28th Annual State of Logistics: Into the great unknown

E-commerce continues to fuel a boom that’s tempered by overcapacity, rate pressures, sluggish demand and political doubt. The result: “cognitive dissonance” that finds a $1.4 trillion market scratching its head.

Over the course of 2016, logisticians and freight business professionals helped U.S. business costs decline for the first time since 2009, even as the booming e-commerce sector “propelled demand” for small parcel delivery services. In the meantime, the traditional transport modes—trucking, rail, water and air cargo—were challenged in 2016 by overcapacity, rate pressures and sluggish demand.

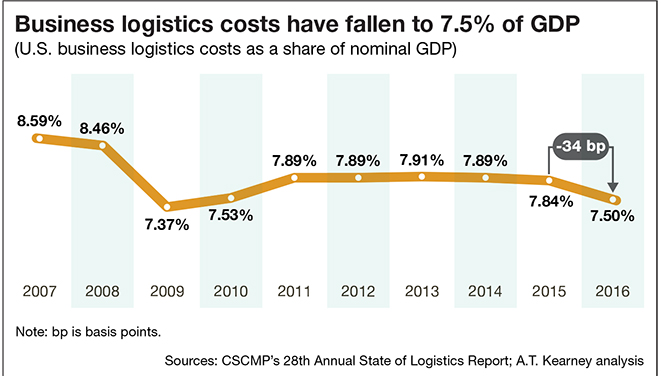

Overall, U.S. business logistics costs fell 34 basis points last year to a near-record 7.5% of gross domestic product (GDP), a number that’s just off the record of 7.4% of GDP set in the Great Recession year of 2009. By comparison, in 1979, the last year before the Motor Carrier Act deregulated the interstate trucking industry, logistics costs were over 18% of GDP in the regulated environment.

These are the major takeaways from the “28th Annual State of Logistics Report (SoL)” co-authored by A.T. Kearney and the Council of Supply Chain Management Professionals (CSCMP) and sponsored by Penske. According to the reported entitled “Accelerating Into Uncertainty,” profit margins were squeezed in 2016 across most modes—parcel being the only exception. Contrary to popular belief, this fact is quite worrisome to some shippers, who remain concerned that bankruptcies, mergers and acquisitions will leave them with fewer choices—and sharply higher rates.

“From the shipper point of view, it’s about rate management,” said Miguel Gonzalez, director of global logistics for DuPont, during the official release last month at the National Press Club in Washington, D.C. “More and more companies are relying on strategic partners, so the question remains: ‘How do we mitigate risks?’ The report reflects the reality we live in.”

Other areas of uncertainty involve the new Trump administration, confusion over export levels amid talk of higher tariffs in international trade, and unsure measures to upgrade U.S. infrastructure and trade policy.

The report acknowledges such uncertainty by noting: “The logistics industry appears destined for a prolonged bout of ‘cognitive dissonance.’” The authors contend that this is due to continued frustration over subpar growth in overall GDP while watching the stock market, technology investments and consumer confidence all rise. To top it off, that uncertainty has not slowed the pace of change. As an example of this volatility, shippers have to look no further than demands on their trucking partners. For example, the American Trucking Associations’ (ATA) advanced seasonally adjusted “For-Hire Truck Tonnage Index” increased 6.5% in May, following a 1.5% decline during April. Such volume disruptions are typical of what logisticians are seeing across all modes in most markets.

“On the contrary, industries are churning with disruption, as newcomers and incumbents vie for market share and innovation undermines old business models,” say the report authors. “One thing is certain: ‘business as usual’ won’t return.”

The big picture

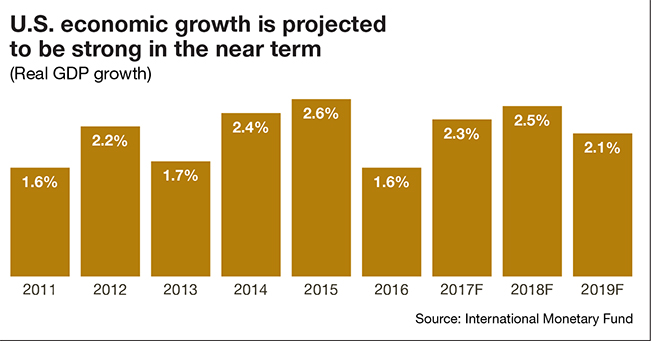

After the International Monetary Fund predicted 3.5% worldwide economic growth this year, the U.S. GDP started 2017 with an underwhelming 1.2% growth in the first quarter—the fourth worst first quarter in the last six years.

