2014 Global (Supply Chain) Economy Outlook

Supply Chain Managers are advised in this year’s “outlook” to align their shipping and sourcing strategies to broader business goals and build competencies around each stage of the product lifecycle to achieve greater customer centricity.

Slow Sailing for the Global Economy

The macroeconomic impact on supply chains this year has been uneven, but not excessively disruptive. Industry analysts tell us not to expect many changes in 2014, with trends in technology, education, and shipping remaining on an even keel.

Practitioners speaking at major supply chain events this year—including the annual conferences of the Institute for Supply Management, the Council of Supply Chain Management Professionals, APICS, and Gartner, Inc.—say investment in human resources will also be a priority.

Related: The Future of Work: How Talent Management Is Powering the Knowledge Value Revolution

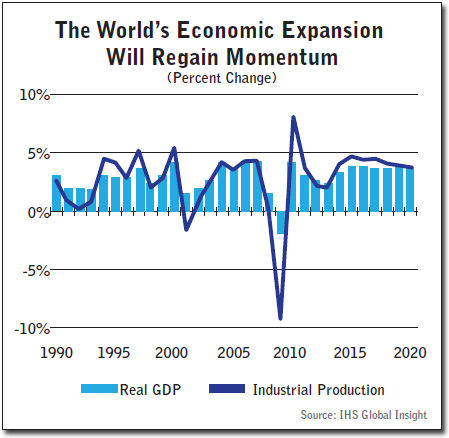

Once again, the U.S. private sector has shrugged off “dysfunctional” Washington politics, says IHS Chief Economist Nariman Behravesh. He notes that real GDP increased at a 2.8 percent annual rate in the third quarter, up from 2.5 percent in the spring quarter. The most encouraging news was the November employment report, which showed 203,000 net new jobs along with upward revisions to August and September data. These suggest the spillovers from the government shutdown to the private economy were minimal. As the drag from fiscal policies diminishes and the housing market recovery advances, real GDP growth should pick up from 1.7 percent this year to 2.5 percent in 2014 and 3.1 percent in 2015.

IHS Chief Economist Sara Johnson, says that Europe is still is “struggling to take off.” Eurozone real GDP grew just 0.1 percent quarter on quarter (q/q) in the third period, down from 0.3 percent q/q in the second quarter. While economists expect growth to edge higher in the fourth quarter, they say recovery will remain gradual and vulnerable in the face of still significant headwinds.

In Japan, the positive growth impact of “Abenomics” is waning, says IHS. Japan’s growth pace fell by one-half to a 1.9 percent annual rate in the third quarter, restrained by a drop in net exports and slowdowns in private capital investment and consumer spending. IHS expects that the economy will accelerate temporarily in late 2013 and early 2014, as consumers buy in advance of next April’s sales tax increase. Exports are also poised to recover, as the yen’s depreciation lifts competitiveness. For the longer term, Japan’s ability to sustain even moderate growth will require meaningful structural reforms.

Economists also wonder if the vague promise of reform in China will be fulfilled. They observe that China’s growth stabilization has carried into the fourth quarter. The data also shows solid increases in industrial output and fixed-asset investment, along with a rebound in exports. This is consistent with a view that China’s economy will accelerate moderately over the next two years. The Third Plenum communiqué called for market forces to play a “decisive” role in the allocation of resources, while affirming state-owned enterprises as a pillar of the economy with growing vitality and influence. How these contradictions are resolved will make a big difference to China’s future economic growth.

Meanwhile, in other large emerging markets, the “panic” has subsided, but problems remain. With the Federal Reserve’s tapering of asset purchases soon to become a reality, capital markets might again become less receptive to emerging market risks. It is important to look for potential trouble spots, where a temporary reduction in demand for new portfolio assets could expose countries to potential balance-of-payment and debt-service difficulties. High on the “watch list” are Brazil, India, Indonesia, South Africa, and Turkey.

So what’s the bottom line? Growth fundamentals in the global economy remain largely in synch with IHS’s expectations. Some economies look “perky” (the United Kingdom), some are set to accelerate soon (the United States), some have slowed (Eurozone and Japan), and some have stabilized (China, Brazil, and India). Next year, more countries are likely to be classified as perky compared with this year.

Cautionary Note on Emerging Markets

While Gartner, Inc. builds a compelling argument for entering emerging markets, its latest report also addresses the possible downside of hasty penetration. The challenges are daunting to supply chain organizations, says Gartner. Dealing with the risk of uncertainty is a common theme.

A survey of 35 of the 100 companies listed by Gartner as among the top global supply chains found the most cited supply chain challenge in emerging markets is dealing with changing rules, including regulatory or tax requirements. This was followed by building local talent or teams and adapting supply chains to local market needs.

Demand in these markets is often highly fragmented, with customers spread across many rural and urban locations. The infrastructure required to support both physical product and information flows is often unreliable, with poor transit systems hindering transportation, limited technology a barrier to communication, and local supply capabilities inconsistent.

Political and regulatory instability impacts market access and makes long-term supply chain investment and partnering strategies a risky task.

Supply chain managers are advised in this year’s “outlook” to align their shipping and sourcing strategies to broader business goals and build competencies around each stage of the product lifecycle to achieve greater customer centricityPatrick Burnson, Executive Editor

Scarcity of both material and nonmaterial resources is a global concern, reinforcing the importance of sustainability and social responsibility in these supply chains. A Gartner survey of chief supply chain officers identified the nonmaterial resource of human capital as their top long-term resource risk concern.

The ability to understand and manage local culture is a major challenge for most companies, with talent shortages and retention being significant concerns in the emerging markets.

Despite these challenges, supply chain organizations are responding to the opportunity afforded by emerging markets by first working closely with their sales and product teams to understand the differentiated product and service needs of these markets. Leaders are designing the right supply chain organizations and networks to best serve these needs within a broader global supply chain strategy.

Findings contained in the 4th Annual Global UPS Change in the (Supply) Chain Survey, conducted by IDC Manufacturing Insights echo many of those cited by Gartner.

Growth for high-tech products is significant in emerging markets, with nearly two-thirds of high-tech executives having either already established a presence in emerging markets or expecting to do so within a year. North American companies are the most aggressive when it comes to emerging market expansion, with 80 percent either in emerging markets today or planning to be there within a year. However, some barriers to global expansion remain, with the top two cited as: difficulty understanding the appeal of products in a new marketplace (19 percent) and challenges executing new in-market strategies (17 percent).

Focus on Customer-centricity

High-tech companies are also making strategic shifts to their supply chain models to enable greater customer-centricity, meet changing consumer demand patterns, and capture new growth opportunities.

According to the 4th Annual Global UPS Change in the (Supply) Chain Survey, interest in near-shoring has more than tripled since 2010. Globally, 27 percent of high-tech logistics executives are embracing near-shoring as one strategy to improve their customer service.

When queried about the top drivers for near-shoring, 77 percent of the global managers say they want to improve service levels by bringing production closer to demand and almost 55 percent cited improving control over quality and intellectual property.

Other high-tech executives, including 82 percent in the U.S., will continue to use their existing supply chain strategies. Survey respondents cite the cost benefits of low-cost manufacturing countries and the location of key suppliers as the top reasons for not considering near-shoring. Survey findings also show that 41 percent of high-tech executives expect to see exports grow faster over the next two years compared to 2013. Another 39 percent expect to see exports to grow at the same level over the next two years.

To differentiate their products in the face of growing global competition, many high-tech companies are shifting from product quality as the primary focus to making their supply chains more customer-centric. For example:

- 39 percent of those surveyed say their supply chains are built to be primarily customer-centric today and will grow to 44 percent in the next two years.

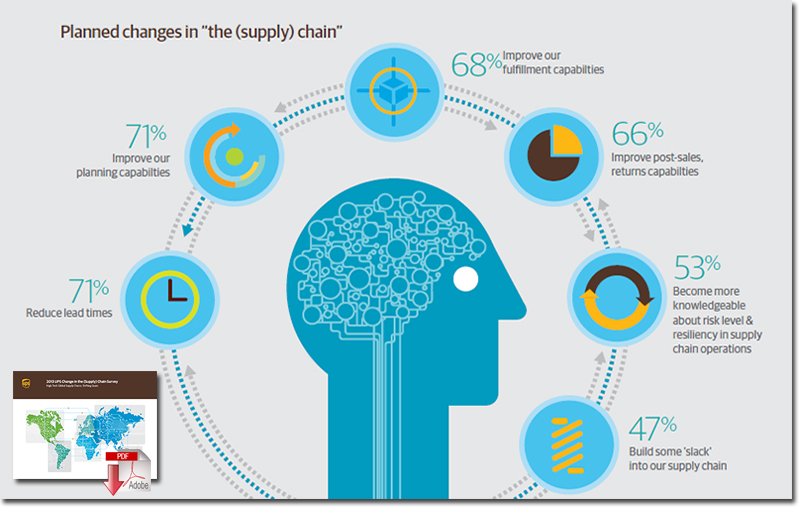

- For those high-tech companies re-focusing their efforts on customer-centricity, several changes are planned to improve customer service, including: reducing lead times (71 percent), improving planning (71 percent), improving fulfillment (68 percent), and improving post-sales/returns capabilities (66 percent).

Finally, when it comes to high-tech product lifecycle management, almost 60 percent of high-tech logistics executives rank themselves as “market leaders” in product innovation, but their confidence in capabilities drops along the entire product lifecycle. Less than half of global high-tech logistics executives think they are “market leaders” when it comes to reverse logistics (34 percent), product retirement (40 percent), or even global product launches (46 percent).

Shifting market dynamics such as end consumer demand, emerging market growth, and increased global competition are having significant implications for high-tech supply chains at every stage of the product lifecycle, say survey analysts.

In a broader context, supply chain managers are advised in this year’s “outlook” to align their shipping and sourcing strategies to broader business goals and build competencies around each stage of the product lifecycle to achieve greater customer centricity. At the same time, managers must remain mindful of improving operational efficiencies and driving growth in new markets.

IHS Top 10 Economic Predictions for 2014

World growth will accelerate gradually in 2014. The world economy is likely to emerge from its extended “soft patch” of the last two years, thanks to the easing of the twin headwinds of private-sector deleveraging and public-sector austerity. This will be especially true for the developed economies. In many of the emerging economies, growth is also likely to be a little stronger in 2014, as they (once again) enjoy export-led growth to the United States, Europe, and China.

- US growth will slowly speed up

- The European recovery will proceed, but at a very sluggish pace

- China’s growth rate will be sustained

- Other emerging markets will also perform a little better

- Unemployment rates in the developed world will remain high

- Commodity prices will go nowhere and inflation will remain a low-level threat

- The Federal Reserve will start scaling back its stimulus, while other central banks will likely wait or provide more stimulus

- Fiscal headwinds will ease

- The US dollar will strengthen against most currencies

- There will be more upside risks than downside risks facing the global economy

That said, the global growth rebound is likely to be quite modest. IHS expects 3.3% growth in 2014, compared with 2.5% in 2013. The good news is that the upside surprises about growth may more than balance out downside surprises, provided some of the more daunting risks facing the world economy (e.g., an oil shock) don’t materialize. One early positive sign is that the quarterly annualized global growth in the second and third quarters of this year are estimated by IHS to have been 3.3% and 3.4%, respectively. This is higher than prior quarters and suggests that global growth has already reached the 3.3% pace predicted by IHS for 2014.

Related Links