2016 Global Trade to Grow at Slowest Pace since the 2009 Financial Crisis

World trade will grow more slowly than expected in 2016, expanding by just 1.7%, well below the April forecast of 2.8%, according to the latest World Trade Organization estimates.

The world trade forecast for 2016 has been adjusted to 1.7% growth, the forecast for 2017 has also been revised, with trade now expected to grow between 1.8% and 3.1%, down from 3.6% previously.

With expected global GDP growth of 2.2% in 2016, this year would mark the slowest pace of trade and output growth since the financial crisis of 2009.

The downgrade follows a sharper than expected decline in merchandise trade volumes in the first quarter (-1.1% quarter-on-quarter, as measured by the average of seasonally-adjusted exports and imports) and a smaller than anticipated rebound in the second quarter (+0.3%).

The contraction was driven by slowing GDP and trade growth in developing economies such as China and Brazil but also in North America, which had the strongest import growth of any region in 2014-15 but has decelerated since then.

World Trade Organization Director-General Roberto Azevêdo said:

“The dramatic slowing of trade growth is serious and should serve as a wake-up call. It is particularly concerning in the context of growing anti-globalization sentiment. We need to make sure that this does not translate into misguided policies that could make the situation much worse, not only from the perspective of trade but also for job creation and economic growth and development which are so closely linked to an open trading system.

“While the benefits of trade are clear, it is also clear that they need to be shared more widely. We should seek to build a more inclusive trading system that goes further to support poorer countries to take part and benefit, as well as entrepreneurs, small companies, and marginalised groups in all economies. This is a moment to heed the lessons of history and re-commit to openness in trade, which can help to spur economic growth.”

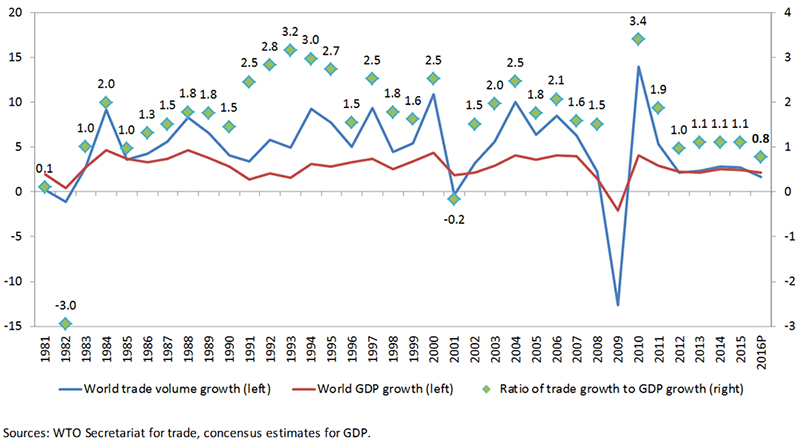

The latest figures are a disappointing development and underline a recent weakening in the relationship between trade and GDP growth. Over the long term trade has typically grown at 1.5 times faster than GDP, though in the 1990s world merchandise trade volume grew about twice as fast as world real GDP at market exchange rates. In recent years however, the ratio has slipped towards 1:1, below both the peak of the 1990's and the long-term average.

If the revised projection holds, 2016 will be the first time in 15 years that the ratio between trade growth and world GDP has fallen below 1:1. Historically strong trade growth has been a sign of strong economic growth, as trade has provided a way for developing and emerging economies to grow quickly, and strong import growth has been associated with faster growth in developed countries. However the increase of the number of systematically important trading countries and the shift in the ratio of trade and GDP growth makes it more difficult to forecast future trade growth.

Therefore, the WTO is for the first time providing a range of scenarios for its 2017 trade forecast rather than giving specific figures. As Chart 1 below shows, the current trend in the relationship between trade growth and world GDP is lower than observed over the last three decades.

Chart 1: Ratio of world merchandise trade volume growth to world real GDP growth, 1981-2016

(% change and ratio)

