2015 Third-Party Logistics Study Takes Deep Dive into Omni-Channel Supply Chain

Nearly one-third of the respondents participating in the study said they are not prepared to handle omni-channel retailing and only 2% of respondents rated themselves as high performing in the omni-channel space.

The relationships between third-party logistics (3PL) service providers and shippers are seeing ongoing developments due in large part to the continuing emergence and sophistication of omni-channel retailing.

That was one of the key findings of The 19th Annual Third-Party Logistics Study, which was released by consultancy Capgemini Group, Penn State University, and Korn/Ferry International, a global talent advisory firm. The study was sponsored by Penske Logistics.

The study’s analysis was based on feedback from more than 770 shippers and logistics services providers in North America, Europe, Asia-Pacific, and Latin America.

One common thread in the study, regardless of geography, was that even though the importance of the omni-channel supply chain is “well understood,” the omni-channel supply chain is still maturing, which, in turn, is resulting in a consumer/retail expectations gap that the sudy’s authors said has led to a wait and see approach.

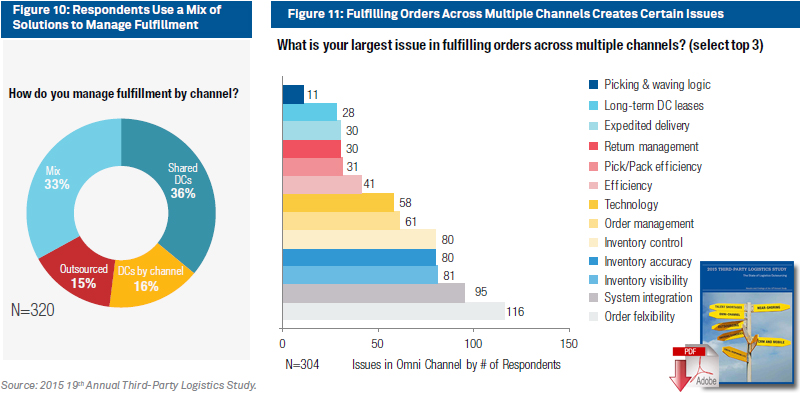

That was directly reflected in the primary drivers cited by survey respondents for adopting an omni-channel supply chain approach, with 32 percent citing customer service as the main driver, service levels next at 23 percent, and freight costs rounding out the top three at 11 percent.

But omni-channel is not a done deal for all, with 33 percent indicating they are not prepared to handle it and another 2 percent saying they arte high performers in the space.

What’s more, 50 percent said they are currently testing or investing in new fulfillment strategies to spur omni-channel network growth, and 16 percent using or considering local store home delivery, and 15 percent doing or planning Sunday delivery.

“Omni-channel is one of those topics that I think the way it matures could potentially be different than the way we have seen previous strategies change relationships [between 3PLs and shippers],” said Shanton Wilcox, vice president of supply chain management at Capgemini, in an interview. “When we had this conversation around the world, it was very eye opening to see how in different global economies there were different sets of problems.”

For example, he noted how in Europe, in one case, there were two delivery trucks from the same carrier arriving at the same address, with one for a B2B delivery and another for a B2C delivery, which is inefficient. And in Asia, having inventory is viewed as advantageous but how it actually gets there is often considered immaterial.

On top of that, he noted there is a general consensus that things will change but is not known to what extent and waiting to see what customer trends, or fads, are truly becomes a hard requirement that 3PLs can build a scalable model around and deliver in a cost-effective manner.

“It is a matter of what they can do to build cost-effectively and then once those requirements are known, it becomes who is best to build that,” he explained. “This might be the next evolution of the 3PL business model to then say this truly something they need to step into.”

As usual, technology was a key theme in the study, with 58 percent of its shipper and 3PL respondents investing in warehouse management systems and 54 percent spending on ERP software, and 54 percent committing capital to transportation management systems.

Other areas of IT investment were supply chain visibility at 43 percent, warehouse management system add-ons at 33 percent, RFID at 21 percent, and mobile apps and related technologies at 33 percent.

Wilcox pointed out that in addition to these aforementioned technologies, there is also a continued improvement and efficiency in cloud technologies, too, which shippers and 3PLs can better leverage.

“A few years back, there was more of a focus on client server, point-to-point integrations, which was hard to manage from a data standardization perspective; cloud takes care of that,” he said. “A 3PL now has a lot more faith in a cloud-based TMS that is easier to get up and running and is faster. It is almost always a commercial solution, as opposed to a custom-built solution from a 3PL.”

The survey also explained how 40 percent of surveyed shippers indicated they have moved some operations to Mexico, with 55 percent coming from the U.S., 36 percent from China, and 9 percent from Canada.

A major reason for this, according to its respondents, include a favorable short-term and long-term business environment for logistics. Other factors include lower operating costs, favorable tax and tariffs, reduced freight transit time, and closer proximity to supply sources.

The ability to attract and retain supply chain talent was also highlighted in the study, with 62.6 percent of respondents stating it continues to be a challenge, with 60 million people expected to leave the industry by 2015, according to industry estimates, but there are only 40 million people to fill those positions. The survey explained this is largely due to current positions within both the supply chain sector, coupled with the dynamics of supply chain professionals changing at a fast rate.

Article Topics

Capgemini News & Resources

Risk Management: Building resilient supply chains in a risky world Reverse logistics in need of some love 2024 WMS Update: At the intersection of warehousing and e-commerce 6 TMS Trends for 2024 Yard Management Systems (YMS): A must-have for the modern operation Six emerging supply chain software trends to watch Steady march into the cloud More CapgeminiLatest in Transportation

Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge More TransportationAbout the Author