2014/15 Top 50 Global & Domestic U.S. Third-Party Logistics Providers

In the wake of the recent acquisition of Norbert Dentressangle by XPO Logistics, the logistics community is bracing for even more major consolidation deals, and the third-party logistics provider (3PL) community is loving it, especially as their margins continue to widen - particularly throughout North America.

According to the latest figures compiled by the third-party logistics consultancy Armstrong & Associates, major domestic 3PL players posted double-digit growth in 2014, with more of the same in this year’s forecast.

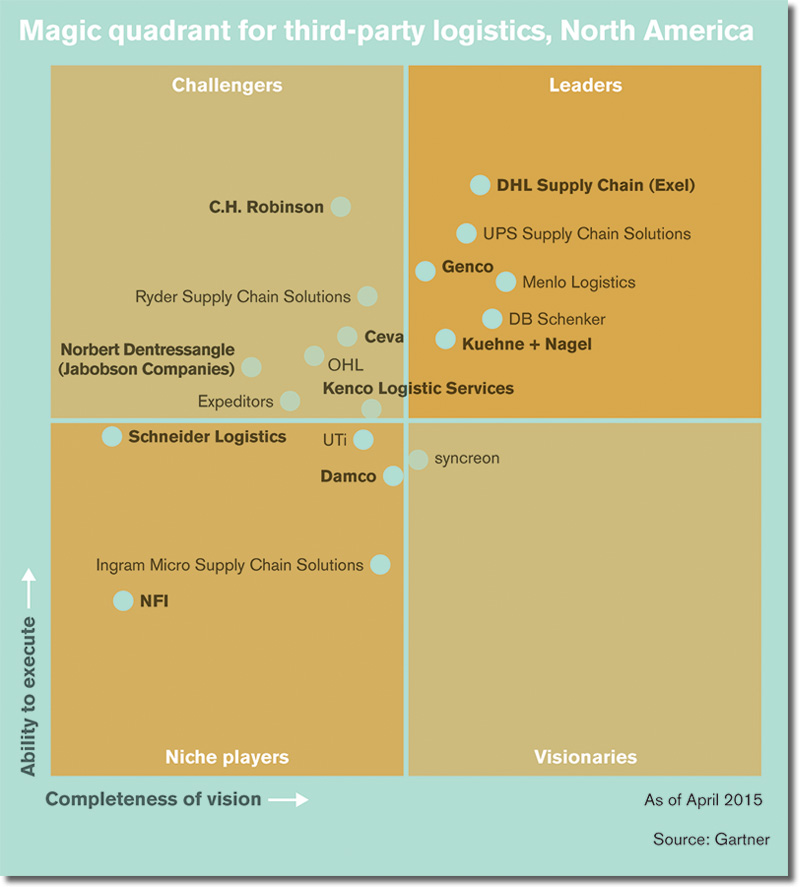

In the meantime, analysts at research giant Gartner have published their annual Magic Quadrant report that provides market intelligence on its premier list of lead logistics providers.

All in all, it appears to be a good time to be a third-party logistics provider - and according to both Armstrong and Gartner, it looks like the party is going to keep roaring along.

For example, thanks to its prominence in the Asia Pacific region, DHL Supply Chain and Global Forwarding reported gross logistics revenue earnings of more than $32 billon last year - more than a billon over 2013 numbers. The company’s concentration on controlled-atmosphere shipping in the Americas also contributed to record profits.

On the domestic side, it was all C.H. Robinson Worldwide, which garnered slightly less than $14 billon in gross logistics revenue last year.

A distant, but significant, second place was held by Expeditors International with earnings of nearly $7 billion. Expeditors value-added warehousing continues to attract new business, and analysts note that there’s more growth potential in 2015 for the cluster of 3PLs that can differentiate their services in this manner.

“At this time last year, we noted that shippers were going to hedge their bets by working with several domestic and international 3PLs,” says Dick Armstrong, the consultancy’s chairman. “That trend hasn’t changed, and in fact, it may become even stronger in 2015.”

Armstrong & Associates Top 50 U.S. Domestic 3PLs

-

2014 Gross Logistics Revenue (USD Millions)*Third-Party Logistics Provider

-

$13,470C.H. Robinson Worldwide

-

$6,565Expeditors

-

$5,799J.B. Hunt (JBI, DCS & ICS)

-

$5,758UPS Supply Chain Solutions

-

$5,157Kuehne + Nagel (The Americas)

-

$4,180UTi Worldwide

-

$3,571Hub Group

-

$3,506Burris Logistics

-

$3,390Schneider Logistics & Dedicated

-

$3,300Exel

-

$2,618CEVA Logistics (The Americas)

-

$2,615DB Schenker Logistics

-

$2,463Panalpina (The Americas)

-

$2,461Ryder Supply Chain Solutions

-

$2,357XPO Logistics

-

$2,142Total Quality Logistics

-

$1,950Coyote Logistics

-

$1,900BDP International

-

$1,717Menlo Logistics

-

$1,696Americold

-

$1,624Landstar

-

$1,605Transplace

-

$1,500GENCO

-

$1,462FedEx Trade Networks/FedEx Supply Chain Services

-

$1,430Cardinal Logistics Management

-

$1,394Swift Transportation

-

$1,305OHL

-

$1,182Werner Enterprises Dedicated & Logistics

-

$1,173Echo Global Logistics

-

$1,160NFI

-

$1,137Penske Logistics

-

$1,030APL Logistics (The Americas)

-

$1,007Damco (The Americas)

-

$1,000syncreon

-

$895Nippon Express (The Americas)

-

$891Yusen Logistics (Americas)

-

$850Transportation Insight

-

$849Ruan

-

$800Neovia Logistics Services**

-

$800Ingram Micro Logistics**

-

$781Norbert Dentressangle US

-

$774Agility (The Americas)

-

$723ModusLink Global Solutions

-

$715GEODIS (The Americas)

-

$693DSV (The Americas)

-

$689Crane Worldwide Logistics

-

$688Hellmann Worldwide Logistics (The Americas)

-

$623Freightquote

-

$615U.S. Xpress Enterprises

-

$610BNSF Logistics

Adrian Gonzalez, the founder and president of Adelante SCM, a peer-to-peer networking community for logistics professionals and 3PL watchdog, concurs, saying that the 3PL industry is perhaps becoming more “barbell shaped.”

“At one end of the barbell we see small, niche providers thriving, and at the other end are the very large players retaining market share,” says Gonzalez. “And everybody else is getting squeezed out in the middle.” He adds that “gaining scale” is driving a lot of merger and acquisition activity in the 3PL industry today - and that will keep fueling it in the months ahead.

Brooks Bentz, a former supply chain management practice partner with Accenture who now serves as president of Transplace’s supply chain consulting business, agrees with both Armstrong and Gonzalez, observing that no slowdown in merger and acquisition activity is in sight.

“When you look at the Armstrong list, and see that C.H. Robinson is up at the top in the U.S., it’s clear that there’s quite a gap between their annual revenue and those that follow. I think you will find that some - if not most - will see closing that gap as an attainable goal for themselves, and they’ll choose to do that through deals,” he says.

For other 3PLs, adds Bentz, they’ll choose to go the route of organic growth, which is a long, slow process compared to the current practice of buying up revenue. At the same time, he adds, the over-arching trend in logistics management will be to drive improved supply chain performance. He maintains that few 3PLs - if any - have it right. In large part, that’s due to the growth of very large-scale multi-national companies.

“Because so many 3PLs have generally grown through multiple acquisitions, they’ve created a hydra-headed monster for logistics managers” says Bentz. “These include cultural and geographic differences, varying regulations and rules, and they’re reliant upon a large array of service providers.”

Armstrong & Associates Top 50 Global 3PLs

-

2014 Gross Logistics Revenue (USD Millions)*Third-Party Logistics Provider

-

$32,193DHL Supply Chain & Global Forwarding

-

$23,293Kuehne + Nagel

-

$19,861DB Schenker Logistics

-

$17,916Nippon Express

-

$13,470C.H. Robinson Worldwide

-

$8,661DSV

-

$7,864CEVA Logistics

-

$7,483SDV (Bolloré Group)

