Freight Brokers & 3PLs Scrambling to Offer Shipper Deals in Tight Capacity Truckload Spot Market

Facing the tightest spot truckload market in at least four years, the number of available loads on the spot truckload freight market jumped 5.4% during the week ending Sept. 30 and tight capacity sent the load-to-truck ratio for van freight into uncharted territory.

Reacting to the tightest spot truckload market in at least four years, freight brokers and third-party logistics providers are working overtime to obtain truckload (TL) capacity for shippers during this peak freight season.

And experts are telling Logistics Management that the current tight capacity situation will continue well into 2018 partially because of the 4-to-6 percent productivity hit that is widely expected from the coming December implementation of the electronic logging device (ELD).

Jeff Tucker, CEO of the Tucker Company Worldwide, said the ELD situation reminds him of the same impact on capacity that the one-hour reduction in hours of service (HOS) had in 2004.

“That was a shock to the (capacity) system, exactly the way ELDs will have today,” Tucker told Logistics Management. “Back in 2004, we had endured a tight market for about two years. But that change prolonged the shortage for another 18 months.”

Tucker said his company and other major freight brokers “have been preparing for the ELD process for two years” in trying to get recalcitrant shippers to plan for a much tighter freight market starting in 2018.

“We’re going to have the same if not impact as we had with HOS,” Tucker said.

“If you’re not preparing your executive leadership team that things will be different for the next 12-to-18 months, you’re doing yourself a disservice.”

“If I’m wrong, we’ll all be heroes. But if I’m right, these are fairly predictable disruptions that we can plan for,” Tucker said.

As a harbinger of 2018 rate increases, J.B. Hunt Transport Services recently sent a letter to customers warning of stiff contract rate increases.

J.B. Hunt told shippers to expect increases as high as “10 percent or more” as the ELD mandate exacerbates an already tight driver shortage.

“This is one of the highest periods of turbulence and volatility in supply we have ever experienced, and we don’t think it will abate any time soon,” John Roberts, J.B. Hunt president, and CEO, and Shelley Simpson EVP; Chief Commercial Officer; President, Highway Services at J.B. Hunt Transport, said in a letter to customers.

Tom Sanderson, CEO of Transplace, a non-asset based third-party logistics services provider, said TL capacity is very tight both in reefer and dry van.

“Shippers are seeing it in the form of much higher spot market rates,” Sanderson told Logistics Management. “Plus, there is a lot more freight turned down by carriers. That means more freight is being pulled into the market at higher spot rates.”

The number of available loads on the spot truckload freight market jumped 5.4% during the week ending Sept. 30 and tight capacity sent the load-to-truck ratio for van freight into uncharted territory, according to DAT Solutions, which operates the DAT network of load boards.

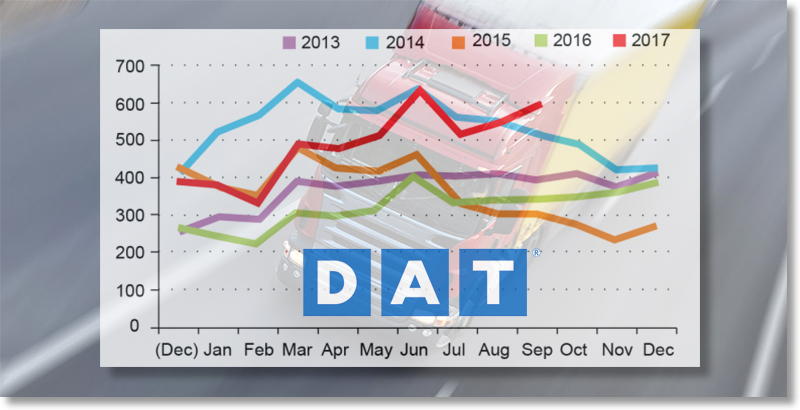

DAT: Freight Index hits all-time high in September

Tight capacity sends spot rates to their highest point since December 2014, according to DAT Solutions.

DAT said overall the number of available trucks dropped 3.2% during late September and pushed load-to-truck ratios higher for all three equipment types:

- Van: 7.0 loads per truck, up 10%;

- Flatbed: 50.2 loads per truck, up 16%; and

- Refrigerated: 12.4 loads per truck, up 2%

DAT said national average spot TL rates continue to “simmer” at two-year highs.

Contract rates will soon follow the spot market increases in their normal annual bid cycle, Sanderson said. “There’s a lag,” he said. “But some of the biggest TL carriers, including Hunt, have been very aggressive as they say to expect double-digit rate increases in contract rates.”

Brokers like Tucker and 3PLs like Transplace say their in-house expertise and long-standing relationships with carriers really pay off in tight markets such as this.

That is paying off in lowered rates in contract carriage as opposed to the currently tight spot market, which DAT Services says is the tightest in over two years.

“What Transplace does is we’re very good at contract procurement and execution,” Sanderson said.

“When we award freight for a year, we are excellent at honoring commitments to carriers. When markets are soft, we still expect carriers to honor contract rates to our customers.”

Sanderson warned shippers against trying to cut corners with their carriers in markets such as this or risk being left out of the capacity equation. “Shippers have to be fair to carriers in both ways,” he said.

“Those shippers who took advantage of surplus capacity are paying the severe price right now.’

Sanderson said most of Transplace’s several billion dollars of managed freight moves under contract. “We’re not making money on the spread (between contract and spot markets),” he said.

“It’s a management fee model. When capacity is tight, the value proposition is better. So many customers are getting squeezed by higher prices and they’re under pressure from their CFOs. It tends to spur people to get help and that’s how we show how we buy and executive freight transportation.”

In a surplus capacity market, Sanderson quipped, “Anybody can manage freight.”

Sanderson said shippers should have anticipated the current tight TL market years ago and tried to move as much of their freight to contract carriage, which is less vulnerable to capacity shortages and spot market hikes.

“If you switch to contract rates today, it’s probably a little too late,” he said. “Unless the spot market gets worse.”

Tucker said brokers have been “moving toward” using more contract carriage as a way to protect shippers from the vagaries of the spot dry van and reefer markets.

“The industry has been moving toward that,” he said. “Some shippers consider brokers a vital part of their mix. We have kept rates steady in some cases the past four years by using contract rates. We use a dedicated service, contract and spot markets. We play in all three areas.”

Related: Keep Looking Up to Follow Path of Truckload Rates

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Transportation

Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge More TransportationAbout the Author