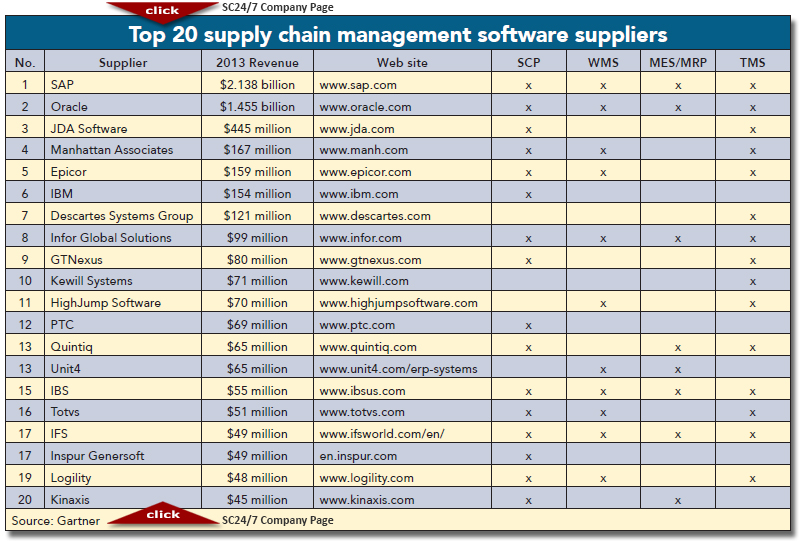

2014 Top 20 Global Supply Chain Management Software Suppliers

The market for supply chain management software continues to expand, highlighting the importance of software in today’s supply chains.

The market for supply chain management software (SCM), maintenance and services posted another year of solid growth, generating $8.944 billion in 2013, including applications for procurement software.

That represented a nearly 7.4% increase over 2012 revenues, according to Chad Eschinger, vice president of supply chain with research firm Gartner.

Without procurement, the market generated $6.1 billion, a healthy 9% increase over 2012 revenues for the group of applications that are most relevant to our readers, including supply chain planning and supply chain execution applications such as warehouse management systems (WMS) and transportation management systems (TMS).

Looking forward, Gartner is predicting a compound annual growth rate (CAGR) for SCM software excluding procurement of 9.9% for the next 5 years, reaching $9.8 billion in 2018.

The biggest change in the market may be the way processes that once operated in their own silos are now converging into the broader supply chain management space, such as procurement.

That is reflected in the appearance of tracks on procurement and supply management at conferences such as WERC, APICS and CSCMP. It’s also reflected in the growing revenues in the procurement software space. “Less supplier revenue is being generated out of supply chain planning and execution applications with more activity in procurement,” says Eschinger. “If you think about it, there is a limited audience for planning and execution, but procurement is as universal as e-mail: Everyone needs it.”

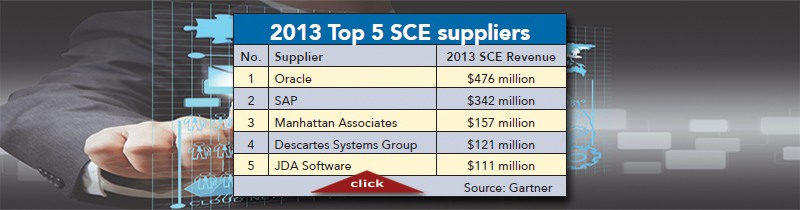

The top five market leaders will look familiar to readers of last year’s survey. SAP ($2.138 billion) and Oracle ($1.455 billion) once again lead the pack. SAP posted a gain of some $400 million, or nearly 20%. Much of that increase can be attributed to the addition of Ariba to its product suite.

Meanwhile, Oracle held its own, posting an increase of about $2 million in revenue. As with last year, they were followed by JDA Software ($445 million) and Manhattan Associates ($167 million). Epicor held on to the No. 5 spot with $159 million. As with last year, enterprise resource planning (ERP) vendors occupy four of the top eight spots. Meanwhile, the top three providers (SAP, Oracle and JDA) accounted for 45% of the total supply chain management software market, down slightly from 48% last year.

Last year’s merger of JDA and RedPrairie made room for PTC, at No. 12 with $69 million. Best known as a provider of product lifecycle management solutions, PTC makes the supply chain management grade as a result of its acquisition of Servigistics.