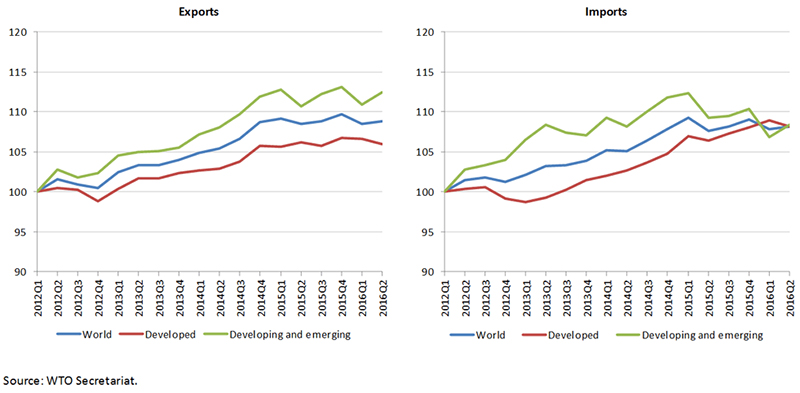

Since the WTO's April 2016 forecast was issued, some important downside risks have materialized, most notably a period of financial turbulence that affected China and other developing market economies early in the year, but which has since eased. Recent movements in trade by level of development are illustrated by Chart 2, which shows seasonally-adjusted quarterly merchandise trade indices in volume terms (i.e. adjusted to account for fluctuations in prices and exchange rates.)1

Chart 2: Volume of merchandise exports and imports by level of development, 2012Q1-2016Q2

Seasonally adjusted volume indices, 2012Q1=100

Import demand of developing economies fell 3.2% in Q1 before staging a partial recovery of 1.5% in Q2. Meanwhile, developed economies recorded positive import growth of 0.8% in Q1 and negative growth of -0.8% in Q2. Overall, world imports stagnated in the first half of 2016, falling 1.0% in Q1 and rising 0.2% in Q2. This translated into weak demand for exports of both developed and developing economies. For the year-to-date, world trade has been essentially flat, with the average of exports and imports in Q1 and Q2 declining 0.3% relative to last year.

These results are largely in line with the signals given by the WTO's World Trade Outlook Indicator (WTOI), a new tool launched in July to provide “real time” information on trends in global trade. At that time the WTOI indicated that world merchandise trade might rebound in Q2 but would likely remain below trend.

The stagnation of world merchandise trade disguises strong shifts at the regional level, which are illustrated by Chart 3. The most striking feature of this chart is the steep decline in imports of resource-exporting regions over the last two years, driven by falling commodity prices and declining export revenues. South America and Other regions (comprising Africa, the Middle East and the Commonwealth of Independent States) arrested their declines in Q2 of 2016 while imports of North America and Europe both dipped in the latest quarter. Meanwhile, Asian imports declined by 3.4% in Q1 against a backdrop of concerns about slowing growth in China, before rebounding to 1.3% growth in Q2 as these concerns eased. The 3.3% decline in Asian exports in Q1 mirrored the drop in Asia on the import side, but this was mostly reversed by a 3.2% rise in exports in Q2.

Chart 3: Volume of merchandise exports and imports by region, 2012Q1-2016Q2

Seasonally adjusted volume indices, 2012Q1=100

There are some indications that trade may be picking up in the second half of 2016, although the pace of expansion is likely to remain subdued. Container port throughput has increased (Chart 4), export orders have risen in the United States, and nominal trade flows in US dollar terms have stabilized, but numerous risks remain.

The outlook for the remainder of this year and next year is affected by a number of uncertainties, including financial volatility stemming from changes in monetary policy in developed countries, the possibility that growing anti-trade rhetoric will increasingly be reflected in trade policy, and the potential effects of the Brexit vote in the United Kingdom, which has increased uncertainty about future trading arrangements in Europe, a region where trade growth has been relatively strong.

The UK referendum result did not produce an immediately observable downturn in economic activity as measured by industrial production or employment; the main impact was a 13% drop in the exchange rate of the pound against the US dollar and an 11% decline in its value against the euro. Effects over the longer term remain to be seen. Economic forecasts for the UK in 2017 range from fairly optimistic to quite pessimistic. Our forecast assumes an intermediate case, with a growth slowdown next year but not an outright recession.

Chart 4: Container shipping throughput index, January 2007 - July 2016

Seasonally adjusted trend index, 2010=100

Table 1 below summarizes the WTO’s revised trade forecast. According to these estimates, world merchandise trade volume will grow more slowly than world GDP at market exchange rates in 2016 (1.7% compared to 2.2%)

Exports of developed countries are expected to outpace those of developing economies this year, 2.1% compared to 1.2%. On the import side, developing countries are expected to register sluggish growth of 0.4% compared to 2.6% for developed countries..

The biggest downward revision to imports from our April forecast for 2016 applies to South America (-8.3% compared to -4.5% previously) as the recession in Brazil intensified. This was followed by North America, where import growth was revised down from 4.1% to 1.9% as GDP growth came in below earlier projections. Asian import growth was also scaled back to 1.6% from 3.2%, while our forecast for Europe was revised upward from 3.2% to 3.7%.

