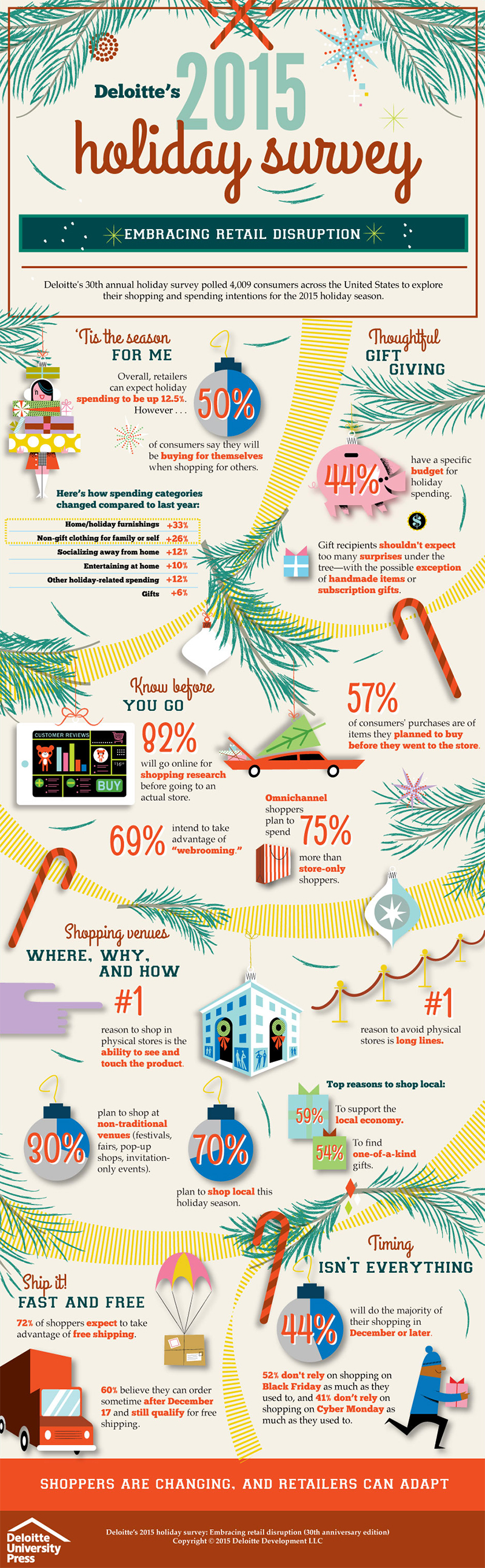

2015 Holiday Survey - Embracing Retail Disruption

Good news for holiday retail, personal income growth may be stubbornly flat, but consumers are enthusiastic about the upcoming shopping season - Deloitte's 30th annual consumer survey suggests what customers are looking for, and what retailers can do to engage them.

Mixed signals, conflicting forces

The consensus from various retail holiday forecasts is that, while retailers will likely see a modest increase in sales for this year’s November–January holiday season, gains will be weaker than last year’s 5.2 percent year-over-year rise.

Specifically, Deloitte’s annual holiday forecast suggests holiday sales will increase 3.5–4 percent, with digitally influenced sales affecting 64 percent, or $434 billion, of in-store retail sales.

Similarly, the National Retail Federation (NRF) is expecting a 3.7 percent increase in holiday sales, representing $630.5 billion in sales. NRF is also predicting online sales growth between 6 and 8 percent, to as much as $105 billion.

Deloitte economists are attributing the uptick in sales to an improving labor market, increasing home values, and lower gas prices - even as, for many, personal income growth remains flat.

Holiday shoppers plan to stuff their own stockings and leave a little sparkle under the tree

Non-gift spending up 16 percent compared with a 6 percent rise in gift spending; holiday shopping traditions wane as digital influence grows.

Holiday cheer is making a comeback but without shiny boxes and bright wrapping, according to Deloitte’s 30th annual holiday survey of consumer spending intentions and trends.

The survey also reveals major disruptions in holiday shopping traditions, largely due to digital engagement. Among the findings:

Consumers plan to spend 12.5 percent more on the holidays overall and treat themselves; non-gift spending substantially outpaces gift spending

- Shoppers surveyed plan to spend $1,440 across categories including gifts, socializing away from home, entertaining at home, non-gift clothing for family or self, home/holiday furnishings, and other holiday-related spending.