Related: JDA Software Announces Integrated (JDA-RedPrairie) Product Roadmap

Making the List

The year 2014 is Lucky 13 - marking the 13th time we have reported on the supply chain software market from a business standpoint since 2002. Although we initially focused on the top providers of WMS solutions, the lines between supply chain execution and supply chain planning providers are no longer clearly drawn; ERP providers supply WMS and supply chain execution providers offer planning and optimization solutions. And, as noted above, companies are increasingly looking to integrate their procurement activities into their manufacturing, distribution and transportation strategies.

For that reason, we partnered with Gartner to create this list. Our starting point is Gartner’s annual list of the top supply chain management providers, which this year included 27 names. It is a numbers game and not a popularity contest. The rankings are based on Gartner’s estimates of a provider’s annual sales for 2013. Meanwhile, Gartner’s estimates are based on revenues related to supply chain management software and not a company’s total revenues.

We make just one adjustment to Gartner’s original list, stripping out companies such as Basware ($124 million), Fieldglass ($83 million), SciQuest ($68 million), IQNavigator ($58 million), Bravo Solution ($55 million) and GEP ($45 million) that are primarily focused on procurement or spend management. While our readers may now coordinate activities with purchasing, their duties are still focused on planning and execution—moving things through the supply chain.

Admittedly, this is an imperfect science. Gartner, for instance, strips out hardware sales from its estimates. For that reason, Gartner credits Manhattan Associates with $167 million when the company’s overall revenues totaled $414 million. What’s more, Gartner does not follow the warehouse control systems (WCS) or manufacturing execution system (MES) spaces for the purposes of its chart.

Finally, it does not include SCM vendors that focus on specific verticals, such as Retalix, now part of NCR. However, it is an apples-to-apples comparison. More importantly, whether you agree with all of the numbers, the order provides a good ranking of the major providers across the supply chain management space.

Notable Trends

Several trends were at work last year in each of the four categories relevant to our readers: ERP and supply chain planning (SCP); WMS; TMS; and MES.

JDA and RedPrairie come together: RedPrairie’s acquisition of JDA was the most talked about event of 2013 in this space. There have been some bumps in the road. For one, JDA’s long-time CEO was replaced this past May. For another, sales took a slight pause: While JDA’s revenue jumped from $426 million in 2012, when RedPrairie was a stand-alone company, to a combined $445 million last year, RedPrairie had posted $105 million on its own in 2012 for a combined $531 million. “This was a difficult year,” says Eschinger. “But the sense I’m getting is that going forward, they are breathing new life into their initiatives and pushing the envelope on innovation.” He points out that JDA remains the No. 3 provider and the largest, stand-alone provider focused solely on supply chain technologies.

Related: JDA Software Announces CEO Change to Drive Next Phase of Strategic Growth

ERP/SCP/SCM: Enterprise-level supply chain planning applications grew by 10% last year, reaching $3.4 billion. Several trends were at work, including:

- It’s all about inventory: As with last year, there was continued interest in inventory optimization, which posted 11% growth, a reflection of companies’ continued interest in driving down their investments in inventory while maintaining or increasing their service levels.

- Another strong year for sales and operations planning (S&OP): For the second year in a row, S&OP applications, which tie supply chain activities closely to marketing and sales efforts, grew by 20%. “These applications can extract information from a variety of sources and present it in a way that can be acted on in real time,” says Eschinger. “With analytics, S&OP can create a what-if scenario in a few hours that once took several days to create with spreadsheets.”

- Multi-business platform collaboration: Collaboration remains a topic of supply chain conversations. Companies increasingly want to take advantage of their network of suppliers and customers. SAP’s acquisition of Ariba—a community that includes 1.5 million businesses—is driving that message home. “You now have one vendor with much tighter integration capability to bring together your buyers and suppliers,” Eschinger says. “This is the way many of us think businesses are going to get greater visibility.”

- Cloud computing continues to get traction: The cloud computing space is growing at about 25% a year, says Eschinger. More companies are migrating some of their offerings to the cloud. Still, in today’s market, the cloud is most prevalent in network-based applications, such as transportation management and procurement.

- WMS: The market for warehouse management software grew by 3% in 2013, to just more than $1.1 billion. The market continues to evolve in several ways.

