2016 State of Logistics: Less-than-truckload

LTL carriers adjusting to “more competitive” pricing environment

The nation’s less-than-truckload (LTL) carriers, due to their concentrated market pricing power in this $36 billion sector, say they they’re holding up well in a year of slightly slackening demand for their services.

Even in the first quarter that is typically the slowest for LTL freight demand, YRC Freight, which operates both its long-haul and regional units that combined for $5.3 billion in revenue last year, managed to nearly quadruple its operating income in the first quarter to $13.4 million compared with the 2015 first quarter.

Old Dominion Freight Line (ODFL), the perennial leader in LTL profitability, posted $60.3 million net income on $707 million revenue in the first quarter, nearly identical to its $62.5 million earnings on $696 million revenue in the 2015.

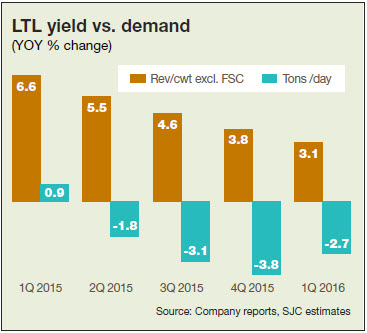

ODFL yield (revenue per hundredweight) increased just 0.3% because of what Stifel trucking analyst David Ross calls an LTL pricing environment that’s “a little more competitive than originally anticipated.”

But most of the top LTL executives say pricing remains “rational,” even during the usually slow first quarter and “even” despite scant 0.5% growth in first-quarter GDP. That’s because they operate in a sector combined with projected capacity constraints from regulations covering hours of service (HOS) and electronic logging devices.

“Eventually, a stronger economic environment will bode well for us over the long term,” says James Welch, CEO of YRC Worldwide. “Despite near-term headwinds from decreasing fuel surcharge revenue and an inconsistent industrial economy, we believe LTL pricing remains rational.”

In data prepared exclusively for Logistics Management (LM) by SJ Consulting, shippers can see why LTL executives are output figures reported by the Institute of Supply Management. In March, that barometer jumped 2.3% to 51.8—which is considered quite positive.

“I’m encouraged by that,” adds Brad Jacobs president and CEO at XPO Logistics. “If we see an ISM manufacturing index stay above 50 above for three months, I’d become even more positive.”