereby make sure that the supply chain was always in a state of managed risk.

Second, the team adopted systems to enable monitoring of vendor continuity. The PO&T sourcing council championed a program in which critical suppliers were continuously policed using advanced financial analytics. The program involved publishing a quarterly report featuring key analytics on suppliers to ensure there were no risks associated with their ability to support the company’s supply chain over time.

Third, standard risk scores were developed for each category, using a mathematical manipulation of the percentage of dual sourcing in each category, the percent spend with preferred suppliers, percentage of suppliers struggling financially, and the percentage of those with quality problems.

Eye-Opening Results

The results from the transformation were astounding. On an objective level, five areas that showed quantitative improvements were savings realized; improved management of external spend; procurement compliance; shorter PO processing lead-times; and risk reduction.

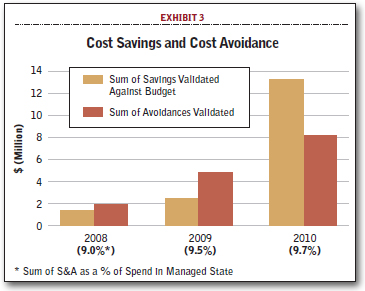

Using the refined business processes noted earlier and implementing the organizational changes, Biogen Idec’s PO&T sourcing and procurement group drove savings in excess of $13 million (validated against budget), and avoided spend of more than $8 million in 2010.

The aggregate savings achieved represented a 500 percent increase in total over the prior two years. In addition, the savings reflected a return of 15 times the total costs of operating the new PO&T Sourcing and Procurement group. (See Exhibit 3.)

In terms of the “managed state” external spend, the improvements were dramatic: in 2010 over 90 percent of spend profile had been reassessed under new market intelligence-based sourcing process, to get all the categories to an optimized managed state.

This analytic was highly important because it showed that using the processes developed, more than four-fifths of external spend was being actively assessed—that is, cross-referenced with existing contractual covenants and either bid competitively or actively negotiated.

A crucial benefit of reaching and being able to demonstrate the degree of diligence in managed spend was that it enabled senior management to have confidence in the processes.

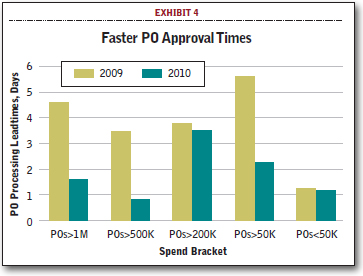

In turn, this paved the way for significant reductions in approval times for POs of greater than $500,000. (See Exhibit 4.)

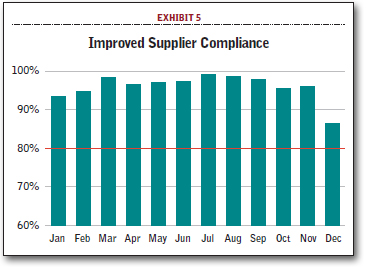

A residual benefit of the new spend management discipline—and a sign of the effectiveness of the standard supplier scorecards—was the fact that supplier compliance numbers were sustained at well above 90 percent, as seen in Exhibit 5.

Supplier compliance is an analytic that measures how many transactions with suppliers meet financial imperatives (adherence to contract, adherence to lead times, and so forth) as well as delivery and quality targets. By standardizing the way in which suppliers were being measured, and publishing the data to key suppliers, the team was able to drive significant gains in compliance, and in turn greatly reduce supply chain risks.

On a subjective level, the results were just as compelling. With new systems and processes in place, the confidence of line functions in the competence of the sourcing unit grew—to the point where they now actively seek out the group for all major initiatives.

Every sourcing project is supported by a strong business case, and new strategies are reviewed by the sourcing council. A business case is comprised of spend analytics, vendor risk analytics, additional market intelligence, “should-cost” models, and vendor continuity reports. In the past, supplier selection was often a function of the supplier’s marketing strength, price was proposed by the supplier, and supply assurances were based on the relationships between sup- pliers and line functions. Now, however, the sourcing teams have become much more proactive in building strong negotiating positions and buy-in based on solid data and analytics.

Once selected, new suppliers are vetted using a rigorous qualification process. For suppliers with above-average risk profiles, contingency plans are integrated into contractual terms and conditions, or alternative redundancies are identified. In addition, suppliers are now much more willing to work with Biogen Idec PO&T sourcing teams. Some have recognized Biogen Idec’s requests for quotations as the clearest and easiest in the biotech industry to respond to.

Overall, Biogen Idec’s bold transformation of its sup- ply chain sourcing activities has produced an array of significant improvements. The visibility and transparency produced by a tightly interlinked system of disciplines and metrics has assured the leadership team that the company’s supply chain is under control, and that all sourcing decisions are made in compliance with robust procedures that are aligned with the company’s strategic objectives.

Recently, a senior executive asked a simple question via email: “How much are we spending with supplier XYZ this year, and what’s their risk profile?” The category team leader was able to provide a document that was in the requestor’s hands within the hour that provided a full report on spending, KPIs, savings opportunities, and performance scorecards for that supplier. The executive’s response: “I love knowing that when I ask a question, I get the full analysis behind it. I used to get subjective viewpoints; now I get documented data!”

About the authors: Joydeep Ganguly is Director, Operations Analytics, at Biogen Idec Inc. Alasdair Shepherd is Biogen Idec’s Vice President, Global Operations; Esther Alegria is Biogen Idec’s V.P., Manufacturing & General Manager of RTP Operations; and Rob Ciamarra is Associate Director, PO&T Sourcing. Rob Handfield is the Bank of America University Distinguished Professor of Supply Chain Management at North Carolina State University.

Visit Robert Handfield’s Blog Supply Chain View from the Field