According to the report, “this disconnect was the latest unsettling discrepancy between soft indicators of sentiment and hard data on actual economic activity.” This reality leaves shippers and logistics pros with “little clarity” on economic fundamentals for 2017. Further complicating the outlook are variables such as currency exchange levels (namely the strong U.S. dollar), interest rates and political trends.

“Against that uncertain backdrop,” says the SoL authors, “logistics executives must make vital decisions about capacity, pricing, technology deployment and strategy.”

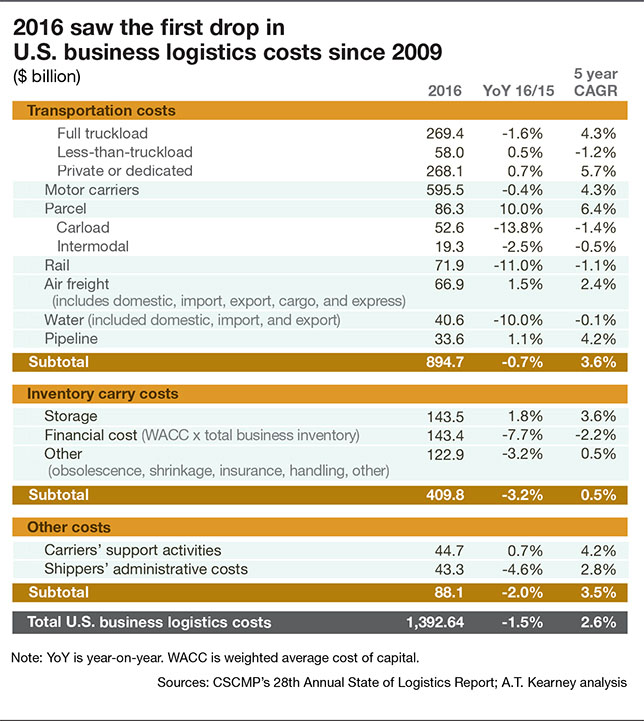

However, those logistics management experts have still been able to squeeze out efficiencies from their existing networks. As proof, the SoL reports that U.S. business logistics costs fell 1.5% last year after rising at a five-year compound annual rate of 4.6% from 2010 to 2015. Costs fell across all three components—transportation, inventory carrying and miscellaneous costs.

According to the SoL, the declines reflect overcapacity, slack volumes and rate pressures in several sectors, even as demand and prices rose in others. Logistics provider executives are certainly seeing this reality first hand. Marc Althen, president of Penske Logistics, a sponsor of the annual SoL, struck a more optimistic tone. “The good news is that supply chain activity is accelerating,” he says. “Warehousing is very active, and demand for our technological solutions is strong.”

According to Althen, 2017 is “shaping up to be a good year after a challenging 2016. Shippers are asking to take cost out of the system, and we’re seeing new business activity across all our divisions—transportation management, warehousing, truck leasing and dedicated contract carriage.”

Mode by mode

As usual, trucking is the engine that drives the U.S. transportation machine. However, the report dives into the details of the financial health of all four of the major freight modes.

Trucking, which hauls about 75% of goods by value in the United States, continued to struggle with overcapacity in 2016, especially in the $270 billion truckload (TL) sector. According to the SoL, TL costs fell 1.6% last year, even as its five-year compound annual growth rate (CAGR) rose 4.3% from 2010 to 2015. By comparison, the smaller $58 billion LTL sector enjoyed a 0.5% rise last year even as its five-year CAGR fell 1.2%. The $268 billion private trucking market costs rose 0.7% as its five-year CAGR was up 5.7%, according to SoL data.

Overall, motor carrier costs fell 0.4% last year as five-year growth rates were up 4.3%. The trucking industry was estimated to be $595 billion of the total $894 billion transport market that includes $73 billion in pipeline and water.

Parcel carriers, namely UPS, FedEx and U.S. Postal Service, fared the best while riding the e-commerce wave. Parcel costs rose 10% in the $86 billion sector as five-year CAGR rings in at 6.4%. For the first time, the parcel market exceeded revenue posted in the rail sector, and parcel rates are expected to continue to rise, according to report author Sean Monahan, partner with A.T. Kearney.

“UPS is starting a new holiday surcharge for Thanksgiving and Christmas,” says Monahan, adding that the new charge reflects the carrier’s rising costs of reconfiguring their distribution centers and hubs to get closer to customers’ last-mile delivery demands.

