7th Annual Distribution Center & Materials Handling Salary Survey

Though compensation is climbing less rapidly than in recent years, the percentage of satisfied distribution center and materials handling employees is approaching perfection.

Salary Salary Survey

The results of Modern Materials Handling magazine 7th Annual Distribution Center & Materials Handling Salary Salary Survey illustrate an industry flush with contented workers and thriving businesses.

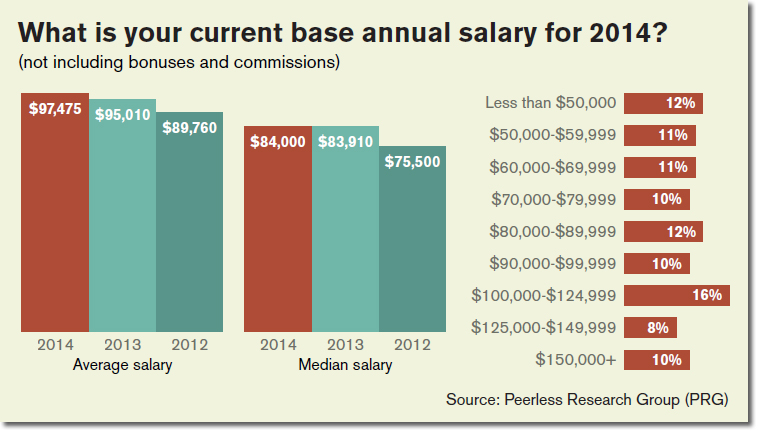

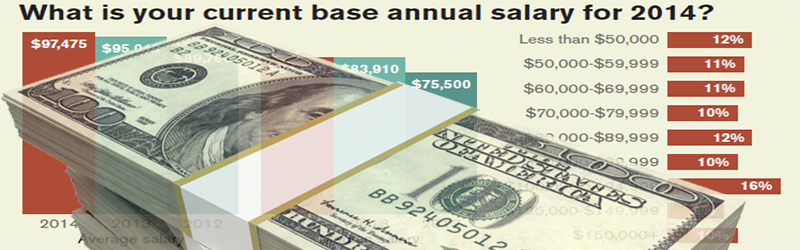

At $97,475, the average base salary is the highest in the history of our survey, up 2.6% over last year’s record average.

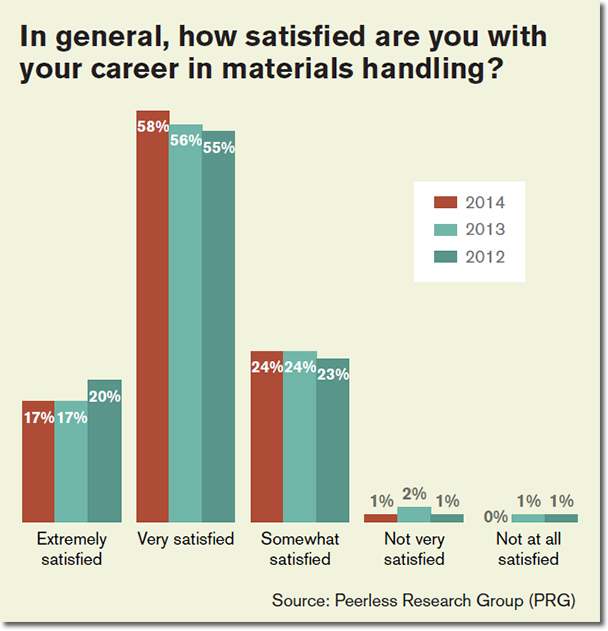

Also, for the first time in survey history, 99% of the more than 570 respondents expressed satisfaction with their work.

This is despite the fact that overall compensation rose just 2.2% this year, following the nearly 7% jump reported in 2013.

Survey respondents represent a broad range of industries and disciplines, and 92% say they like their jobs. Similarly, 93% would recommend the materials handling profession to others.

Half indicated they intend to finish their careers with their current employer, but the average turnover rate jumped from around 6.5% in the previous three years to 7.8%.

Together with yet another increase in the number of 18- to 34-year-olds, the average age is 50, with 25% of respondents aged 18 to 44, up 5% over last year.

The use of drastic cost-saving measures like layoffs and pay cuts continues to plummet since the highs of 2011, and hiring continues to surge.

In 2011, just 46% reported their companies had hired or added personnel in the previous 12 months and that figure has jumped to 63%. In the same period, pay cuts and salary freezes fell from 36% to 20%.

The post-recession bump ensured those who weathered the storm were rewarded for their efforts. Since the recovery, bonuses are being awarded more for individual performance than increased sales. And fewer than ever report their companies have resorted to cutting wages, benefits, and overtime to make ends meet.

And They Don’t Just Do It For The Money

Open-ended responses from survey participants highlight the pros and cons of the profession.