- ERP is coming on strong: As we reported last year, ERP vendors such as SAP, Oracle, Infor and Epicor continue to take market share, according to Dwight Klappich, vice president of research. As Klappich points out, Manhattan is growing its top-line revenue, but the ERP vendors are growing the number of clients in their rosters, and doing so at a rate that is faster than the market. “They now have credible WMS products, which allows them to go after bread-and-butter clients,” says Klappich. “There’s a far bigger market for good enough, core WMS and if you’re already an ERP user, it’s easy to go to their WMS.”

- Get on a platform: For the past several years, Klappich has been writing about supply chain convergence. The concept is that companies have long focused on optimizing the silos in their operations, such as transportation and distribution. Now, they want to work across those functions as an end-to-end fulfillment process. The technical hurdle: “We can’t synchronize functions, let alone optimize them, until we can get all of our supply chain execution applications on a common technical platform,” says Klappich. He adds that he is now talking to end users who are making platform decisions, a trend that may benefit Manhattan, which has been building its platform since 2005, and SAP. Both companies have developed most of their applications internally compared to competitors that have grown through acquisitions that then have to be integrated.

- Work planning: An emerging application gaining traction, work planning looks at a body of work, from receiving to order picking to shipping, across a shift and creates a plan to allocate people and equipment in the right functional areas at the right time to complete the work. “These are nascent developments coming from leaders such as Manhattan and JDA, but it’s a step in the right direction,” says Klappich.

- WMS/WCS convergence: As companies ramp up the level of automation in their facilities, especially around multi-channel commerce, the lines between WCS and WMS continue to blur. “It’s driving end users to think more about WCS than in the past,” says Klappich.

TMS: The market for transportation management software grew by 12% in 2013, posting revenues of about $820 million.

- Growth of the mid-market TMS: As with last year, Klappich sees much of the growth coming from mid-sized shippers spending $25 million to $100 million a year on freight. “We continue to look for someone to develop a dominant strategy to serve shippers in the small- to mid-sized business market,” Klappich says.

- More analytics: Some leading TMS providers are now offering tools that allow for what-if scenarios outside the traditional planning horizon. Two examples: What is the best way to ship if fuel surcharges go up by 10%, or, what are my capacity requirements four months from now so that I can negotiate with my carriers today.

- Mobility: Solution providers are moving away from dedicated hardware that has to be installed inside the cab of a truck to deploying their solutions on smart phones and tablets that may simply plug into a dashboard. “They’re less cumbersome, they offer a more modern interface, and they can take advantage of social media,” says Eschinger. “It’s a leapfrog over where we were.”

MES: Gartner does not formally survey and size the market for manufacturing execution software solutions for discrete manufacturers. However, Simon Jacobson, a vice president who covers the MES space for Gartner, estimates it at $1.6 billion, a leap of about $100 million from 2012. As with the WMS space, some of that growth is now coming from ERP vendors who are adding MES to their portfolios. A key driver to the growth, Jacobson says, is “the desire for a flow of information within the factory environment.”

There were two important acquisitions in the space. First, Schneider Electric purchased Invensys, an acquisition that closed in January of this year. The second was the acquisition in February of Werum, a German-based provider of MES, by Korber, an international technology group.

While the market continues to grow slowly, one of the most important evolutions Jacobson sees is that companies are moving away from full-blown MES implementations to more targeted applications that support “manufacturing intelligence”—that is applications that provide better visibility and traceability into the manufacturing process. “Companies are focused on getting more out of their existing manufacturing lines rather than building new lines,” says Jacobson. “For that reason, they are looking to manufacturing intelligence to optimize their processes and get the most from what they have.”

He cites the example of a food and beverage manufacturer that realized an $800,000 savings in its first year by getting better visibility into its raw materials usage. “They now know when they’re using too much or too little in a batch,” says Jacobson. “It’s an example of manufacturing intelligence driving very quick value within a year rather than going through the entire MES implementation process.”

Related News: Accellos & HighJump Software Merge*

*Gartner calculated 2013 revenues for Accellos at $32 million and HighJump Software at $70 million, total combined revenues of $102 million. This would put the combined 'new' company at number 10.

Related: $10 Billion Supply Chain Software Revenues in 2014