The $72 billion rail sector suffered the most last year, with rail costs falling 11% amid overcapacity. However, five-year CAGR rail costs were off just a scant 1.1%, reflecting overall rail profitability in the period, while 2017 is expected to be a much stronger year for rail.

“There’s been a significant recovery in coal demand,” says Beth Whited, Union Pacific’s executive vice president and a panelist at the SoL release event. “Low demand for coal has receded, exports of grains have improved, and chemicals are up.”

According to the SoL, the $67 billion airfreight sector enjoyed a 1.5% rise in costs last year and five-year CAGR of 2.4%, while water rates were off 10% and pipeline costs were up 1.1% last year, the report said.

And in a bit of good news for shippers who control inventory, overall costs in that area fell in 2016. Shippers’ administrative costs fell a whopping 4.6%, while total inventory carrying costs fell 3.2% helped by the decline in administrative costs. That brought total U.S. business logistics costs to $1.392 trillion, a 1.5% annual decline. Five-year CAGR for all business logistics costs were up 2.6% from 2010 to 2015.

Read more details about each transportation mode in the State of Logistics 2017 here.

The crystal ball

According to the SoL authors, 2017 could be a pivotal year for logistics. They note that demand patterns are shifting and technology is enabling new competitors to challenge old business models—significant moves that could reshape individual sectors and even the logistics industry as a whole.

The new order could include “major business combinations, large-scale shifts in distribution flows, deep capacity cuts, massive infrastructure investments,” among other changes. And, the report includes a stern warning about the possibility of “increasing political risk” in the world’s largest democracy.

“Rising protectionist sentiment around the world threatens to constrict global trade flows—the lifeblood of logistics,” the SoL report warns. “Trump won the U.S. presidency with a mixed message of tax relief, regulatory reform and trade restrictions. His agenda could cut both ways for logistics, and it’s still not clear which proposals will become law.”

As part of the report, SoL authors offer four potential scenarios for logistics in the next few years based on current realities:

- Plain sailing. Regulatory constraints recede, global trade flourishes and technology improves efficiency.

- Choppy waters. New policies favor U.S. manufacturing force shippers and logistics companies to adapt, spurring faster technological adoption.

- Stemming the tide. Tighter regulations raise operating costs and accelerate investment in cost-saving technologies.

- In the doldrums. Regulatory costs rise and tough economic conditions deter technological investments.

Among the technological innovations coming soon, Penske’s Althen calls driverless trucks “the next technological wave,” and adds that it’s coming sooner than the industry may think. “We’ll see end-to-end platooning, or two or more trucks led by an autonomous vehicle, within two to three years and evolving from there.” But even with automation, he says that there will be a need for interaction with humans, as drivers will take over the finesse parts of moving goods.

Finally, as transportation demand levels are closely tied to overall U.S. economic output, the report’s economic forecast is more of the same—moderate growth, but certainly nothing spectacular in the near future. According to the SoL, U.S. economic growth is projected to be strong in the near term, forecast for 2.3% GDP growth this year, 2.5% next year and 2.1% in 2019.

However, the pending renegotiation of the 23-year-old North American Free Trade Agreement (NAFTA) is worrisome for all logistics markets, according to authors. President Trump threatened in March to unilaterally withdraw from the agreement, which has resulted in a four-fold increase in trade among Mexico, Canada and U.S. Of course, Tump has since walked back that threat, slightly.

“Restrictive trade policies would shake logistics providers, many of which depend on global commerce,” say the SoL authors. “The pending renegotiation of NAFTA is of particular interest to railroads and trucking companies, which would lose business if trade with Mexico declines.”

The report also warns against a worst-case scenario, which would amount to Trump’s pro-business agenda stalling in Washington while Congress enacts import barriers that could spark trade warfare, damaging the entire logistics industry.

“It’s out there,” says DuPont’s Gonzalez of such volatility. “And that means more time in meetings with ancillary in-house experts on taxes, government affairs and NAFTA. It’s not just here in the United States. We’re seeing geopolitical factors everywhere in the world, and it’s one more variable we have to manage.”

In the meantime, logistics professionals of all political stripes are urging Washington to cool the rhetoric. Cooler heads predict that technological change will drive new supply chain innovation in the future across all modes and borders.

Read more details about each Mode in the State of Logistics 2017:

Less-than-truckload (LTL)

Truckload (TL)

Rail/Intermodal

Ocean Cargo

Air Cargo

Third-Party Logistics (3PL)