Export growth in 2016 was downgraded for most regions, with the strongest revisions applied to Asia (0.3% compared to 3.4% in April) and North America (0.7% compared to 3.1%). Meanwhile, South America's export growth is expected to be stronger than previously forecast (4.4% compared 1.9%), benefitting from favourable exchange rate movements. Even with the downward revision to our estimates, risks to the forecast remain mostly on the downside.

A range of estimates have been provided for 2017 to reflect the increasingly uncertain relationship between trade and output growth. World trade growth could be as high as 3.1% next year if it regains some of its earlier dynamism. However, it could also be as low as 1.8% if the ratio of trade growth to GDP growth continues to weaken.

Estimates of export growth range from 1.7% to 2.9% for developed countries and from 1.9% to 3.4% for developing economies in 2017. On the import side, developed countries could see trade growth of between 1.7% and 2.9% while developing countries expand by between 1.8% and 3.1%.

A number of reasons have been advanced to explain the decline in the ratio of trade growth to GDP growth in recent years, including the changes in the import content of demand, absence of trade liberalization, creeping protectionism, a contraction of global value chains (GVCs), and possibly the increasing role of the digital economy and e-commerce, but all have likely played a role. Whatever the cause, the recent run of weak trade, and economic, growth suggests the need for a better understanding of changing global economic relationships. The WTO, and other international organizations, are working hard to understand this current evolution and its implications for continued growth.

Table 1: Merchandise trade volume and real GDP, 2012-2017

Annual % change

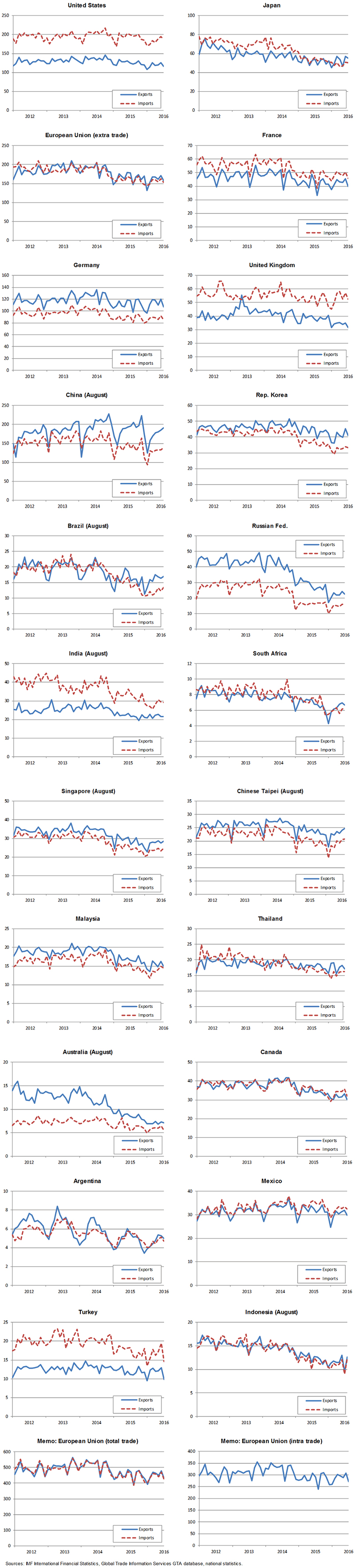

It should be noted that the trade forecasts in Table 1 relate to changes in the quantity of goods traded rather than changes in their dollar value. In 2015, merchandise trade volumes continued to grow slowly despite the sharp 14% decline in the dollar value of world trade, which was largely due to the appreciation of the US dollar. As chart 5 below shows, the dollar has started to depreciate again in the first half of 2016, with an inverse effect on values of traded goods, particularly commodities such as oil. If this trend continues for the remainder of the year, world merchandise trade growth in dollar terms could exceed trade growth in volume terms in 2016. Trade developments in current dollar terms are shown for selected economies in Chart 6.

Chart 5: Effective exchange rates and crude oil prices, Jan. 2012 - Jul. 2016

(Indices, January 2012=100)

Chart 6: Merchandise exports and imports of selected economies, January 2012-July 2016

(Billion dollars)

Article Topics

Amber Road News & Resources

Logistics Platforms: Ways Companies Can Win In the Digital Era Ethical Sourcing – The Business Imperative (and Advantage) How Rules of Origin Really Do Make a Difference for Sourcing Practices E2open’s acquisition of Amber Road is a done deal E2open Completes Acquisition of Amber Road Bridging the Data Gap Between Sourcing and Logistics Medical Technologies Company Remedies Complex Compliance Operations More Amber RoadLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain