10 Supply Chain Trends for the Next 10 Years

What trends will affect the next generation of supply chains? That’s a question more and more SCM professionals are asking themselves. The 10 trends offered here are validated with executive input from senior executives across different industries.

Recently, I happened to be perusing the aisle of a bookstore (there are still a few of them left) and found a book by Pavan Sukhdev titled Corporation 2020. The title was intriguing and the contents were illuminating.

Basically, the author argued for a new formula for business success going forward—one that looked at all aspects of doing business and emphasized the corporation’s responsibility to society and to sustainability.

The forward-looking nature of Sukhdev’s book set the wheels in motion for this article. Quite a bit has been written over the years about the future of supply chains. MIT’s SCM 2020 project, for example, brought together leading thinkers and practitioners to address the subject.

However, this research and most articles I have read on the topic have focused on supply chain operations and not on the points of “intersection”—that is, the related activities that are outside of the supply chain’s direct control such as R&D, information technology, and post-sales service. In my list of the top trends, I have incorporated a number of these intersection points.

As we think about the major trends that will affect the next generation of supply chains, we need to consider certain macroeconomic factors. Prominent among these is the changing global economic demographics.

Walk into any multinational consumer goods or manufacturing company today and you’re sure to hear a lot of discussion about the BRIC (Brazil, Russia, India, and China) markets.

The GDP growth in those countries far exceeds the growth in more fully developed economies. Further, the sheer number of consumers in these countries already accounts for about 40 percent of the world’s population.

And by 2050, their combined economies are expected to eclipse that of the world’s richest countries—including the U.S. and European Union.

Another macro-economic reality to consider is the shortage of knowledge workers to satisfy the needs of the expanding markets. Studies show that these shortages are beginning to be felt in the immediate term.

Some of this shortage will be offset by the Baby Boomers wanting (or needing) to work longer to overcome lingering effects of the latest recession. In any case, the shortage of skilled workers overall underpins several of the specific trends we present below.

In earlier articles in Supply Chain Management Review, I discussed the “Top 10 Supply Chain Mistakes” (July/August 2004) and “10 New Ideas for Generating Value” (May/June 2009). With that same “top 10” approach in mind, I embarked on this article.

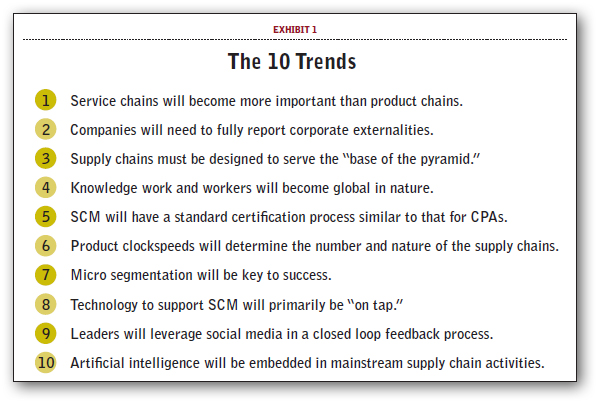

The 10 trends identified are listed in Exhibit 1 and discussed in turn below. The list was based on my research and on consulting engagements with companies in a range of industries.

Importantly, the trends were reviewed by a group of senior executives, both in supply chain and in other corporate functions, representing a cross section of industry. The intent was to capture empirical data around the relevance and ability to execute against each of the trends for their particular company and industry.

“The 10 Trends in Detail” - Continued on Next Page

The 10 Trends in Detail

1. Service chains will become more important than product chains. In many if not most business sectors today, great product is considered to be the table stakes just to play the game. Increasingly, discerning consumers are demanding more from pre- and post-sales service for the goods they buy.

Accordingly, companies that effectively couple the pre- and post-sales service supply chain activities (including product knowledge, in-store service, warranties, responsive consumer services, and the like) will emerge as the winners over their solely product-centric competitors.

That message was underscored by Apple CEO Tim Cook in his recent apology to consumers in China for the company’s perceived failure to listen to feedback about post-sales service.

This was a great example of a company with one of the most innovative products in the marketplace forgetting that the consumer is still largely in charge and that service plus product (in this case, repair and warranty practices) trumps product only.

2. Companies will need to fully report supply chain externalities. In Corporation 2020, Sukhdev writes in depth about corporate externalities—defined as the impacts of an organization’s manufacturing and business processes on other segments of society—and the need to disclose those externalities.

While some work has been done around supply chain sustainability and the need to reduce carbon footprint, companies will need to do a much better job of disclosing the end-to-end impacts of their supply chains.

This means measuring and reporting on the effect of major supply chain transactions on jobs created, carbon footprint reduction, sustainable procurement processes, types of labor used, and modes of transportation among others.

The customer or consumer will begin to demand the transparency into these impacts much as these have now on the labeling of food and beverage products.

3. Supply chains must be designed to serve the “base of the pyramid.” The late Professor C.K. Prahlad authored a compelling book entitled The Fortune at the Bottom of the Pyramid, which later was modified and widely referred to as the “base” of the pyramid.

The book pointed to the market potential of the five billion-plus people in the world whose incomes are less than $2,000 a year. We contend that companies in the consumable and durable sectors, in particular, will need to create products and associated supply chains to support the products that will cater to this market segment.

To tap into this enormous potential, our supply chains must go through a total utilitarian design philosophy in order to deliver sustainable bottom-line performance. Current supply chain thinking, which is largely based on a cost plus model, will need to shift to a “not to exceed” cost model.

4. Knowledge work and workers will become global in nature. Knowledge work in supply chains today accounts for approximately 40 percent of the total labor hours spent. Much of this work deals with complex analytics, planning, procurement processing, and provision of services.

This nature of the work, the need for multi-language support, and the associated local complexities of the different geographies being served will necessitate the seamless globalization of supply chain knowledge work.

As an example, you could see a U.S.-centric company performing supply chain planning in the Philippines, operating procurement centers of excellence in Singapore, and conducting global business analytics in Brazil.

5. SCM will have a standard certification process similar to that for CPAs. Many universities offer undergraduate and graduate degrees in supply chain management. In addition, professional associations such as APICS, CSCMP, and ISM offer a range of certification programs.

However, in most cases these programs either focus on the basics of SCM or on a specific activity such as import/export or financial analysis. We believe that a fundamental shift will occur in the normalized delivery, content served, and certifications of supply chain professionals.

Many other professions like accounting (Certified Public Accountant) and engineering (Professional Engineers) require national board examinations as well as continuing professional education (measured by a specified number of hours per year).

We contend that a similar professional credentials program will be required for supply chain professionals to normalize the knowledge base of the incoming resources.

6. Product clockspeeds will determine the number and nature of the supply chains. I recently worked with a global consumer durables company where over 70 percent of the products had a life span of less than 18 months. Another 20 percent had a life span of three to four years, with the remaining 10 percent exceeding five years.

This “fast clockspeed” lifecycle is becoming more the norm than the exception. The days of the steady and static product catalog is past; thinking otherwise, in fact, is a recipe for disaster. However, we continue to find companies using a single supply chain approach to service all segments irrespective of the time constraints.

The winners of the future will have the same number of distinct supply chains as there are product clockspeeds. In addition, supply chain organizations will need to be aligned by product segments as well as functional segments in a matrix fashion to serve the distinct supply chain needs.

7. Micro segmentation will be key to success. Do you have a detailed knowledge of your individual consumer or customer segments—your micro segments? The honest answer for most companies would be “no.” A micro segment is defined as that exact part of the general buying category that triggers the purchasing decision—not the category itself.

To illustrate, in recent work with a provider of smart phone accessories, we discovered that the company had several underserved micro segments—specifically, the design your own/assemble your own accessory segment. However, the ability to identify and service those segments was far beyond the reach of this company’s supply chain.

Going forward, organizations will need to know their micro segments, and their supply chains must be able to effectively service them based on the business strategy. I always encourage clients to think of their business in terms of the individual consumer or groups of consumers as opposed to a broad brush view of categories. Put another way, adopt a B2C (business to consumer) mindset even if your operation is predominantly B2B (business to business).

8. Technology to support SCM will primarily be “on tap.” SaaS (software as a service) is gaining mainstream attention. We contend that most if not all supply chain technologies by 2020 will be delivered and consumed via this method—or “on tap.”

The user will pay for the ability to use the capability and will not have to incur the large fixed costs of ongoing maintenance, upgrades, and infrastructure expenditures that can amount to almost 25 to 30 percent of the cost of ownership.

The widespread adoption of SaaS constructs will likely be accelerated by the rise of cloud computing and diminishing concerns about the security aspects of SaaS.

9. Leaders will leverage social media in a closed loop feedback process. Social media data is everywhere today. In recent work we did with a durable goods company, we found that they had 2,000 websites/ blogs that were discussing their products and service needs on a fairly regular basis.

However, this company—like most—did not have a systematic method to study the data and disseminate the information to the various supply chain constituencies (design, planning, procurement, service, manufacturing, and so forth). This is necessary to provide closed loop feedback processes that allow the company to proactively respond to the feedback.

The winning companies will be able to receive, process and act on the data that is being provided to them by their constituents via social media.

10. Artificial intelligence will be embedded in mainstream supply chain activities. Humans learn by doing and processes improve as they get “leaned out.” Yet somehow, every time we build a supply chain system we begin the process from the ground up.

Planners go through the same calculation steps every time they start; procurement folks repeat approximately 35 percent to 40 percent of the activities they did in the past. The same holds true for people involved in building logistics and execution systems.

The problem is that when embarking on a supply chain program or initiative we do not have access to algorithms that learn and retain the knowledge and experience of the past. We contend that supply chain artificial intelligence will need to be embedded in more effectively automating mainstream supply chain activities.

“Executive Validation of the Trends” - Continued on Next Page

Executive Validation of the Trends

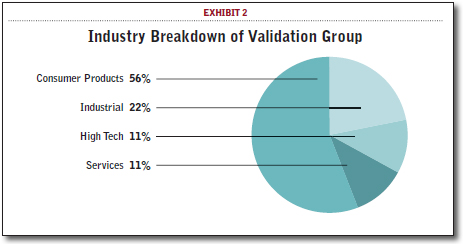

To validate our 10 trends in the “real world,” we conducted a short but impactful field survey with a group of senior executives from various industries.

Their responsibilities ranged from chief executive officer, chief financial officer, chief operating officer, and chief information officer to heads of supply chain.

The industry mix, as shown in Exhibit 2, was comprised of 55 percent consumer products, 22 percent industrial manufacturing, and 11.5 percent each in high-tech and services.

The responses from each segment were weighted equally.

Several members of the executive group surveyed also had significant prior experience in pharmaceutical/heath care and were able to bring additional perspective from that experience.

We discussed the trends in person with each of the executives in our validation group. (For a full listing of the companies and participants, see Author’s Note.)

We asked these executives to respond to the 10 trends identified based on four criteria: relevance to the industry; relevance to corporate business performance; ability to execute on the trend; and complexity of execution.

Each of the four criterion was graded on a three-point scale with a low being scored as 1, medium a 2, and high a 3.

Relevance to industry was defined as the relevance to the particular executive’s industry overall (as opposed to just his specific company).

Relevance to business performance focused on the ability to move the needle of balance sheet or P&L performance in a positive direction.

Ability to execute was interpreted as the corporation’s ability to act on the trend in the immediate near term. The final criterion addresses the overall complexity of the implementation.

While survey result tabulation and computation can often lead to a lot of analysis (just ask a statistician), our objective in field testing the trends was to gauge the level of relevance in the current business setting.