- The largest increases from 2014 occur in the non-gift clothing and home/holiday furnishings categories: Spending on holiday furnishings rose 33 percent to $124 from last year followed by a 26 percent increase on non-gift clothing.

- The amount shoppers plan to spend on gifts ticked up 6 percent to $487 this year from $458 in 2014–the smallest increase among all holiday-spending categories. By comparison, shoppers plan to spend $976 on non-gift categories, an increase of 16 percent from 2014.

- The number of holiday gifts shoppers plan to buy remains relatively unchanged at 13.7 total gifts similar to last year’s 13.4 and is up only slightly from a low of 12.8 in 2011–compared with a high of 23.1 in 2007.

- Half (50 percent) of shoppers say they buy gifts for themselves when shopping for others, up 7 percentage points from 2014.

Digital shoppers make stores bright; Webrooming trumps showrooming during the hunt

- Nearly 7 in 10 (69 percent) plan to do “webrooming” - look at items online first, then go to a store to see the item before completing a purchase–jumping from 58 percent last year.

- Roughly half (52 percent) expect to engage in “showrooming” - going first to a store to look at an item, then search online for the best price before completing a purchase.

- Forty-three percent of shoppers expect to buy a product online and pick up the item from the store instead of having the item shipped to them–primarily to save on shipping charges (67 percent), to get the item faster (49 percent), and pick up other items on the same trip (35 percent).

- More than 8 in 10 (82 percent) plan to do research online before making a purchase this holiday season.

- Shoppers who visit stores, online and mobile destinations expect to spend 75 percent more on holiday purchases than those who shop stores alone.

Shoppers claim to be retailer loyal but many will explore local and non-traditional venues; Black Friday continues to lose some of its luster while December shapes up to be a busy month

- Shoppers expect that 75 percent of their total shopping will occur in stores or on sites they’ve visited before. The Internet tops the list of shopping destinations (47 percent), just ahead of discount/value stores (45 percent), followed by traditional department stores (30 percent).

- Nearly three-quarters (72 percent) of consumers plan to try new or different stores or sites than in the past. Among these shoppers, new venues include local stores/businesses (67 percent), websites they haven’t visited before (54 percent), festivals and fairs (26 percent), and temporary/seasonal stores and pop-up shops (26 percent).

- More than half (52 percent) of surveyed consumers say they do not rely on Black Friday as much as they did in the past; 41 percent say the same of Cyber Monday, up 5 percentage points from last year.

- The bulk of holiday shopping continues to take place in December with 44 percent of shoppers planning to wait until December or later to shop, up 5 percentage points from five years ago.

Holiday shoppers crave instant gratification, fast checkout and free shipping

- The top three reasons respondents shop in stores are the ability to see and touch the product (54 percent), save money on shipping costs (31 percent), and purchase gifts immediately (25 percent).

- Shoppers expect store associates to make shopping fast and convenient. Specifically, people want associates to help them check out quickly (63 percent), be knowledgeable about products (59 percent), and inform them of discounts and offers (55 percent). However, 61 percent of shoppers feel they are better connected to information than store associates.

- Free shipping is most preferred retail offering this year with 72 percent of shoppers planning to take advantage of free shipping, followed by easy returns (55 percent) and price matching among 51 percent, up 6 percentage points from 2014.

“While the macro spending signs are encouraging, something more profound is occurring that is drastically disrupting holiday retailing,” said Rod Sides, vice chairman, Deloitte LLP and Retail and Distribution practice leader. “A major category shift is underway where shoppers have much more than gifts in their line of sight.

For some, years of elongated promotions make the holidays seem like the right time to fill the kids’ closets or update the home, and the variety of retail venues from pop-ups to boutiques is inspiring experimentation.”

Sides added, “Many of the moments that matter this holiday season will occur before shoppers ever set foot in a store. Getting the early promotions and engagement right in the digital channels are core to winning the in-store purchase and the shoppers who tend to spend more. It’s also about customizing the offer.

Since it’s not just about gifts this year, retailers should make those offers fulfill shoppers’ other needs. Additionally, the digital influence has conditioned shoppers to anticipate speed and convenience in the store trip, so the final moments also count. Associates that quickly connect a shopper to an item researched in advance or make the buy online/pick-up in store process run smoothly, for example, can create a positive and memorable service experience.”

Related: Supply Chain Trends that Influence Retailers Approach to Black Friday

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Supply Chain

Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process More Supply Chain