-

$7,463Sinotrans

-

$7,338Panalpina

-

$7,043DACHSER

-

$6,565Expeditors

-

$5,960GEODIS

-

$5,920Hitachi Transport System

-

$5,822Toll Holdings

-

$5,799J.B. Hunt Dedicated Contract Services & Integrated Capacity Solutions

-

$5,758UPS Supply Chain Solutions

-

$5,387GEFCO

-

$4,300Agility

-

$4,180UTi Worldwide

-

$4,080IMPERIAL Logistics

-

$3,945Yusen Logistics

-

$3,800Hellmann Worldwide Logistics

-

$3,571Hub Group

-

$3,506Burris Logistics

-

$3,409Norbert Dentressangle

-

$3,390Schneider Logistics & Dedicated

-

$3,212Damco

-

$2,942Kintetsu World Express

-

$2,842CJ korea express

-

$2,723Kerry Logistics

-

$2,461Ryder Supply Chain Solutions

-

$2,357XPO Logistics

-

$2,293Sankyu

-

$2,142Total Quality Logistics

-

$1,950Coyote Logistics

-

$1,900BDP International

-

$1,816Wincanton

-

$1,797arvato

-

$1,745NNR Global Logistics

-

$1,717Menlo Logistics

-

$1,696Americold

-

$1,659APL Logistics

-

$1,640Mainfreight

-

$1,624Landstar

-

$1,605Transplace

-

$1,514JSL Logistica

-

$1,501Logwin

-

$1,500GENCO

-

$1,462FedEx SupplyChain/FedEx Trade Networks

Analysts also continue to track what has been coined “The Amazon Effect” on the third-party logistics industry. The Seattle-based e-commerce giant has hired 50,000 full-time workers to staff its distribution centers across the U.S. in order to speed up delivery times. It’s $99 annual “Prime Membership Service” comes with a free two-day delivery on many items. Further complicating this scenario is Walmart, which plans to introduce an unlimited shipping service for online shoppers this summer.

Bentz notes that the torrid pace of the growth of internet sales and the resulting fulfillment and logistics requirements will bode very well for 3PLs. “The ‘I-want-it-now, if-not-sooner’ consumer demand is being served - and in some cases created or amplified - by companies like Amazon and Walmart,” he says.

Impact of “Near-Shoring”

The domestic battle being waged by these retail behemoths is not likely to be confined to the U.S., however. Indeed, many analysts see the trend sweeping through all of North America before long.

John Langley Jr., Ph.D., who serves as a director of development at the Center for Supply Chain Research at the Smeal College of Business at the Pennsylvania State University, observes that U.S. shippers are concentrating more on hemispheric services this year. This trend, he says, is in response to “less-than-exciting” global economic activity.

“The manufacturing industry in Mexico is improving, which is creating opportunities for 3PLs as logistics services play a crucial role in rendering Mexico as cost competitive,” says Langley. “Mexico has more free-trade agreements than any other country, a strategic geographic location, and is renowned as a low-cost manufacturing and export destination.”

However, Langley cautions that a lack of quality infrastructure and certain regulatory aspects continue to challenge Mexico. Analysts with The Hackett Group, an intellectual property research firm, share this view, observing that many mid-size U.S. cities now make attractive alternatives to Mexico and other offshore locations for companies considering consolidating finance, IT, and related business services operations.

“Many companies are realizing that the U.S. is becoming an increasingly viable option for elements of their service delivery organization,” says Jim O’Connor, The Hackett Group’s principal and global finance practice leader. “We’re seeing real growth in this sector, with nearly 700 U.S. centers of excellence, shared service centers, and global business services operations now up and running.”

According to O’Connor, labor and operating costs are still high in the U.S. compared to Eastern Europe, Latin America, and Asia. But the gap is shrinking, while there are significant other benefits. “In more and more cases, those benefits outweigh the additional cost. In addition, the public response to offshoring has made keeping jobs at home a attractive option for U.S. companies,” he says.

At the same time, says analysts at Gartner, the 3PL industry is “progressing along a maturity spectrum in accordance with customer requirements through a combination of acquisition and organic growth strategies.” The research firm’s annual Magic Quadrant rankings chart the growth of the top global logistics services companies as they work to improve their ability to improve and expand value-added services.