This as opposed to predicting trends from a pundit perspective—and my apologies to all the pundits.

The executives’ points of view are presented without any internal bias or analysis added.

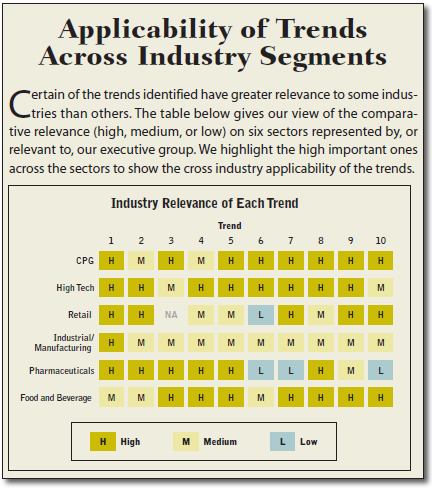

In the accompanying sidebar on industry applicability, we provide our perspective on the impact of the trends on individual business sectors based on the many client engagements that we have completed in the past few years.

Industry Relevance

The executive group ranked Trends 1, 6, and 7 as the highest in the relevance category. To recap, these trends are:

- Trend 1: Service chains will become more important than product chains.

- Trend 6: Product clockspeeds will determine the number and nature of the supply chains.

- Trend 7: Micro segmentation will be key to success.

All three of these trends received relevance scores higher than 80 percent. The percentage was determined by the sum of all 10 rankings divided by the maximum total score of 30 (that is, the amount if all 10 executives had given the trend a high [3] relevance rating).

In essence, the increased importance of pre- and post-sales service, the ability to segment product clockspeeds with a supportive supply chain footprint, and the ability to hone in on the customer/consumer targets were deemed most relevant across the largely manufacturing-centric executive group. The next highest set of rankings were the trends of “on tap” technology and social data closed loop chains.

Business Performance

In terms of impact on business performance, Trends 1 (service vs. product chains), 4 (globalization of knowledge workers), 6 (clockspeeds), and 10 (imbedded artificial intelligence) received the highest rankings from the executive group. The average scores for the three were higher than 75 percent.

The next highest-ranked trend, with a score of close to 70 percent, was Trend 7 (“Micro Segmentation will be key to success”).

Combining the results of the first two criteria (which essentially is a gauge of the trend’s ability to affect financial performance) reveals that Trends 1, 6, and 7 have the greatest potential to advance the supply chain performance curve.

All three had combined relevance and performance scores in excess of 75 percent. Trends 4 (globalization of knowledge workers) and 10 (artificial intelligence) were the fast followers with scores that were higher than 70 percent.

Surprisingly, Trends 2 and 3—disclosing SCM externalities and designing supply chains and products for base of pyramid—were ranked as having only low to medium relevance. The low relevance of the pyramid trend was a likely function of the market positioning of majority of the surveyed companies (high end brands or U.S.-centric brands).

Examining the externality ranking, most of the executives agreed that it was highly relevant and many already had programs in place. However, the general sense was that the ability to positively monetize on the additional expense associated with this trend was still in the distant future. On both of these trends, however, many of the executives suggested a wait-and-see attitude.

In terms of business performance in particular, they pointed to the cost of compliance associated with Trend 2 and the company’s ability to flourish in the emerging geographies associated with Trend 3.

“Ability to Execute” - Continued on Next Page

Ability to Execute

Trends 2, 6, and 8 received the highest ability to execute rankings. These trends are:

- Trend 2: Disclosing supply chain externalities will be crucial.

- Trend 6: Product clockspeeds will determine the number and nature of the supply chains.

- Trend 8: Technology to support SCM will primarily be “on tap.”

In general, the executive rankings on ability to execute came in lower (average scores were closer to 55 percent) than the other three criteria measured. Interestingly, the lowest ranked trends (i.e., least ability to implement) with scores of less than 50 percent, related to adopting artificial intelligence learning systems and incorporating social data into the supply chains.