I feel there is a solid career path in this industry. I started as a forklift operator selecting orders 18 years ago, and I have progressed into a director of operations role.Question: Why would you recommend the distribution center materials handling profession to others?

- It’s an industry that requires unique skills and knowledge with more openings than candidates

- Supply chain management seems to finally be recognized as a significant contributor to the company’s performance.

- It’s a challenging, interesting business that allows you to help your customers better their businesses.

- Our lives are different every day. New challenges, new customers and new opportunities to help customers become more efficient and productive.

- In materials handling, you deal with solutions all the time. See a need, address the need.

- As more people realize the importance of proper materials handling and the cost savings that can be achieved, the more fun I have. I have an accounting and purchasing background and was able to start using inventory control methods long before they were even recognized, so I have enjoyed watching how it has evolved in the last 20 years.

- It’s a challenging environment with solid rewards.

Question: Why would you not recommend the distribution center materials handling profession to others?

- Seems under-appreciated.

- The compensation for employees is lower than the contributions they make.

- The places I have worked give little respect or monetary compensation to logistics and warehousing personnel.

But despite all the tumult of the past half-decade, our annual salary survey has consistently shown very high satisfaction rates. The disconnect between monetary gain and happiness suggests those in the materials handling profession find plenty of reward in their work, even before payday rolls around.

The Compensation Picture

This year, 65% of respondents said their salary increased in the past year, and 31% said it stayed the same. In 2013, the average base salary increase was 4.6%, dropping below the 5.2% averages of previous years. Of those respondents who saw a salary increase last year, nearly one in 10 received increases of 10% or more.

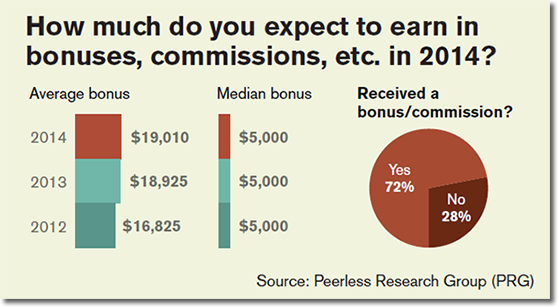

The average bonus is $19,010, and bonuses increased on average by 23%. This is somewhat lower than 2012’s high-water mark of 39% average bonus increases, indicating a leveling off of growth following rapid gains in the post-recession recovery. After falling off to 11% last year, incentives for improved inventory management jumped back to 15%, while the emphasis on increased sales fell from 36% of bonuses to 28%.

Overwhelmingly, bonuses result from the company reaching its performance goals (68%) and individual performance (45%). As recently as 2010, those factors yielded bonuses for just 18% and 5% of respondents, respectively.

Demographics

About 13% of respondents work for companies with estimated 2013 revenues of less than $10 million. Another 16% expect between $10 million and $50 million, and fully half are larger than $250 million, including 21% above $2.5 billion.

Industries represented by respondents include food, beverage and tobacco (11%); automotive and transportation equipment (7%); wholesale trade (7%); retail trade (7%); industrial machinery (7%); chemicals and pharmaceuticals (6%); and third-party logistics (4%). Primary job functions of respondents include warehouse, distribution and logistics (39%); plant management (17%); engineering (15%); company management (11%); and purchasing (7%).

Fewer than 22% of respondents have been in the materials handling profession for less than 10 years. About half have been at it for more than 20 years, including 18% with 30-plus years in the field. On average, those who have been in the industry less than five years can expect to earn $71,750. But if they stick with it, their next decade could produce a 26% increase, to an average of $90,515 for those with 10 to 15 years in the profession. Above the 20-year mark, the average salary hovers around $102,000.

The 11% of respondents in company management (CEO, VP, GM, etc.) noted a dip in compensation in 2013, to an average just more than $140,000. In 2014, that group earned an average of $151,000. Conversely, the engineers who make up 15% of the survey base saw averages fall from $101,000 to a little better than $90,000. For the first time in four years, however, compensation for plant management positions moved into six-figure territory.

Fewer employees have faced wage decreases since the dark days of 2009, when one in 10 respondents saw their salaries reduced by an average of 15% year over year. In the past four years, only 4% have seen decreases, and in 2014 those decreases averaged 10%.

Those with supervisory responsibilities (74%) can expect to earn 23% more than their non-supervisor colleagues, as compared to the 30% gap between the two groups as captured in last year’s results, and the 36% gap in 2012. Those with budgetary responsibilities (67%) earn about 37% more than those without.

In last year’s survey, the average supervisor salary increased 5.5%, but was dwarfed by the more than 10% increase in non-supervisor salaries. The trend has continued, as supervisor compensation fell slightly as non-supervisor salaries grew slightly.