The report notes that, increasingly, 3PLs have extended their services beyond the basics - providing opportunities to increase their value and resolve additional customer supply chain challenges. For example, these services include returns and repair processing, assembly and kitting, packaging, postponement, freight payment and audit, network modeling, shipment consolidation, cross-docking, and logistics and supply chain consulting.

According to Greg Aimi, Gartner’s director of supply chain research and Magic Quadrant co-author, there’s a transformation underway across today’s logistics industry, and perceptions of logistics service providers are changing.

“In an industry that had been commoditized into transactional warehousing and transportation activities, the idea of specialized services, joint-value creation, and supply chain integration would have seemed nonsensical,” says Aimi. “Relationships have been historically transactional, pragmatic, and physical activity-oriented. Third party providers responded in kind by competing head-to-head in low-margin pricing wars and assumed the role of an interchangeable commodity - a low-value part.”

Ami maintains that most of the 3PLs today in North America - if not across the globe - started the transformation by providing deep capabilities in one of three major logistics service roots: transportation services, warehousing and fulfillment services, or international freight forwarding and customs brokerage.

Furthermore, this pattern will probably not change in the coming years. “In fact, many providers today still predominantly offer services from just one of these roots,” says Aimi. “Other providers, especially the larger ones, have expanded their offerings to include services from one or both of the other roots.”

Gartner Defines a “Good” Player

Magic Quadrants are made up of two major axes, “ability to execute” and the “completeness of vision.” According to Aimi, to create a Magic Quadrant that would be valuable to logistics customers, it was important to develop a definition of what good outsourced logistics is in the context of the criteria of the two axes.

According to Aimi, the first critical factor is that a provider offers a broad set of services that match shipper demand trends. “As shippers refine their logistics management capabilities, they normally want to consolidate the portfolio of logistics providers they work with,” notes Aimi. “This means shippers would like the opportunity to use more services from the same or smaller set of providers, and that’s a huge, critical factor.”

The second major factor is that a 3PL must offer more than just a “large menu” of services. “Today’s logistic managers are looking to have seamless access to an integrated portfolio of services, and they expect them to be supported globally by unified technology platforms,” says Aimi.

Fair and competitive pricing represents the third critical factor, says Aimi, who notes that the best logistics providers know how to segment customers’ needs and deliver the right offering and the right pricing when needed. “This shows a bit more vision for the providers that master this and directly influences their ability to execute.”

Finally, as shippers continue to mature, they look to their logistics providers to be able to tailor their services to the idiosyncrasies of their industry - and to have retained and developed highly-seasoned competency in top industry-specific practices.

This is the fourth critical factor, according to Aimi. “Logistics managers are looking and hoping to gain leverage through specialized expertise and capabilities beyond what they have themselves,” he says. “Providers with more depth and tailored support for industry variants tend to move right on the ‘completeness of vision’ axis.”

Beyond these four basic factors, other influences on the “completeness of vision” may still affect the “ability to execute.” According to Aimi, the execution scale had a multiplying factor that considered the difficulty of managing top performance based on customer base size, organization scale, and process complexity.

With this contextual backdrop, Gartner says that companies can now more fully understand how the various 3PL providers were evaluated, what was deemed important and what might be differentiated, and, consequently, why the dots for each 3PL appear where they do on the Magic Quadrant.

Other Top Third-Party Logistics Provider articles:

- 2015 Top 50 Global & Domestic 3PLs

- 2014 Top 50 Global & Domestic 3PLs

- 2013 Top 50 Global & Domestic 3PLs

- 2012 Top 50 Global & Top 30 Domestic 3PLs

- 2011 Top 50 Global & Top 30 Domestic 3PLs

Related Article: 25 Years of Third-Party Logistics Research & Studies

Article Topics

Adelante SCM News & Resources

BluJay research focuses on the need to build resilient supply chains Industry Study looks at Inventory Management as a Critical Function within Omni-Channel Logistics Report: Customer experience is driving supply chain innovation 2015 Top 50 Global & Domestic U.S. Third-Party Logistics Providers Unpacking Risk Shifting How Can Supply Chain Management Enable Profitable Growth? Shifting Risk and Meeting in the Middle Might Be Key to Shipper & Third-Party Logistics Relations More Adelante SCMLatest in Transportation

Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge More TransportationAbout the Author