Specifically, some executives raised concerns about the data linkage that would be needed for best-of-breed learning system to be effective.

Complexity of Execution

Trends 1, 6, and 10—service chains, product clockspeed, and artificial intelligence—received the highest complexity rankings (average of 86 percent), meaning that the executive group perceived them to be the most difficult to implement. Part of this may be due to the highly cross functional nature of the trends.

Standardization of education processes was ranked just below these top three in terms of execution complexity.

Summarizing the Results

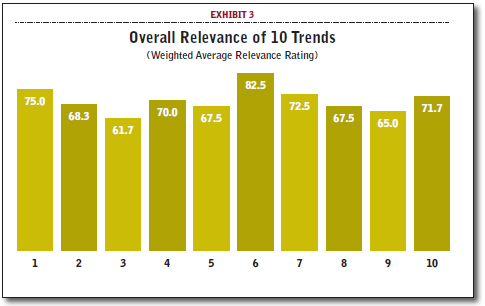

When weighted equally across the four dimensions and normalized, the overall relevance rankings by our executive group show a distribution that ranges from 61 percent to 82 percent (see Exhibit 3).

Trends 6, 1, and 7 have the largest relevance, reflecting the issues that are top of mind for the executives. Notably, their ability to execute against these trends is relatively high as well.

The middle cluster—comprised of Trends 2, 4, and 8—show an overall relevance ranking greater than 68 percent, suggesting that these are only slightly less relevant and tougher to implement than the top-tier trends.

Finally, the trends with the lowest overall ranking are perceived to be of lesser relevance and slightly more difficult to implement than the others. The bottom two in the overall rankings were Trend 3 (serving the “Base of the Pyramid”) and Trend 9 (leveraging social media in closed loop process).

The ranking of the social media trend, in particular, came as a bit of a surprise—given all the recent hype surrounding Big Data. Yet the result proves the point that while Big Data is a useful tool, the ability to transfer the data to supply chains and the related ability to execute remains a big challenge.

As we step back and decipher the implications for supply chain practitioners, it is abundantly clear that the ability to create differentiated and multiple supply chains and to embrace a service-based culture is of paramount importance. These capabilities, coupled with the need to service smaller, unique segments in a profitable manner, continue to be high on industry and executive agendas. Importantly, all of these highly ranked competencies have the ability to move the economic performance needle.

Finally, we would be remiss if we did not mention some of the ideas that the executives themselves brought up during our discussions. Their insights ranged from the ability to foster open collaboration (across Buy, Make and Move portions of supply chain) with trading partners; to improving enterprise supply chain risk management processes and education; to incorporating in real time local regulatory measures and product postponement for local preferences.

Staying still is not an option for supply chain practitioners. Having the ability to create incremental value is fine, but real progress comes from anticipating and capitalizing on the kinds of mega trends we have discussed here.

We believe that these trends we have put forth will be powerful drivers for change going forward, and it is encouraging to see that the senior executive group agreed in large measure. Equally encouraging and enlightening was the deeper understanding gained of the implementation challenges that lie ahead. One has to start somewhere: Enjoy the journey.

Author’s Note: The author would like to thank the following companies and senior executives for their personal participation and opinions (in alphabetical order for both). Companies: Ainsworth Pet Nutrition; Clorox; Designer Whey; Filtec; Godiva; Incase; JustFood ERP; Moark; Niagara Bottling; and Pelican Products.

Senior Executives: Ashley Dorna, Kevin Deighton, Marc DiGiorgio, Jeff Fowler, Mark Hersh, Linzell Harris, Jamie Hornstein, Grace Jeon, Chad Keuhn, and Nick Newman.

Sumantra Sengupta is a Managing Director with the business and operations strategy firm EVM Partners LLC. He can be reached at [email protected]. Additionally, check out his new book titled “Supply Chains Unshackled”