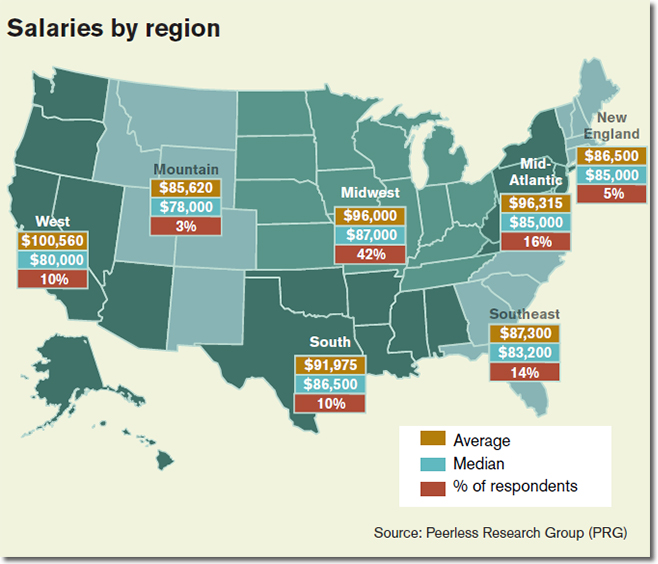

Regionally within the United States, there have been some localized ups and downs in average salaries. In the Midwest, where 42% of respondents are located, salaries fell by about 3% from 2012 to 2013, only to spike by nearly 9% in 2014 from $88,270 to $96,000.

In the Southeast, where 14% of all respondents are employed, average salaries dropped from just under six figures to $87,300. The figure is nearly 20% lower than it was in our 2012 survey.

Job Satisfaction

When asked about their futures, 50% see themselves finishing their careers at their current employers. Whether they responded “yes,” “no,” or “unsure,” average salaries essentially held firm. About 47% have already been with their employers for 10 years – including 21% with more than 20 years.

Since last year, the same 17% express “ldquo;extreme satisfaction” with their careers. The percentage of those “very” or “somewhat” satisfied again rose to 58% and 24%, respectively. Today, just 1% are “not very” satisfied, and no respondents claim they are not at all satisfied.

This year, 34% of respondents indicate no interest in seeking another job, the lowest in four years. About 38% say they are “open to other possibilities.” The same 21% as last year are passively looking for work elsewhere and 7% are actively looking. Those looking elsewhere are motivated primarily by compensation (60%), the desire for new challenges (35%), and a lack of advancement opportunities (37%).

When asked about stress levels at work, 45% say it is more stressful than two years ago, and 39% say stress levels have remained the same. A record 16% report less stress.

Among the 11% who report their job is “extremely” stressful and the 34% whose work is “very” stressful, the top complaints included workload (51%), not enough people (48%), not enough time (40%), balancing work life and home life (39%), questionable management decisions (39%) and working with outdated technologies (28%).

The industry’s talent gap is evident in the “not enough people” response, which is up from two in five to nearly half.

Respondents, by the Numbers

In September of 2014, Modern Materials Handling magazine subscribers received an invitation by e-mail to participate in the seventh-annual salary survey. The e-mail included a dedicated URL linked to a Web site that hosted the questionnaire.

The study, performed by Peerless Research Group, received a total of 573 responses from qualified materials handling professionals.

The average respondent is a 50-year-old male earning $97,475 in salary and $19,010 in bonuses (median salary $84,000, median bonus $5,000), for a combined average increase of 2.2% over last year (median compensation is identical to 2013). The percentage of female respondents, after falling from 12% in 2011 to 6% in 2012 is now at 7%. The average base salary for women also dropped from $76,242 in 2011 to $66,635 in 2012, but now stands at $73,560.

The average respondent has a budget authority of $203,000 (median: $16,000). About 66% of respondents work for manufacturing companies. The average respondent works for a company with 3,340 employees (median: 820) and an estimated annual revenue of $802 million (median: $277 million). He has worked with his company for about 11 years of his 18-year materials handling career, during which time he has worked for 2.3 companies.

Among respondents, 78% have been in the industry at least 10 years, 49% for more than 20, and 18% have been at it for more than 30 years.

Only 7% of respondents were personally impacted by layoffs in the previous 12 months, as opposed to 14% in 2011, and 9% in both 2012 and 2013.

Related: Forecasting a Supply Chain Talent “Perfect Storm”

Article Topics

MHI News & Resources

2024 Intralogistics Robotics Survey: Robot demand surges MHI surpasses 1,000 members Modex 2024: Records broken, robots everywhere WERC annual conference program spans education, networking, facility tours Modex 2024 reports record-shattering attendance MHI Report notes investment increases as supply chains become more tech-forward and human-centric Make your plans for ProMat 2025 More MHILatest in Warehouse|DC

Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Plastic Pollution is a Problem Many Companies are Still Ignoring More Warehouse|DCAbout the Author